OPEN-SOURCE SCRIPT

업데이트됨 Rolling VWAP [QuantraSystems]

Rolling VWAP

Introduction

The Rolling VWAP (R͜͡oll-VWAP) indicator modernizes the traditional VWAP by recalculating continuously on a rolling window, making it adept at pinpointing market trends and breakout points.

Its dual functionality includes both the dynamic rolling VWAP and a customizable anchored VWAP, enhanced by color-coded visual cues, thereby offering traders valuable flexibility and insight for their market analysis.

Legend

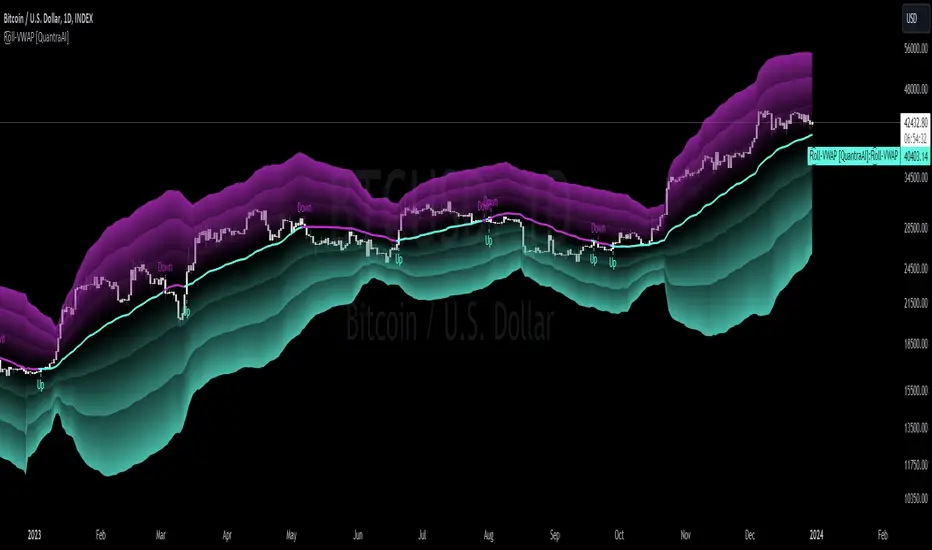

In the Image you can see the BTCUSD 1D Chart with the R͜͡oll-VWAP overlay.

You can see the individually activatable Standard Deviation (SD) Bands and the main VWAP Line.

It also features a Trend Signal which is deactivated by default and can be enabled if required.

Furthermore you can find the coloring of the VWAP line to represent the Trend.

In this case the trend itself is defined as:

Close being greater than the VWAP line -> Uptrend

Close below the VWAP line -> Downtrend

Notes

The R͜͡oll-VWAP can be used in a variety of ways.

Please note that we always advise to find more confluence by additional indicators.

Traders are encouraged to test and determine the most suitable settings for their specific trading strategies and timeframes.

Methodology

The R͜͡oll-VWAP is based on the inbuilt TV VWAP.

It expands upon the limitations of having an anchored timeframe and thus a limited data set that is being reset constantly.

Instead we have integrated a rolling nature that continuously calculates the VWAP over a customizable lookback.

To also keep the base utility it is possible to use the anchored timeframes as well.

Furthermore the visualization has been improved and we added the coloring of the main VWAP line according to the Trend as stated above.

The applicable Trend signals are also part of that.

The parameter settings and also the visualizations allow for ample customizations by the trader.

For questions or recommendations, please feel free to seek contact in the comments.

Introduction

The Rolling VWAP (R͜͡oll-VWAP) indicator modernizes the traditional VWAP by recalculating continuously on a rolling window, making it adept at pinpointing market trends and breakout points.

Its dual functionality includes both the dynamic rolling VWAP and a customizable anchored VWAP, enhanced by color-coded visual cues, thereby offering traders valuable flexibility and insight for their market analysis.

Legend

In the Image you can see the BTCUSD 1D Chart with the R͜͡oll-VWAP overlay.

You can see the individually activatable Standard Deviation (SD) Bands and the main VWAP Line.

It also features a Trend Signal which is deactivated by default and can be enabled if required.

Furthermore you can find the coloring of the VWAP line to represent the Trend.

In this case the trend itself is defined as:

Close being greater than the VWAP line -> Uptrend

Close below the VWAP line -> Downtrend

Notes

The R͜͡oll-VWAP can be used in a variety of ways.

- Volatility adjusted expected range

This aims to identify in which range the asset is likely to move - according to the historical values the SD Bands are calculated and thus their according probabilities displayed. - Trend analysis

Trending above or below the VWAP shows up or down trends accordingly. - S/R Levels

Based on the probability distribution the 2. SD often works as a Resistance level and either mid line or 1. SD lines can act as S/R levels - Unsustainable levels

Based on the probability distributions a SD level of beyond 2.5, especially 3 and higher is hit very seldom and highly unsustainable.

This can either mean a mean reversion state or a momentum slowdown is necessary to get back to a sustainable level.

Please note that we always advise to find more confluence by additional indicators.

Traders are encouraged to test and determine the most suitable settings for their specific trading strategies and timeframes.

Methodology

The R͜͡oll-VWAP is based on the inbuilt TV VWAP.

It expands upon the limitations of having an anchored timeframe and thus a limited data set that is being reset constantly.

Instead we have integrated a rolling nature that continuously calculates the VWAP over a customizable lookback.

To also keep the base utility it is possible to use the anchored timeframes as well.

Furthermore the visualization has been improved and we added the coloring of the main VWAP line according to the Trend as stated above.

The applicable Trend signals are also part of that.

The parameter settings and also the visualizations allow for ample customizations by the trader.

For questions or recommendations, please feel free to seek contact in the comments.

릴리즈 노트

Added custom alerts!Alerts are based upon the same logic as the trend signals found in the user menu.

릴리즈 노트

Added monochrome colors and the option for user-defined color themes.릴리즈 노트

Added the ability to remove the Deviation Band fill effect릴리즈 노트

Added 'Dynamic' capabilities.릴리즈 노트

Updated Dynamic Function Library.Updated header name tag.

릴리즈 노트

Updated License.License formatting shout out to RUBIX_BINARY

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

No statements or claims aim to be financial advice,

neither are any signals from us or our indicators.

Join the Cryptosystems Community (formerly QuantraSystems)👇

discord.gg/FMZDM3bZ9T

neither are any signals from us or our indicators.

Join the Cryptosystems Community (formerly QuantraSystems)👇

discord.gg/FMZDM3bZ9T

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

No statements or claims aim to be financial advice,

neither are any signals from us or our indicators.

Join the Cryptosystems Community (formerly QuantraSystems)👇

discord.gg/FMZDM3bZ9T

neither are any signals from us or our indicators.

Join the Cryptosystems Community (formerly QuantraSystems)👇

discord.gg/FMZDM3bZ9T

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.