INVITE-ONLY SCRIPT

업데이트됨 The Retriever

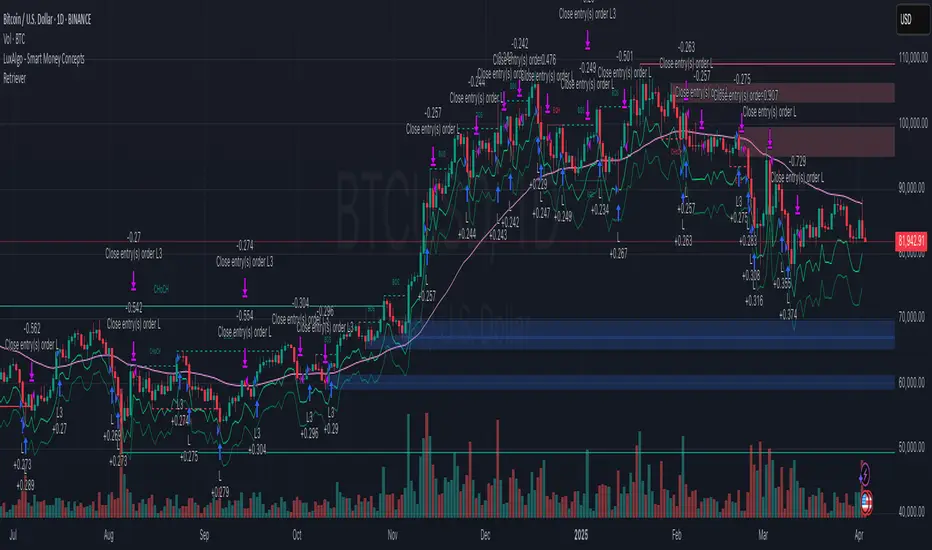

This Pine Script strategy, named "The Retriever" aims to capitalize on price dips based on the size of the candlestick body. It uses a moving average of the body size to identify potential long entry points. Here's a breakdown:

Body Size Calculation: It calculates the absolute difference between the close and open prices (body) to determine the candlestick body size.

Entry Signals:

long: A long entry signal is generated when the close price is significantly higher than the moving average of the body size (ta.sma(body, 100)) multiplied by a factor (mult). Thanks to this principle we are entering just bigger dips but just in case it is sudden movement, typically dip during bulish trend.

longExtra: A second, more aggressive long entry signal is generated when the close price is even further above the moving average (multiplied by mult * 2). This signal is very rare and it is helping to decrease entry point in case huge market dips which can occor just few times per year.

Quantity Calculation: The order quantity (qty) is dynamically calculated based on the current equity and the price range between minRange and maxRange. It aims to adjust the quantity inversely to the price range, possibly increasing the quantity when the price range is smaller. It is actually very smart in several ways:

Exit Conditions: All open positions are closed when either of these conditions is met:

The last candle is green (close is lower than open). There is also minProfit param defined which is set to 0 so it means that our position has to be in profit. So we are never closing in loss. We have to differentiate here between order and position. Order can be in loss but overal position has to be always in profit.

Body Size Calculation: It calculates the absolute difference between the close and open prices (body) to determine the candlestick body size.

Entry Signals:

long: A long entry signal is generated when the close price is significantly higher than the moving average of the body size (ta.sma(body, 100)) multiplied by a factor (mult). Thanks to this principle we are entering just bigger dips but just in case it is sudden movement, typically dip during bulish trend.

longExtra: A second, more aggressive long entry signal is generated when the close price is even further above the moving average (multiplied by mult * 2). This signal is very rare and it is helping to decrease entry point in case huge market dips which can occor just few times per year.

Quantity Calculation: The order quantity (qty) is dynamically calculated based on the current equity and the price range between minRange and maxRange. It aims to adjust the quantity inversely to the price range, possibly increasing the quantity when the price range is smaller. It is actually very smart in several ways:

- it is making bigger trades when market price is low (closer to manually defined minRange) and vice versa making smaller trades when market is close to maxRange

- trade size is calculated based on current equity so it allows to use compound interest effect

- as there is no SL in this strategy trade size is calculated to be max around 50-60% drawdown based on backtested results so it can survive 80-90% market drawdowns (entry point is after huge dip)

Exit Conditions: All open positions are closed when either of these conditions is met:

The last candle is green (close is lower than open). There is also minProfit param defined which is set to 0 so it means that our position has to be in profit. So we are never closing in loss. We have to differentiate here between order and position. Order can be in loss but overal position has to be always in profit.

릴리즈 노트

New version released. It is newly integrating long term trades on EMA cross. The % of profitable trades is decreased but strategy can gain from long trends now.초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 LukasNovak에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Write me a DM and I can help you to set up this strategy using Binance exchange API.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 LukasNovak에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Write me a DM and I can help you to set up this strategy using Binance exchange API.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.