OPEN-SOURCE SCRIPT

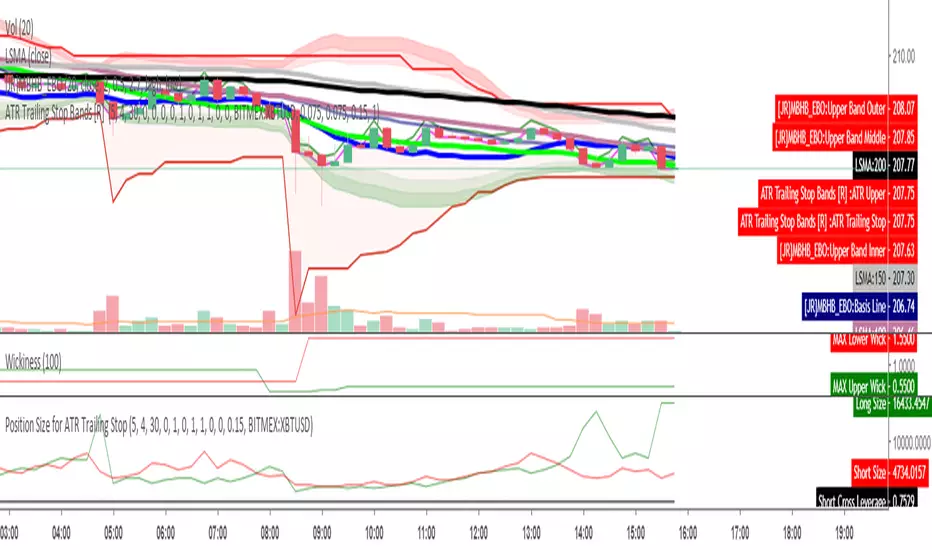

업데이트됨 Position Size for ATR Trailing Stop

This indicator will calculate your position size, short or long, based on the ATR Trailing Stop indicator of mine, and are needed to be used together. General risk management suggests risking just 1 percent of your equity and using low leverage.

릴리즈 노트

Changed the Equity to be Float with no minimum value so you can set it to XBT Satoshi value.릴리즈 노트

This new version allows you to set Manual Entries rather than the current price in case you want to set Limit Orders, and Manual Stops in case you want to override the ATR Trailing Stop and set your own instead. It thus becomes a general purpose Position Size Calculator.릴리즈 노트

The original version was designed with XBTUSD on BitMex in mind, this new premium version deals with BTC pairs on Mex, or equity that is valued in USD(T) like Bitfinex. It also includes fees within the risk percentage, and you can set what percentage for fees based on whether you are using a market order and paying the Taker fee for entry, or a limit order and receiving the Maker rebate, though I suggest assuming a Stop Market gets hit for dealing with worst case scenario on total risk.릴리즈 노트

Added ETHUSD on BitMex position sizing, which has an unusual contract size.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.