OPEN-SOURCE SCRIPT

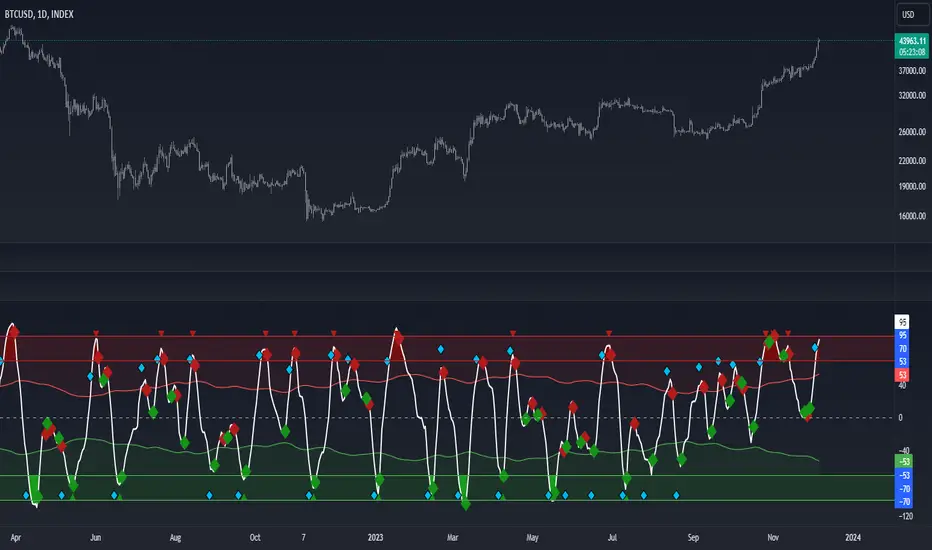

업데이트됨 Volume Zone Oscillator by [VanHelsig]

Volume Zone Oscillator

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

릴리즈 노트

Updated calculations and backtested. 릴리즈 노트

-릴리즈 노트

BackTest BTC Index (BackTest of local buys and local sells) BackTest ETH Index

https://www.tradingview.com/x/Dxb8cWuv/

릴리즈 노트

Organazide code, changed default inputs오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.