OPEN-SOURCE SCRIPT

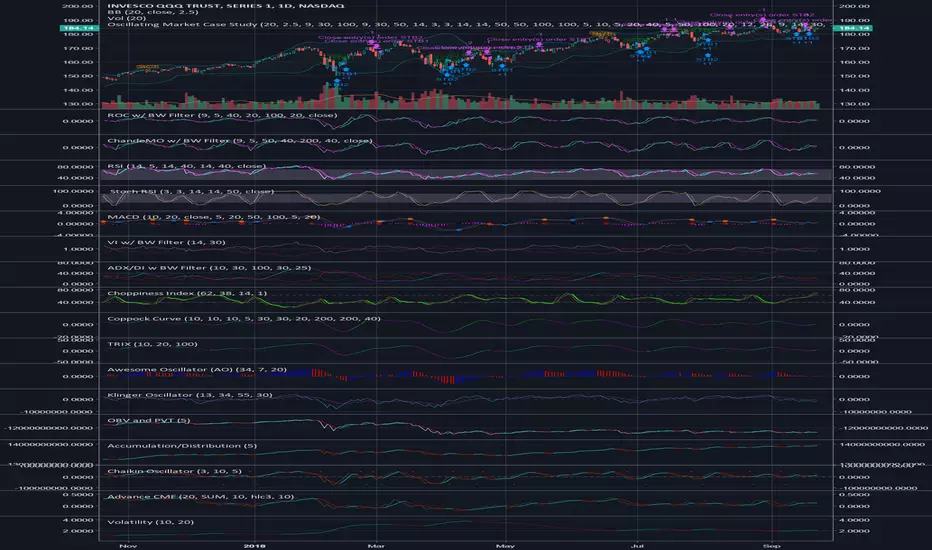

업데이트됨 Oscillating Market Case Study

This is a little something I created to analyze the market. Ultimately, I wanted to create something that could encapsulate the entire market as best as possible. The idea was simple, use technical analysis to create cases that would indicate entry positions and exit positions for long positions initially. After completing that, I decided to add a few shorting cases.

A combination of 25-30 indicators were used to create this, and the indicators were modified with a filter to create a smoothed overlay.

So here's the breakdown:

- 10 total cases: 7 long, 3 short

- The 7 long cases are broken down into three categories; long term, medium term, short term

- Short Term: OC1, OC2, STB1, STB2

- Medium Term: STB1, STB2

- Long Term: LTB1

- Shorting Cases: SC1, SC2, SC3

- The cases are both plotted as text and entry orders; this can be toggled on and off through the format menu.

I suggest you use the format menu to get the most out of this script. The menu consists of toggles to turn of the plots and/or the entries. It's pretty self explanatory. Use it to keep the chart cleared and concise so you only visualise the cases that you need.

Personally, the cases that have worked the best for me are:

- Long Cases: OC1, OC2, STB2, LTB1

- Shorting Cases: SC2, SC3

I kept this description as short as possible, but please feel free to reach out if you have any questions.

Pretty much, use the cases and see if it works for you.

A combination of 25-30 indicators were used to create this, and the indicators were modified with a filter to create a smoothed overlay.

So here's the breakdown:

- 10 total cases: 7 long, 3 short

- The 7 long cases are broken down into three categories; long term, medium term, short term

- Short Term: OC1, OC2, STB1, STB2

- Medium Term: STB1, STB2

- Long Term: LTB1

- Shorting Cases: SC1, SC2, SC3

- The cases are both plotted as text and entry orders; this can be toggled on and off through the format menu.

I suggest you use the format menu to get the most out of this script. The menu consists of toggles to turn of the plots and/or the entries. It's pretty self explanatory. Use it to keep the chart cleared and concise so you only visualise the cases that you need.

Personally, the cases that have worked the best for me are:

- Long Cases: OC1, OC2, STB2, LTB1

- Shorting Cases: SC2, SC3

I kept this description as short as possible, but please feel free to reach out if you have any questions.

Pretty much, use the cases and see if it works for you.

릴리즈 노트

Wanted to post a clearer picture without all the indicators. Work with the toggles in the format menu, it will let you filter which cases you see and allow you to decide the best combinations. Wish I could post images with a tutorial. Let me know if you have any questions. This is a little something I created to analyze the market. Ultimately, I wanted to create something that could encapsulate the entire market as best as possible. The idea was simple, use technical analysis to create cases that would indicate entry positions and exit positions for long positions initially. After completing that, I decided to add a few shorting cases.

A combination of 25-30 indicators were used to create this, and the indicators were modified with a filter to create a smoothed overlay.

So here's the breakdown:

- 10 total cases: 7 long, 3 short

- The 7 long cases are broken down into three categories; long term, medium term, short term

- Short Term: OC1, OC2, STB1, STB2

- Medium Term: STB1, STB2

- Long Term: LTB1

- Shorting Cases: SC1, SC2, SC3

- The cases are both plotted as text and entry orders; this can be toggled on and off through the format menu.

I suggest you use the format menu to get the most out of this script. The menu consists of toggles to turn of the plots and/or the entries. It's pretty self explanatory. Use it to keep the chart cleared and concise so you only visualise the cases that you need.

Personally, the cases that have worked the best for me are:

- Long Cases: OC1, OC2, STB2, LTB1

- Shorting Cases: SC2, SC3

I kept this description as short as possible, but please feel free to reach out if you have any questions.

Pretty much, use the cases and see if it works for you.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.