OPEN-SOURCE SCRIPT

Normalized Jurik Moving Average [QuantAlgo]

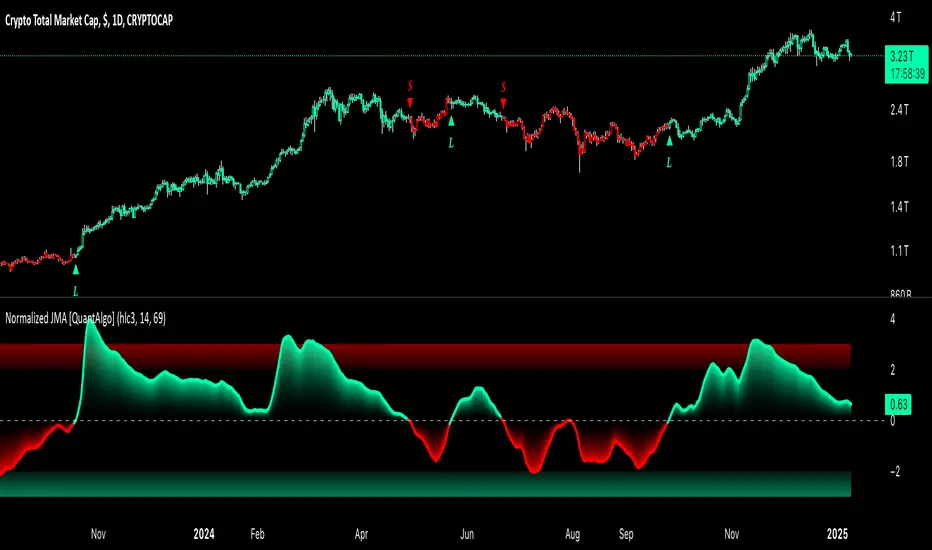

Upgrade your investing and trading strategy with the Normalized Jurik Moving Average (JMA), a sophisticated oscillator that combines adaptive smoothing with statistical normalization to deliver high-quality signals! Whether you're a swing trader looking for momentum shifts or a medium- to long-term investor focusing on trend validation, this indicator's statistical approach offers valuable analytical advantages that can enhance your trading and investing decisions!

🟢 Core Architecture

The foundation of this indicator lies in its unique dual-layer calculation system. The first layer implements the Jurik Moving Average, known for its superior noise reduction and responsiveness, while the second layer applies statistical normalization (Z-Score) to create standardized readings. This sophisticated approach helps identify significant price movements while filtering out market noise across various timeframes and instruments.

🟢 Technical Foundation

Three key components power this indicator are:

🟢 Key Features & Signals

The Normalized JMA delivers market insights through:

🟢 Practical Usage Tips

Here's how to maximize your use of the Normalized JMA:

1/ Setup:

2/ Reading Signals:

🟢 Pro Tips

🟢 Core Architecture

The foundation of this indicator lies in its unique dual-layer calculation system. The first layer implements the Jurik Moving Average, known for its superior noise reduction and responsiveness, while the second layer applies statistical normalization (Z-Score) to create standardized readings. This sophisticated approach helps identify significant price movements while filtering out market noise across various timeframes and instruments.

🟢 Technical Foundation

Three key components power this indicator are:

- Jurik Moving Average (JMA): An advanced moving average calculation that provides superior smoothing with minimal lag

- Statistical Normalization: Z-Score based scaling that creates consistent, comparable readings across different market conditions

- Dynamic Zone Detection: Automatically identifies overbought and oversold conditions based on statistical deviations

🟢 Key Features & Signals

The Normalized JMA delivers market insights through:

- Color-adaptive oscillator line that reflects momentum strength and direction

- Statistically significant overbought/oversold zones for trade validation

- Smart gradient fills between signal line and zero level for enhanced visualization

- Clear long (L) and short (S) markers for validated momentum shifts

- Intelligent bar coloring that highlights the current market state

- Customizable alert system for both bullish and bearish setups

🟢 Practical Usage Tips

Here's how to maximize your use of the Normalized JMA:

1/ Setup:

- Add the indicator to your favorites, then apply it to your chart ⭐️

- Begin with the default smoothing period for balanced analysis

- Use the default normalization period for optimal signal generation

- Start with standard visualization settings

- Customize colors to match your chart preferences

- Enable both bar coloring and signal markers for complete visual feedback

2/ Reading Signals:

- Watch for L/S markers - they indicate validated momentum shifts

- Monitor oscillator line color changes for direction confirmation

- Use the built-in alert system to stay informed of potential trend changes

🟢 Pro Tips

- Adjust Smoothing Period based on your trading style:

→ Lower values (8-12) for more responsive signals

→ Higher values (20-30) for more stable trend identification

- Fine-tune Normalization Period based on market conditions:

→ Shorter periods (20-25) for more dynamic markets

→ Longer periods (40-50) for more stable markets

- Optimize your analysis by:

→ Using +2/-2 zones for primary trade signals

→ Using +3/-3 zones for extreme market conditions

→ Combining with volume analysis for trade confirmation

→ Using multiple timeframe analysis for strategic context

- Combine with:

→ Volume indicators for trade validation

→ Price action for entry timing

→ Support/resistance levels for profit targets

→ Trend-following indicators for directional bias

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

👉 Access our best trading & investing tools here (3-day FREE trial): whop.com/quantalgo/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

👉 Access our best trading & investing tools here (3-day FREE trial): whop.com/quantalgo/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.