OPEN-SOURCE SCRIPT

업데이트됨 Average Down Calculator

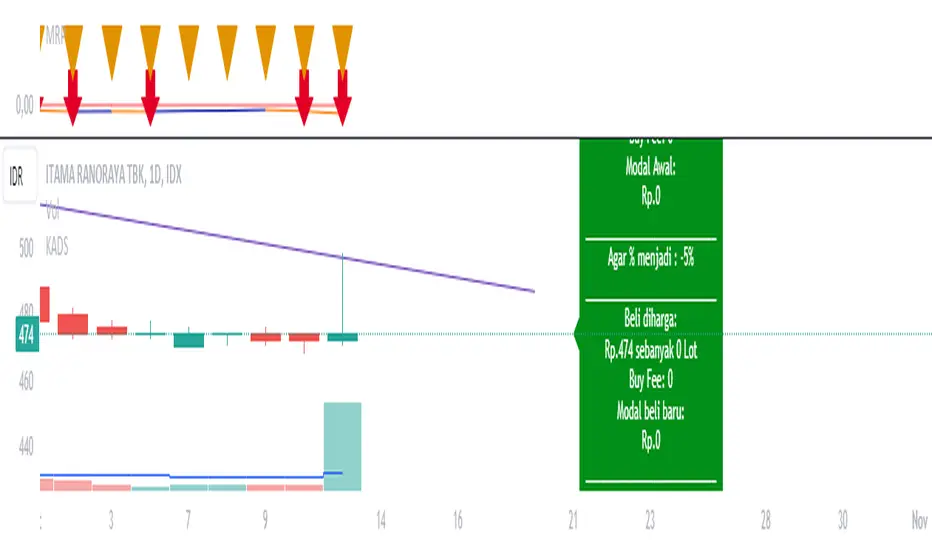

Average Down Calculator is an indicator for investors looking to manage their portfolio. It aids in calculating the average share price, providing insights into optimizing investment strategies. Averaging down is a strategy investors use when the price of a security they own goes down. Instead of selling at a loss, they buy more shares at the lower price to reduce the average cost per share.

There are situations where a stock's price moves contrary to your expectations. The market moves downward. Despite this, your faith in the stock persists. This indicator allowing you to strategically add more stocks to lower the average price. But You must remember, it’s not without risks, as it involves investing more money in a losing position.

This Indicator allowing you to quickly understand your new position and make informed decisions. It’s designed for easy use, regardless of your experience level with investing.

Steps to use it:

1.put buy fee from your securitas

2.next put the price of the emiten from your portofolio

3.and how many lot you have

4.next is the the taget of percentage you want it become.

5 the last you can choose, the price that you want to buy for average.

this calculator is designed to help you navigate your investment better, choose it wisely.Be aware of the risks of investing more in a declining asset and consider diversification to manage potential losses.

There are situations where a stock's price moves contrary to your expectations. The market moves downward. Despite this, your faith in the stock persists. This indicator allowing you to strategically add more stocks to lower the average price. But You must remember, it’s not without risks, as it involves investing more money in a losing position.

This Indicator allowing you to quickly understand your new position and make informed decisions. It’s designed for easy use, regardless of your experience level with investing.

Steps to use it:

1.put buy fee from your securitas

2.next put the price of the emiten from your portofolio

3.and how many lot you have

4.next is the the taget of percentage you want it become.

5 the last you can choose, the price that you want to buy for average.

this calculator is designed to help you navigate your investment better, choose it wisely.Be aware of the risks of investing more in a declining asset and consider diversification to manage potential losses.

릴리즈 노트

Average Down Calculator is an indicator for investors looking to manage their portfolio. It aids in calculating the average share price, providing insights into optimizing investment strategies. Averaging down is a strategy investors use when the price of a security they own goes down. Instead of selling at a loss, they buy more shares at the lower price to reduce the average cost per share.There are situations where a stock's price moves contrary to your expectations. The market moves downward. Despite this, your faith in the stock persists. This indicator allowing you to strategically add more stocks to lower the average price. But You must remember, it’s not without risks, as it involves investing more money in a losing position.

This Indicator allowing you to quickly understand your new position and make informed decisions. It’s designed for easy use, regardless of your experience level with investing.

Steps to use it:

1. Put buy fee from your securitas

2. Next enter the price of the emiten from your portofolio

3. And how many lot did you have

4. Next is the taget of percentage you want it become.

5 the last you can choose the price that you want to buy for average.

this calculator is designed to help you navigate your investment better, choose it wisely. Be aware of the risks of investing more in a declining asset and consider diversification to manage potential losses.

NEW UPDATE:

the arrow line only pop up after you enter the number

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.