PINE LIBRARY

업데이트됨 PointofControl

Library "PointofControl"

POC_f()

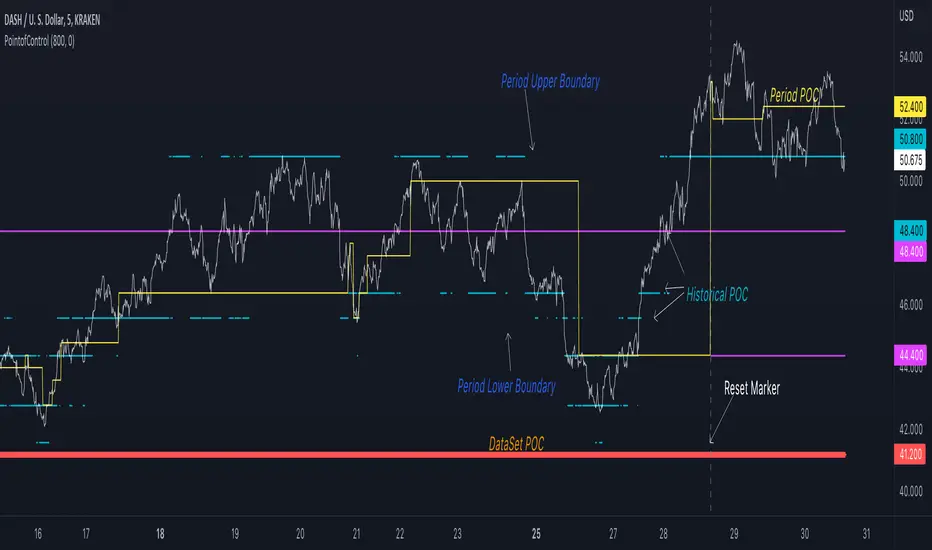

The genesis of this project was to create a POC library that would be available to deliver volume profile information via pine to other scripts of indicators and strategies.

This is the indicator version of the library function.

A few things that would be unique with the built in

- it allows you to choose the kind of reset of the period, day/week or bars. This is simple enough to expand to other conditions

- it resets on bar count starting from the beginning of the data set (bar index =0) vs bars back from the end of the data set

- A 'period' in this context is the time between resets - the start of the POC until it resets (for example at the beginning of a new day or week)

- it will calculate an increment level rather than the user specifying ticks or price brackets

- it does not allow for setting the # of rows and then calculating the implied price levels

- When a period is complete it is often useful to look back at the POCs of historical periods, or extend them forward.

- This script will find the historical POCs around the current price and display them rather than extend all the historical POC lines to the right

- This script also looks across all the period POCs and identifies the master POC or what I call the Grand POC, and also the next 3 runner up POCs

There is a matching indicator to this library

POC_f()

The genesis of this project was to create a POC library that would be available to deliver volume profile information via pine to other scripts of indicators and strategies.

This is the indicator version of the library function.

A few things that would be unique with the built in

- it allows you to choose the kind of reset of the period, day/week or bars. This is simple enough to expand to other conditions

- it resets on bar count starting from the beginning of the data set (bar index =0) vs bars back from the end of the data set

- A 'period' in this context is the time between resets - the start of the POC until it resets (for example at the beginning of a new day or week)

- it will calculate an increment level rather than the user specifying ticks or price brackets

- it does not allow for setting the # of rows and then calculating the implied price levels

- When a period is complete it is often useful to look back at the POCs of historical periods, or extend them forward.

- This script will find the historical POCs around the current price and display them rather than extend all the historical POC lines to the right

- This script also looks across all the period POCs and identifies the master POC or what I call the Grand POC, and also the next 3 runner up POCs

There is a matching indicator to this library

릴리즈 노트

v2릴리즈 노트

v3 - updated calculation in Auto_incr(). Found an issue in using ceiling vs round for the log_. This function may see more changes depending on my tests and feedback.릴리즈 노트

v4 - updated the auto increment calculation- checked for symbol without volume and will produce an error message

- improved comments

- another note on volume, Volume Profiles and POCs essentially examine the volume across price levels or increments, if a single candle crosses multiple price levels, this script allocates the volume of that candle equally between the volume levels and not purely at the ending close or high price level of the candle, this is purely a choice on my part that suggests large body single candles have trading volume through the entire price action of that candle and not at one price point. A more precise method (perhaps for a later update) would be to parse that one large candle into lower time frames and allocate the volume appropriately - perhaps for a future version. For now the approximation of equal volume distribution is good enough.

파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.