OPEN-SOURCE SCRIPT

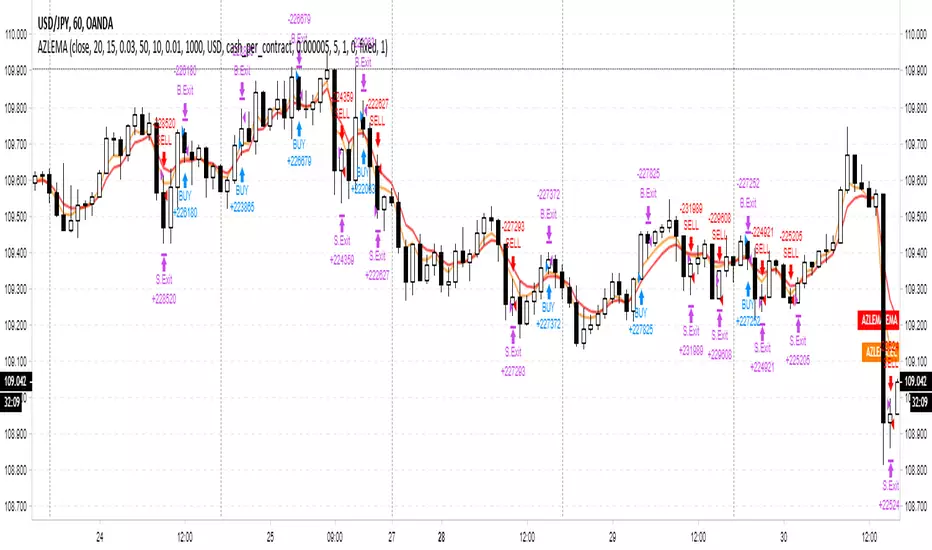

Adaptive Zero Lag EMA Strategy [Ehlers + Ric]

Behold! A strategy that makes use of Ehlers research into the field of signal processing and wins so consistently, on multiple time frames AND on multiple currency pairs.

The Adaptive Zero Lag EMA (AZLEMA) is based on an informative report by Ehlers and Ric [1].

I've modified it by using Cosine IFM, a method by Ehlers on determining the dominant cycle period without using fast-Fourier transforms [2] [3]

Instead, we use some basic differential equations that are simplified to approximate the cycle period over a 100 bar sample size.

The settings for this strategy allow you to scalp or swing trade! High versatility!

Since this strategy is frequency based, you can run it on any timeframe (M1 is untested) and even have the option of using adaptive settings for a best-fit.

>Settings

[1] mesasoftware.com/papers/ZeroLag.pdf

[2] jamesgoulding.com/Research_II/Ehlers/Ehlers (Measuring Cycles).doc

[3]![Cosine IFM [Ehlers]](https://s3.tradingview.com/5/5WqrAJgu_mid.png)

The Adaptive Zero Lag EMA (AZLEMA) is based on an informative report by Ehlers and Ric [1].

I've modified it by using Cosine IFM, a method by Ehlers on determining the dominant cycle period without using fast-Fourier transforms [2] [3]

Instead, we use some basic differential equations that are simplified to approximate the cycle period over a 100 bar sample size.

The settings for this strategy allow you to scalp or swing trade! High versatility!

Since this strategy is frequency based, you can run it on any timeframe (M1 is untested) and even have the option of using adaptive settings for a best-fit.

>Settings

- Source : Choose the value for calculations (close, open, high + low / 2, etc...)

- Period : Choose the dominant cycle for the ZLEMA (typically under 100)

- Adaptive? : Allow the strategy to continuously update the Period for you (disables Period setting)

- Gain Limit : Higher = faster response. Lower = smoother response. See [2] for more information.

- Threshold : Provides a bit more control over entering a trade. Lower = less selective. Higher = More selective. (range from 0 to 1)

- SL Points : Stop Poss level in points (10 points = 1 pip)

- TP Points : Take Profit level in points

- Risk : Percent of current balance to risk on each trade (0.01 = 1%)

[1] mesasoftware.com/papers/ZeroLag.pdf

[2] jamesgoulding.com/Research_II/Ehlers/Ehlers (Measuring Cycles).doc

[3]

![Cosine IFM [Ehlers]](https://s3.tradingview.com/5/5WqrAJgu_mid.png)

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Algo Trading Simplified 👉 PaxProfits.com

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Algo Trading Simplified 👉 PaxProfits.com

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

Discover the easy way to manage Forex trading accounts. Trusted by traders globally.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.