PROTECTED SOURCE SCRIPT

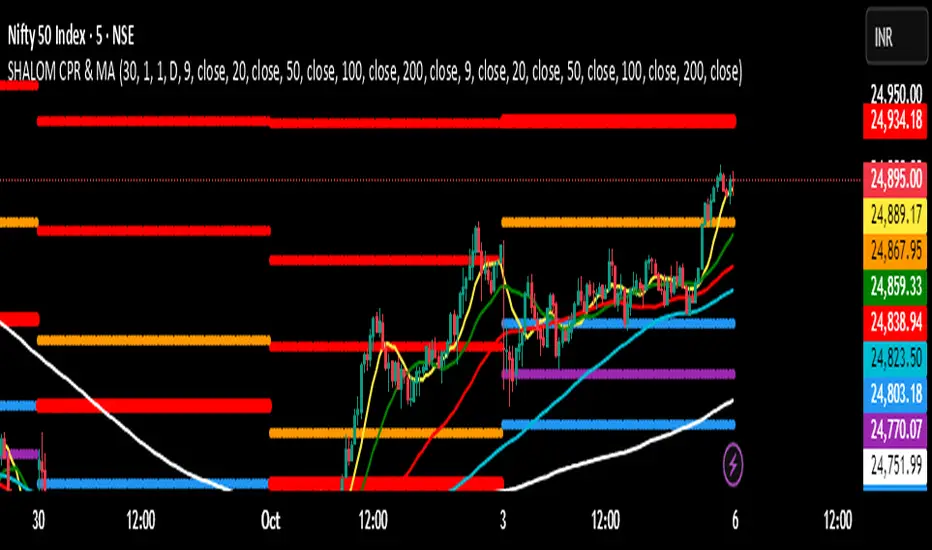

SHALOM TRADING HUB – CPR Camarilla & MA

SHALOM TRADING HUB – CPR Camarilla & MA (v4)

All-in-One Intraday & Swing Toolkit

Daily CPR (Prev Day), Weekly/Monthly Pivots, Prev Day/Week/Month High–Low, EMA/SMA pack, and Camarilla (H1–H4 & L1–L4). Plus Tomorrow CPR preview for next-session planning. 🔥

Features

Daily CPR: TC / PP / BC from previous day (value area & bias).

Floor Pivots: Daily/Weekly/Monthly R1–R4, S1–S4.

Previous High/Low: PDH/PDL, PWH/PWL, PMH/PML lines for breakout/mean-revert reads.

Camarilla Levels: H1–H4 & L1–L4 (popular 1.1 factor variant).

Moving Averages: EMA(9/20/50/100/200) & SMA(9/20/50/100/200) toggles.

Tomorrow CPR (Preview): Next session Pivot / BC / TC / R1 / S1 (D/W/M selectable).

Inputs (Settings)

Number of Daily/Weekly/Monthly pivots – show last N periods.

Show toggles – Daily CPR, Weekly/Monthly pivots, Prev H/L, Camarilla, Inner Camarilla, EMA/SMA.

Tomorrow CPR Type – D / W / M.

MA Lengths – fully customizable.

How to Use (Quick)

Trend bias: Price vs. CPR band & 20/50/200 MA stack.

Value zone: Inside TC–BC → balance; clean break & hold outside → trend continuation.

Reaction zones: Camarilla H3/L3 = bounce areas; H4/L4 = breakout/ breakdown lines.

Higher timeframe confluence: Add Weekly/Monthly pivots for swing levels.

Best Practices

Works on any timeframe; intraday (3–15m) recommended for CPR action.

Lines are derived using security(..., lookahead_on) on previous completed period → no forward repainting of those levels.

If too many lines: reduce “Number of … pivots” or turn off inner Camarilla/extra S/R.

All-in-One Intraday & Swing Toolkit

Daily CPR (Prev Day), Weekly/Monthly Pivots, Prev Day/Week/Month High–Low, EMA/SMA pack, and Camarilla (H1–H4 & L1–L4). Plus Tomorrow CPR preview for next-session planning. 🔥

Features

Daily CPR: TC / PP / BC from previous day (value area & bias).

Floor Pivots: Daily/Weekly/Monthly R1–R4, S1–S4.

Previous High/Low: PDH/PDL, PWH/PWL, PMH/PML lines for breakout/mean-revert reads.

Camarilla Levels: H1–H4 & L1–L4 (popular 1.1 factor variant).

Moving Averages: EMA(9/20/50/100/200) & SMA(9/20/50/100/200) toggles.

Tomorrow CPR (Preview): Next session Pivot / BC / TC / R1 / S1 (D/W/M selectable).

Inputs (Settings)

Number of Daily/Weekly/Monthly pivots – show last N periods.

Show toggles – Daily CPR, Weekly/Monthly pivots, Prev H/L, Camarilla, Inner Camarilla, EMA/SMA.

Tomorrow CPR Type – D / W / M.

MA Lengths – fully customizable.

How to Use (Quick)

Trend bias: Price vs. CPR band & 20/50/200 MA stack.

Value zone: Inside TC–BC → balance; clean break & hold outside → trend continuation.

Reaction zones: Camarilla H3/L3 = bounce areas; H4/L4 = breakout/ breakdown lines.

Higher timeframe confluence: Add Weekly/Monthly pivots for swing levels.

Best Practices

Works on any timeframe; intraday (3–15m) recommended for CPR action.

Lines are derived using security(..., lookahead_on) on previous completed period → no forward repainting of those levels.

If too many lines: reduce “Number of … pivots” or turn off inner Camarilla/extra S/R.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.