PROTECTED SOURCE SCRIPT

DUOT OSCILLATOR

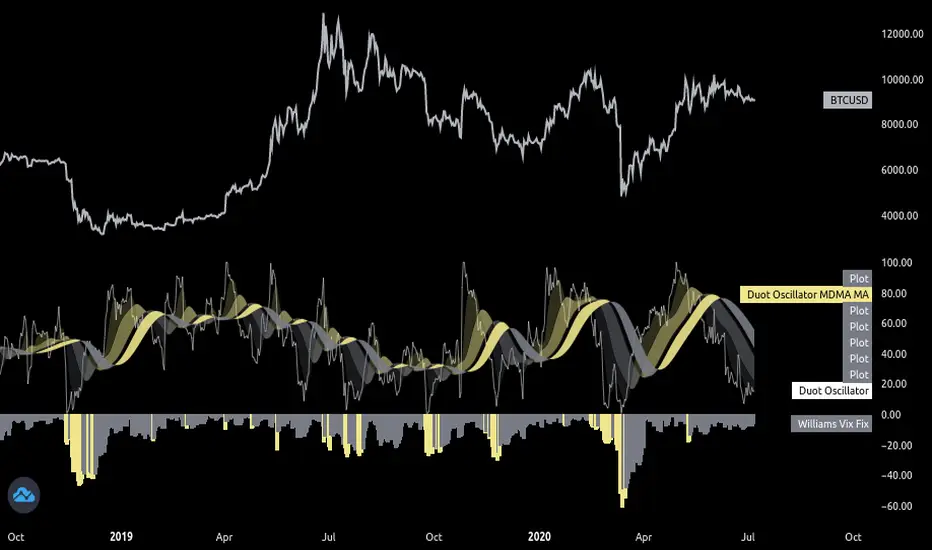

Duot Oscillator is an indicator combining the performance of multiple differential oscillators (RSI, ROC, WCCI, MACD, BBB)

The oscillators are normalized and triple smoothed using a variant of McGuinley Dynamic MA formula, the final result is also then triple smoothed over a fib series.

The final oscillator was found to produce higher success rate when detecting divergence over using either individual signals for each of the oscillators on its own, or a weighted signal of a subset of the mentioned oscillators.

We were not able to verify, hypothesis, or find a reasoning for that claim, but following the divergences of that oscillator were more accurate at least in our setups since Feb 2019 on BTCUSD

Duot oscillator along with William Vix fix and Simple 3 MAs are the main decision makers behind Duot Strategy

Settings:

- Date Selectors

- Normalize Lookback (for all oscillators)

- Minimize parameters (this will use the same MAs Lookbacks for all oscillators, should be fine but if you want to use any parameters optimizers, you can disable that setting and fine tune each individually)

- Oscillators Lookback: if the above checkbox is checked then this value will be used for all oscillators(generally fine except for RSI)

- MAs Lookback for individual oscillators

- William Vix Fix Settings

The oscillators are normalized and triple smoothed using a variant of McGuinley Dynamic MA formula, the final result is also then triple smoothed over a fib series.

The final oscillator was found to produce higher success rate when detecting divergence over using either individual signals for each of the oscillators on its own, or a weighted signal of a subset of the mentioned oscillators.

We were not able to verify, hypothesis, or find a reasoning for that claim, but following the divergences of that oscillator were more accurate at least in our setups since Feb 2019 on BTCUSD

Duot oscillator along with William Vix fix and Simple 3 MAs are the main decision makers behind Duot Strategy

Settings:

- Date Selectors

- Normalize Lookback (for all oscillators)

- Minimize parameters (this will use the same MAs Lookbacks for all oscillators, should be fine but if you want to use any parameters optimizers, you can disable that setting and fine tune each individually)

- Oscillators Lookback: if the above checkbox is checked then this value will be used for all oscillators(generally fine except for RSI)

- MAs Lookback for individual oscillators

- William Vix Fix Settings

보호된 스크립트입니다

이 스크립트는 클로즈 소스로 게시되며 자유롭게 사용할 수 있습니다. 당신은 스크립트를 차트에 사용하기 위해 그것을 즐겨찾기 할 수 있습니다. 소스 코드는 보거나 수정할 수 없습니다.

차트에 이 스크립트를 사용하시겠습니까?

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.