OPEN-SOURCE SCRIPT

Bilateral Stochastic Oscillator Strategy

Introduction

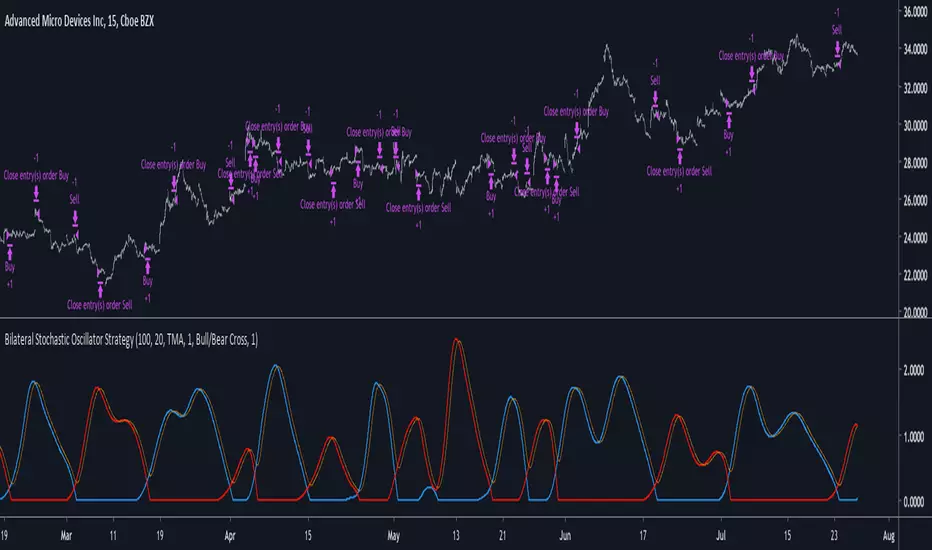

Strategy based on the bilateral stochastic oscillator, this oscillator aim to detect trends and possible reversal points of the current trend. The oscillator is composed of 1 bull line in blue and 1 bear line in red as well as a signal line in orange, the strategy have many options such as two different strategy framework and a martingale mode. If you require more information about the indicator go check it into my uploaded indicators.

Strategy Frameworks

There are two frameworks available that can be selected from the strategy settings window. Both have the same closing conditions, the "Bull/Bear Cross" entry conditions are :

Buy : when the bull line cross over the bear line

Sell : when the bear line cross over the bull line

The "Signal Cross" entry conditions are :

Buy : when the bull line cross over the signal line

Sell : when the bear line cross over the signal line

Both have the same close conditions that is : close when bull/bear cross under the signal line.

Introduction To Martingale

The martingale money management system consist to double the order size after a loosing trade and can be described as a 2^x where x is the current number of loosing trades since the last win trade, when we win a trade the order size return to the default order size. Therefore our order size function is based on exponential growth.

This system enable the trader to win back his previous losses plus a potential profit, martingales must always be used with stops and sometimes take profits in order to get control in a strategy.

It must always be taken into account that in a series of losses the balance can exponentially decay thus ending to 0 in a matter of trades, this is why it is not recommended to use such system. The strategy allow you to select a martingale multiplier that can be inferior to 2 thus limiting risks, a multiplied of 1 disable the martingale.

Results

Those are the some statistics of the strategy applied to some forex majors by using the default settings in a time frames of 15 minutes.

