OPEN-SOURCE SCRIPT

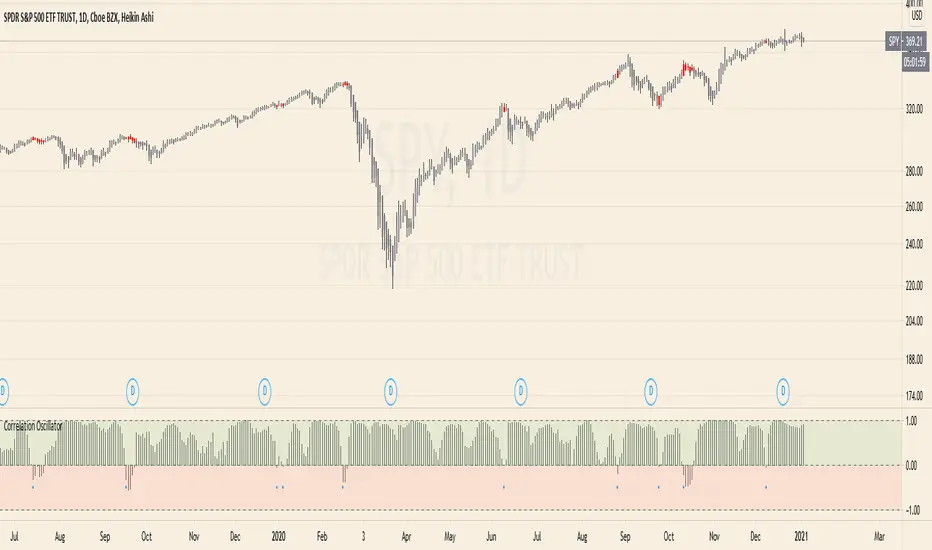

Correlation Oscillator - Anomaly Alerts

This script plots the correlation for two symbols as an oscillator:

A correlation of 1 means that both values move in the same direction together.

A correlation of -1 means that both values are perfectly negative correlated.

Parameter:

Length of the Correlation

The two symbols you want to calculate the correlation for

Barcolor: Defines whether Bar-coloring is set on.

The Number of bars lookback for anomaly: Say both are normally positively correlated it is an anomaly when the correlation turns negative and vica-versa.

Alerts: You can also set an Alert when an anomaly is detected.(blue dots on oscillator)

This has many use-cases:

For example VVIX and VIX are normally positive correlated.

When this turns negative, this can mean that we are on a turning point:

--> VVIX is rising while VIX is falling, risk of future Volatility is increasing (Top)

--> VIX is rising while VVIX is falling, risk of future Volatility is decreasing (Bottom)

Another use-case is just checking the correlation of stocks in your portfolio to diversify.

A correlation of 1 means that both values move in the same direction together.

A correlation of -1 means that both values are perfectly negative correlated.

Parameter:

Length of the Correlation

The two symbols you want to calculate the correlation for

Barcolor: Defines whether Bar-coloring is set on.

The Number of bars lookback for anomaly: Say both are normally positively correlated it is an anomaly when the correlation turns negative and vica-versa.

Alerts: You can also set an Alert when an anomaly is detected.(blue dots on oscillator)

This has many use-cases:

For example VVIX and VIX are normally positive correlated.

When this turns negative, this can mean that we are on a turning point:

--> VVIX is rising while VIX is falling, risk of future Volatility is increasing (Top)

--> VIX is rising while VVIX is falling, risk of future Volatility is decreasing (Bottom)

Another use-case is just checking the correlation of stocks in your portfolio to diversify.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.