OPEN-SOURCE SCRIPT

Earnings Surprise Indicator (Post-Earnings Announcement Drift)

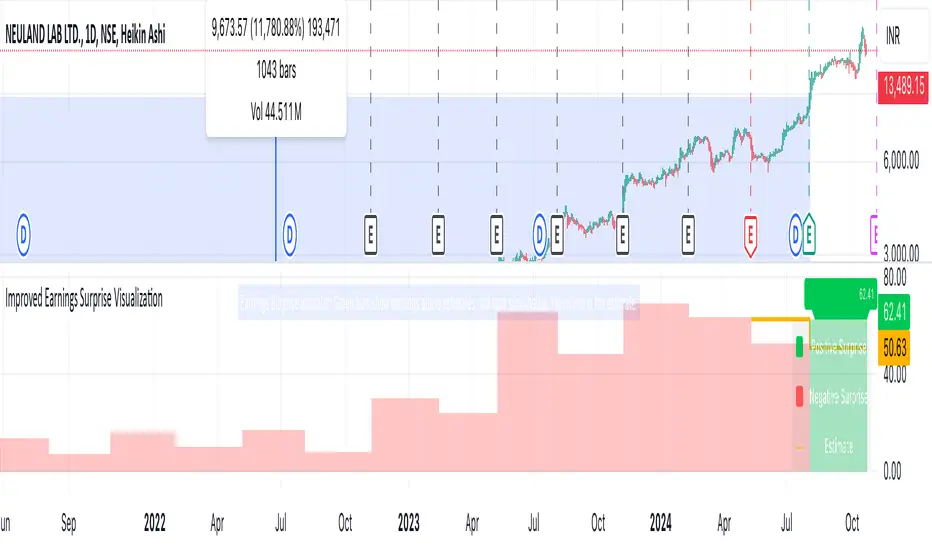

What It Does:

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.