INVITE-ONLY SCRIPT

업데이트됨 Timeless Command | QuantEdgeB

🔍 Overview

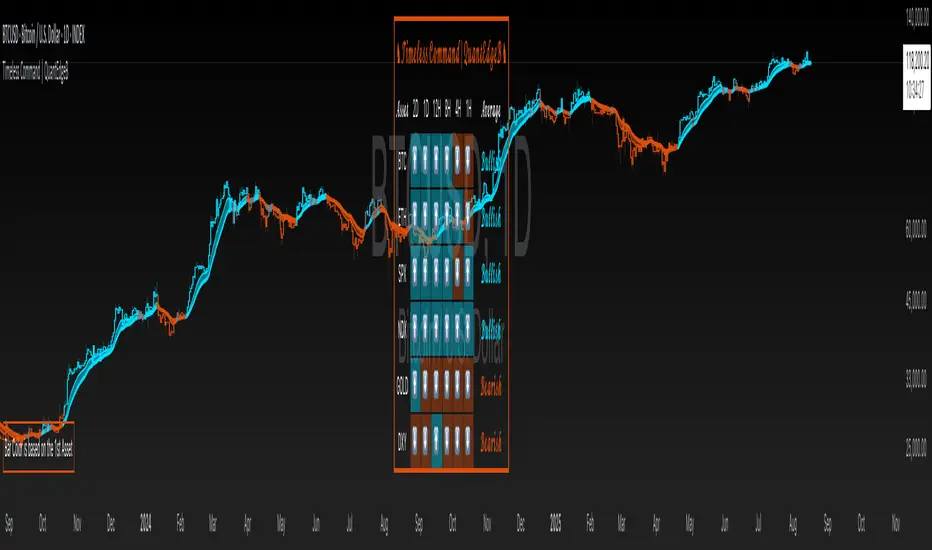

Timeless Command is a multi-asset, multi-timeframe “sentiment dashboard” built around a custom Universal Strategy. It fuses two independent proprietary oscillators into one normalized signal, then snapshots that signal across six user-chosen assets and six user-chosen timeframes—right on your price chart. You instantly see whether Bitcoin, Ethereum, Gold, the U.S. Dollar Index, the S&P 500 or the Nasdaq are “Bullish” or “Bearish” from the 2-day down to the 15-minute horizon, plus an overall bias and bar-color overlays.

✨ Key Features

• 🧠 Universal Strategy

o Combines two independent strategic modules into a single oscillator.

o Applies upper/lower thresholds to generate Long/Short/Neutral signals.

• 🌐 Multi-Asset, Multi-TF Grid

o Up to six symbols (e.g. BTC, ETH, SPX, NDX, GOLD, DXY).

o Six configurable timeframes (days, hours, minutes).

o Automatic conversion of “4H” → “240” minutes for seamless request.security calls.

• 📊 Live Sentiment Table

o Arrow icons per asset/timeframe (“⬆️” vs “⬇️”).

o Per-asset average bias (“Bullish” / “Bearish” / “Neutral”), color-coded.

o Clean, right-aligned table overlay with asset labels and timeframe headers.

• 🎨 Chart Overlays

o Bar coloring driven by the first asset’s average TPI bias.

o Two EMAs (default 12/21) filled to show trend direction.

o Optional mini info table to explain bar-color logic.

⚙️ How It Works

1. Signal Calculation

o Applies thresholds (±0.1) to yield discrete signals from a Universal Strategy: +1 (long), –1 (short), 0 (neutral).

2. Multi-TF Signal Gathering

o For each asset, the script uses request.security to pull the TPI on each selected timeframe, locking values at bar close for consistency.

o Converts each reading into a binary direction (up/down).

3. Averaging & Labeling

o Averages the six directional values per asset to gauge overall bias.

o Renders a “Bullish” or “Bearish” label (or “Neutral” if exactly zero).

4. Visual Overlay

o Bar Color: The chart’s candles recolor based on the first asset’s average bias—blue for bullish, orange for bearish, gray for neutral.

o EMAs: Two exponential moving averages sweep the chart, filled to highlight trending regimes.

5. Dashboard Table

o Rows = assets, columns = timeframes + “Average” column.

o Each cell shows an arrow icon with background shading.

o Last column spells out the per-asset average bias in styled text and color.

🎯 Who Should Use It

• Macro Traders who want a quick cross-market heatmap.

• Multi-Asset Strategists balancing exposure across crypto, equities, FX and commodities.

