OPEN-SOURCE SCRIPT

업데이트됨 Adaptive Fisherized ROC

Introduction

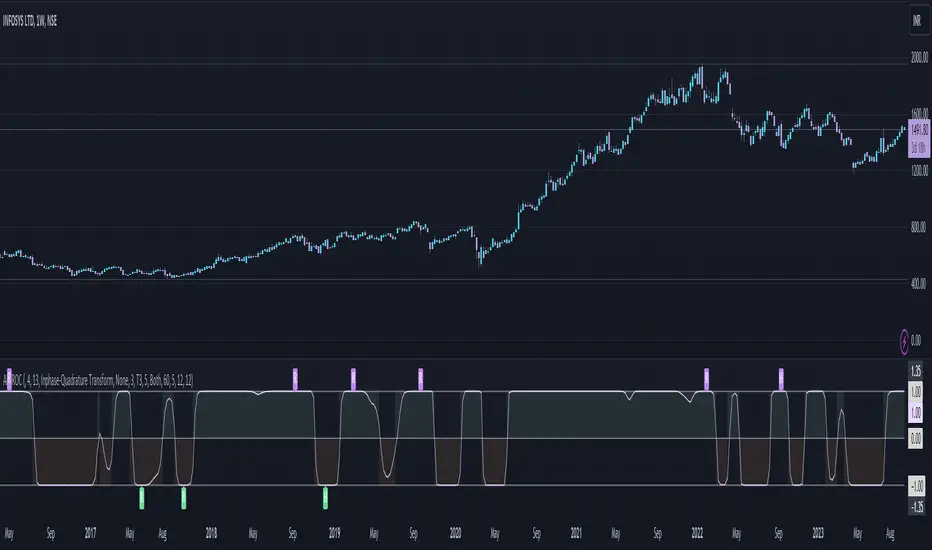

Hello community, here I applied the Inverse Fisher Transform, Ehlers dominant cycle determination and smoothing methods on a simple Rate of Change (ROC) indicator

You have a lot of options to adjust the indicator.

Usage

The rate of change is most often used to measure the change in a security's price over time.

That's why it is a momentum indicator.

When it is positive, prices are accelerating upward; when negative, downward.

It is useable on every timeframe and could be a potential filter for you your trading system.

IMO it could help you to confirm entries or find exits (e.g. you have a long open, roc goes negative, you exit).

If you use a trend-following strategy, you could maybe look out for red zones in an in uptrend or green zones in a downtrend to confirm your entry on a pullback.

Signals

ROC above 0 => confirms bullish trend

ROC below 0 => confirms bearish trend

ROC hovers near 0 => price is consolidating

Enjoy! 🚀

Hello community, here I applied the Inverse Fisher Transform, Ehlers dominant cycle determination and smoothing methods on a simple Rate of Change (ROC) indicator

You have a lot of options to adjust the indicator.

Usage

The rate of change is most often used to measure the change in a security's price over time.

That's why it is a momentum indicator.

When it is positive, prices are accelerating upward; when negative, downward.

It is useable on every timeframe and could be a potential filter for you your trading system.

IMO it could help you to confirm entries or find exits (e.g. you have a long open, roc goes negative, you exit).

If you use a trend-following strategy, you could maybe look out for red zones in an in uptrend or green zones in a downtrend to confirm your entry on a pullback.

Signals

ROC above 0 => confirms bullish trend

ROC below 0 => confirms bearish trend

ROC hovers near 0 => price is consolidating

Enjoy! 🚀

릴리즈 노트

Updated default valuesFixed hilber transform calculation bug

릴리즈 노트

Updated default valuesAdded min length check

Fixed Inphase-Quadrature Transform calculation

Fixed adaptive mode selection bug

릴리즈 노트

Decreased lag of Hann Window smoothing by applying it to the price instead of the indicator itself.Increased linewidth and decreased transparency on background colors

릴리즈 노트

Updated plot릴리즈 노트

Just to update the chart릴리즈 노트

- Added divergence detection

- Removed wrong Kalman filter

- Reworked smoothing system -> Now you can apply the smoothing methods on the source price (which is close[1]) or on the indicator itself depending on what your goal is with the smoothing.

릴리즈 노트

Applied the IFT after the smoothing to stick to the scale of -1 to 1릴리즈 노트

Removed 34 as max length of Homodyne Discriminator릴리즈 노트

Fixed that T3 Normal wasn't selectale.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.