OPEN-SOURCE SCRIPT

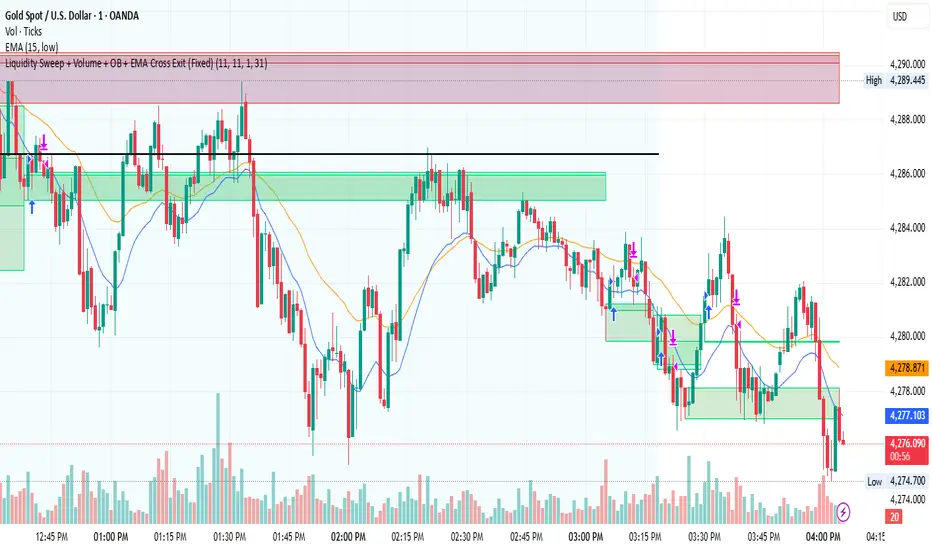

Liquidity Sweep + Volume + OB + EMA Cross Exit

This strategy is a smart-money–inspired trading system designed to capture high-probability reversals after liquidity is taken from the market.

It combines liquidity sweeps, volume confirmation, order block validation, and a dynamic EMA-based exit to control risk and let profits run.

Core Concept

Institutions first take liquidity, then move price in the real direction.

This strategy aims to enter after liquidity is swept and price shows confirmation.

1️⃣ Liquidity Sweep Detection

2️⃣ Volume Confirmation

3️⃣ Order Block Identification

4️⃣ EMA Trend Filter (Optional Entry Bias)

5️⃣ Trade Entry Logic

6️⃣ Exit Strategy – EMA Cross Exit

Benefits:

🛡 Risk & Trade Management

It combines liquidity sweeps, volume confirmation, order block validation, and a dynamic EMA-based exit to control risk and let profits run.

Core Concept

Institutions first take liquidity, then move price in the real direction.

This strategy aims to enter after liquidity is swept and price shows confirmation.

1️⃣ Liquidity Sweep Detection

2️⃣ Volume Confirmation

3️⃣ Order Block Identification

4️⃣ EMA Trend Filter (Optional Entry Bias)

5️⃣ Trade Entry Logic

6️⃣ Exit Strategy – EMA Cross Exit

Benefits:

- Lets strong trends run

- Exits automatically when momentum weakens

- Adapts to different market conditions

🛡 Risk & Trade Management

- One trade at a time (anti-overtrading logic)

- Early exit if trade moves against position after a few bars

- Opposite signal forces exit

- EMA cross provides trend-based exit

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.