업데이트됨

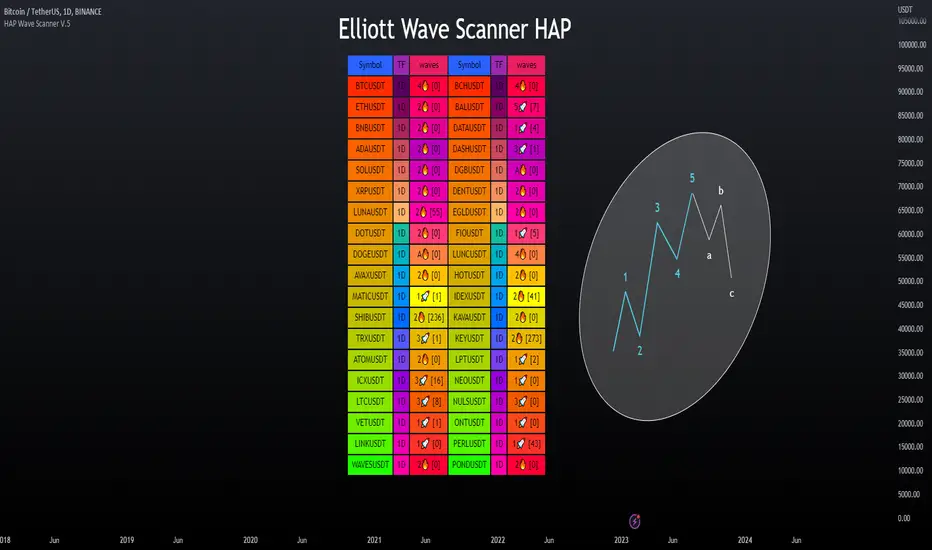

Elliott Wave Scanner - HAP [PRO]

▶Elliott Wave Scanner

This is an added feature of the wave drawing version, but this version is used for scanning multiple currency pairs simultaneously, based on the custom list you have specified as your preferred ones, making it more convenient for you.

This :![Elliott Wave - HAP [PRO]](https://s3.tradingview.com/p/PLh61sBj_mid.png)

════════════════════════

This will be an adjustment of the number bars to be similar to the version in the drawing wave, with the only difference being that this version will be a scan of multiple waveforms simultaneously, including the input data format. It is recommended to only change the numbers, maintaining the original structure to avoid any errors, as demonstrated in the example below.

Pine Script®

**Kindly note to specify the numerical sequence of each wave. Parentheses should always be preceded by a comma and conclude on the final line without one.

════════════════════════

▶Let's take a look at the different parts of the scanned version.

════════════════════════

🎯 Bringing in the RSI to help make decisions, as referenced in the book by "Jason Perl".

if the market is advancing as part of a bullish HAP WAVE up sequence, then the RSI should remain above `40` during corrective setbacks for HAP WAVEs 2 and 4. Similarly, if the market is declining as part of a bearish HAP WAVE down sequence, then the RSI should remain beneath 60 during corrective for HAP WAVEs 2 and 4

For example, an uptrend in Wave tends to cause an RSI divergence between Wave 5 and Wave 3. When Wave 5 exceeds Wave 3, the RSI is often seen at Wave 5, which is lower than Wave 3.

This is an added feature of the wave drawing version, but this version is used for scanning multiple currency pairs simultaneously, based on the custom list you have specified as your preferred ones, making it more convenient for you.

This :

![Elliott Wave - HAP [PRO]](https://s3.tradingview.com/p/PLh61sBj_mid.png)

════════════════════════

This will be an adjustment of the number bars to be similar to the version in the drawing wave, with the only difference being that this version will be a scan of multiple waveforms simultaneously, including the input data format. It is recommended to only change the numbers, maintaining the original structure to avoid any errors, as demonstrated in the example below.

This is a valid example.👇

Wave0= (21),

Wave1= (13),

Wave2= (8),

Wave3= (21),

Wave4= (13),

Wave5= (34),

WaveA= (13),

WaveB= (8),

WaveC= (21)

**Kindly note to specify the numerical sequence of each wave. Parentheses should always be preceded by a comma and conclude on the final line without one.

════════════════════════

▶Let's take a look at the different parts of the scanned version.

════════════════════════

🎯 Bringing in the RSI to help make decisions, as referenced in the book by "Jason Perl".

if the market is advancing as part of a bullish HAP WAVE up sequence, then the RSI should remain above `40` during corrective setbacks for HAP WAVEs 2 and 4. Similarly, if the market is declining as part of a bearish HAP WAVE down sequence, then the RSI should remain beneath 60 during corrective for HAP WAVEs 2 and 4

For example, an uptrend in Wave tends to cause an RSI divergence between Wave 5 and Wave 3. When Wave 5 exceeds Wave 3, the RSI is often seen at Wave 5, which is lower than Wave 3.

릴리즈 노트

V5.2 Improve work efficiency.릴리즈 노트

V5.3The wave drawing version has been updated, making it compatible with the wave drawing version. You can find details about the update in the wave drawing version.

유료 공간에서 이용 가능

이 지표는 Hapharmonic Elite Technical Suite 구독자만 이용할 수 있습니다. 가입하시면 이 지표를 포함한 hapharmonic의 다른 스크립트도 이용하실 수 있습니다.

✨ Access premium indicators at: hapharmonic.com

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

유료 공간에서 이용 가능

이 지표는 Hapharmonic Elite Technical Suite 구독자만 이용할 수 있습니다. 가입하시면 이 지표를 포함한 hapharmonic의 다른 스크립트도 이용하실 수 있습니다.

✨ Access premium indicators at: hapharmonic.com

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.