OPEN-SOURCE SCRIPT

업데이트됨 R-based Strategy Template [Daveatt]

Have you ever wondered how to properly track your trading performance based on risk rather than just profits?

This template solves that problem by implementing R-multiple tracking directly in TradingView's strategy tester.

This script is a tool that you must update with your own trading entry logic.

Quick notes

Before we dive in, I want to be clear: this is a template focused on R-multiple calculation and visualization.

I'm using a basic RSI strategy with dummy values just to demonstrate how the R tracking works. The actual trading signals aren't important here - you should replace them with your own strategy logic.

R multiple logic

Let's talk about what R-multiple means in practice.

Think of R as your initial risk per trade.

For instance, if you have a $10,000 account and you're risking 1% per trade, your 1R would be $100.

A trade that makes twice your risk would be +2R ($200), while hitting your stop loss would be -1R (-$100).

This way of measuring makes it much easier to evaluate your strategy's performance regardless of account size.

Whenever the SL is hit, we lose -1R

Proof showing the strategy tester whenever the SL is hit: i.imgur.com/y4GxZAt.png

The magic happens in how we calculate position sizes.

The script automatically determines the right position size to risk exactly your specified percentage on each trade.

This is done through a simple but powerful calculation:

Pine Script®

Limitations with lower timeframe gaps

This ensures that if your stop loss gets hit, you'll lose exactly the amount you intended to risk. No more, no less.

Well, could be more or less actually ... let's assume you're trading futures on a 15-minute chart but in the 1-minute chart there is a gap ... then your 15 minute SL won't get filled and you'll likely to not lose exactly -1R

This is annoying but it can't be fixed - and that's how trading works anyway.

Features

The template gives you flexibility in how you set your stop losses. You can use fixed points, ATR-based stops, percentage-based stops, or even tick-based stops.

Regardless of which method you choose, the position sizing will automatically adjust to maintain your desired risk per trade.

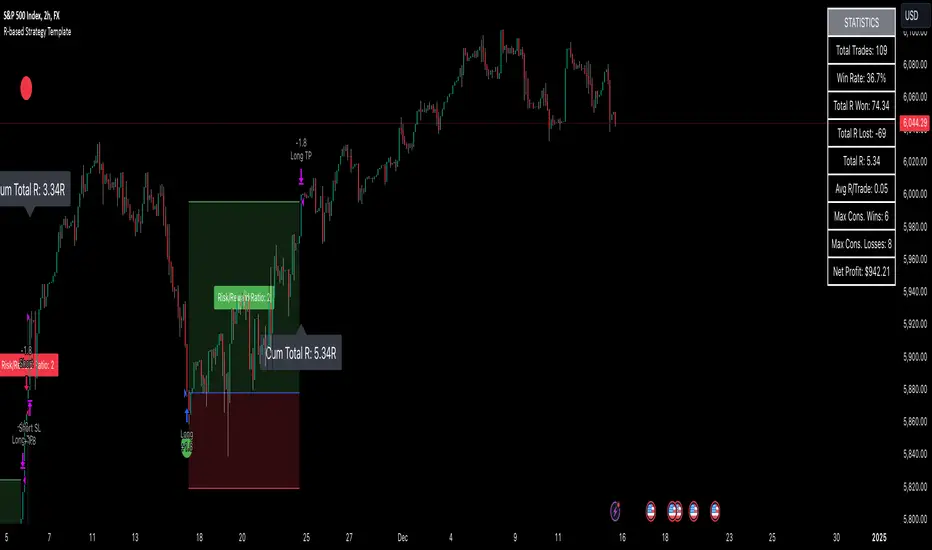

To help you track performance, I've added a comprehensive statistics table in the top right corner of your chart.

It shows you everything you need to know about your strategy's performance in terms of R-multiples: how many R you've won or lost, your win rate, average R per trade, and even your longest winning and losing streaks.

Happy trading!

And remember, measuring your performance in R-multiples is one of the most classical ways to evaluate and improve your trading strategies.

Daveatt

This template solves that problem by implementing R-multiple tracking directly in TradingView's strategy tester.

This script is a tool that you must update with your own trading entry logic.

Quick notes

Before we dive in, I want to be clear: this is a template focused on R-multiple calculation and visualization.

I'm using a basic RSI strategy with dummy values just to demonstrate how the R tracking works. The actual trading signals aren't important here - you should replace them with your own strategy logic.

R multiple logic

Let's talk about what R-multiple means in practice.

Think of R as your initial risk per trade.

For instance, if you have a $10,000 account and you're risking 1% per trade, your 1R would be $100.

A trade that makes twice your risk would be +2R ($200), while hitting your stop loss would be -1R (-$100).

This way of measuring makes it much easier to evaluate your strategy's performance regardless of account size.

Whenever the SL is hit, we lose -1R

Proof showing the strategy tester whenever the SL is hit: i.imgur.com/y4GxZAt.png

The magic happens in how we calculate position sizes.

The script automatically determines the right position size to risk exactly your specified percentage on each trade.

This is done through a simple but powerful calculation:

risk_amount = (strategy.equity * (risk_per_trade_percent / 100))

sl_distance = math.abs(entry_price - sl_price)

position_size = risk_amount / (sl_distance * syminfo.pointvalue)

Limitations with lower timeframe gaps

This ensures that if your stop loss gets hit, you'll lose exactly the amount you intended to risk. No more, no less.

Well, could be more or less actually ... let's assume you're trading futures on a 15-minute chart but in the 1-minute chart there is a gap ... then your 15 minute SL won't get filled and you'll likely to not lose exactly -1R

This is annoying but it can't be fixed - and that's how trading works anyway.

Features

The template gives you flexibility in how you set your stop losses. You can use fixed points, ATR-based stops, percentage-based stops, or even tick-based stops.

Regardless of which method you choose, the position sizing will automatically adjust to maintain your desired risk per trade.

To help you track performance, I've added a comprehensive statistics table in the top right corner of your chart.

It shows you everything you need to know about your strategy's performance in terms of R-multiples: how many R you've won or lost, your win rate, average R per trade, and even your longest winning and losing streaks.

Happy trading!

And remember, measuring your performance in R-multiples is one of the most classical ways to evaluate and improve your trading strategies.

Daveatt

릴리즈 노트

Updating the post chart오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.