• Systematic & Discretionary players looking for unified, threshold-based signals.

• Risk Managers needing a real-time sentinel on regime shifts across key markets.

⚙️ Default Settings

• Assets: BTCUSD, ETHUSD, SPX, NDX, GOLD, DXY

• Timeframes: 2D, 1D, 12H, 4H, 1H, 15m

• Thresholds: ±0.1 for long/short entries

📌 Conclusion

With Timeless Command, you gain an at-a-glance “command center” for cross-market sentiment. It turns complex, multi-TF oscillator data into a simple arrow-and-table view, coloring your price bars to reinforce the prevailing bias. Whether you’re hunting trend continuations, regime changes or mean-reversion setups, this overlay gives you the high-level context you need—without digging through six different charts.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Timeless Command is a multi-asset, multi-timeframe “sentiment dashboard” built around a custom Universal Strategy. It fuses two independent proprietary oscillators into one normalized signal, then snapshots that signal across six user-chosen assets and six user-chosen timeframes—right on your price chart. You instantly see whether Bitcoin, Ethereum, Gold, the U.S. Dollar Index, the S&P 500 or the Nasdaq are “Bullish” or “Bearish” from the 2-day down to the 15-minute horizon, plus an overall bias and bar-color overlays.

✨ Key Features

• 🧠 Universal Strategy

o Combines two independent strategic modules into a single oscillator.

o Applies upper/lower thresholds to generate Long/Short/Neutral signals.

• 🌐 Multi-Asset, Multi-TF Grid

o Up to six symbols (e.g. BTC, ETH, SPX, NDX, GOLD, DXY).

o Six configurable timeframes (days, hours, minutes).

o Automatic conversion of “4H” → “240” minutes for seamless request.security calls.

• 📊 Live Sentiment Table

o Arrow icons per asset/timeframe (“⬆️” vs “⬇️”).

o Per-asset average bias (“Bullish” / “Bearish” / “Neutral”), color-coded.

o Clean, right-aligned table overlay with asset labels and timeframe headers.

• 🎨 Chart Overlays

o Bar coloring driven by the first asset’s average TPI bias.

o Two EMAs (default 12/21) filled to show trend direction.

o Optional mini info table to explain bar-color logic.

⚙️ How It Works

1. Signal Calculation

o Applies thresholds (±0.1) to yield discrete signals from a Universal Strategy: +1 (long), –1 (short), 0 (neutral).

2. Multi-TF Signal Gathering

o For each asset, the script uses request.security to pull the TPI on each selected timeframe, locking values at bar close for consistency.

o Converts each reading into a binary direction (up/down).

3. Averaging & Labeling

o Averages the six directional values per asset to gauge overall bias.

o Renders a “Bullish” or “Bearish” label (or “Neutral” if exactly zero).

4. Visual Overlay

o Bar Color: The chart’s candles recolor based on the first asset’s average bias—blue for bullish, orange for bearish, gray for neutral.

o EMAs: Two exponential moving averages sweep the chart, filled to highlight trending regimes.

5. Dashboard Table

o Rows = assets, columns = timeframes + “Average” column.

o Each cell shows an arrow icon with background shading.

o Last column spells out the per-asset average bias in styled text and color.

🎯 Who Should Use It

• Macro Traders who want a quick cross-market heatmap.

• Multi-Asset Strategists balancing exposure across crypto, equities, FX and commodities.

• Systematic & Discretionary players looking for unified, threshold-based signals.

• Risk Managers needing a real-time sentinel on regime shifts across key markets.

⚙️ Default Settings

• Assets: BTCUSD, ETHUSD, SPX, NDX, GOLD, DXY

• Timeframes: 2D, 1D, 12H, 4H, 1H, 15m

• Thresholds: ±0.1 for long/short entries

📌 Conclusion

With Timeless Command, you gain an at-a-glance “command center” for cross-market sentiment. It turns complex, multi-TF oscillator data into a simple arrow-and-table view, coloring your price bars to reinforce the prevailing bias. Whether you’re hunting trend continuations, regime changes or mean-reversion setups, this overlay gives you the high-level context you need—without digging through six different charts.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

릴리즈 노트

typo mistake fixed초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 QuantEdgeB에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please check out our Whop page for access!!

https://whop.com/quantedgeb/

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 QuantEdgeB에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please check out our Whop page for access!!

https://whop.com/quantedgeb/

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.