//-------------------------------------------------------

EURUSD - Order Size 1000 - Spread 0.0002

Profit : $ 21.08

Trades : 19

PP : 57.89 %

Profit Factor : 3.228

Max Drawdown : -$ 3.81

Average Trade : $ 1.11

//-------------------------------------------------------

GBPUSD - Order Size 1000 - Spread 0.0002

Profit : $ 2.31

Trades : 20

PP : 55 %

Profit Factor : 0.938

Max Drawdown : -$ 20.29

Average Trade : $ 0.12

//-------------------------------------------------------

EURAUD - Order Size 1000 - Spread 0.0002

Profit : -$ 9.22

Trades : 20

PP : 40 %

Profit Factor : 0.698

Max Drawdown : -$ 23.44

Average Trade : $ 0.46

//-------------------------------------------------------

EURCHF - Order Size 1000 - Spread 0.0002

Profit : $ 1.58

Trades : 24

PP : 54.17 %

Profit Factor : 1.103

Max Drawdown : -$ 7.23

Average Trade : $ 0.07

//-------------------------------------------------------

Conclusions

Based on the results the strategy does not posses the sufficient performance in order to apply a martingale or any other growth systems as order size. Parameters might be subject to drastic changes depending on the market/time-frame in order to return long-term positive results. I let you draw your conclusions.

Strategy based on the bilateral stochastic oscillator, this oscillator aim to detect trends and possible reversal points of the current trend. The oscillator is composed of 1 bull line in blue and 1 bear line in red as well as a signal line in orange, the strategy have many options such as two different strategy framework and a martingale mode. If you require more information about the indicator go check it into my uploaded indicators.

Strategy Frameworks

There are two frameworks available that can be selected from the strategy settings window. Both have the same closing conditions, the "Bull/Bear Cross" entry conditions are :

Buy : when the bull line cross over the bear line

Sell : when the bear line cross over the bull line

The "Signal Cross" entry conditions are :

Buy : when the bull line cross over the signal line

Sell : when the bear line cross over the signal line

Both have the same close conditions that is : close when bull/bear cross under the signal line.

Introduction To Martingale

The martingale money management system consist to double the order size after a loosing trade and can be described as a 2^x where x is the current number of loosing trades since the last win trade, when we win a trade the order size return to the default order size. Therefore our order size function is based on exponential growth.

This system enable the trader to win back his previous losses plus a potential profit, martingales must always be used with stops and sometimes take profits in order to get control in a strategy.

It must always be taken into account that in a series of losses the balance can exponentially decay thus ending to 0 in a matter of trades, this is why it is not recommended to use such system. The strategy allow you to select a martingale multiplier that can be inferior to 2 thus limiting risks, a multiplied of 1 disable the martingale.

Results

Those are the some statistics of the strategy applied to some forex majors by using the default settings in a time frames of 15 minutes.

//-------------------------------------------------------

EURUSD - Order Size 1000 - Spread 0.0002

Profit : $ 21.08

Trades : 19

PP : 57.89 %

Profit Factor : 3.228

Max Drawdown : -$ 3.81

Average Trade : $ 1.11

//-------------------------------------------------------

GBPUSD - Order Size 1000 - Spread 0.0002

Profit : $ 2.31

Trades : 20

PP : 55 %

Profit Factor : 0.938

Max Drawdown : -$ 20.29

Average Trade : $ 0.12

//-------------------------------------------------------

EURAUD - Order Size 1000 - Spread 0.0002

Profit : -$ 9.22

Trades : 20

PP : 40 %

Profit Factor : 0.698

Max Drawdown : -$ 23.44

Average Trade : $ 0.46

//-------------------------------------------------------

EURCHF - Order Size 1000 - Spread 0.0002

Profit : $ 1.58

Trades : 24

PP : 54.17 %

Profit Factor : 1.103

Max Drawdown : -$ 7.23

Average Trade : $ 0.07

//-------------------------------------------------------

Conclusions

Based on the results the strategy does not posses the sufficient performance in order to apply a martingale or any other growth systems as order size. Parameters might be subject to drastic changes depending on the market/time-frame in order to return long-term positive results. I let you draw your conclusions.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Check out the indicators we are making at luxalgo: tradingview.com/u/LuxAlgo/

"My heart is so loud that I can't hear the fireworks"

"My heart is so loud that I can't hear the fireworks"

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Check out the indicators we are making at luxalgo: tradingview.com/u/LuxAlgo/

"My heart is so loud that I can't hear the fireworks"

"My heart is so loud that I can't hear the fireworks"

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.