OPEN-SOURCE SCRIPT

BTC Correlation Percentage

Purpose

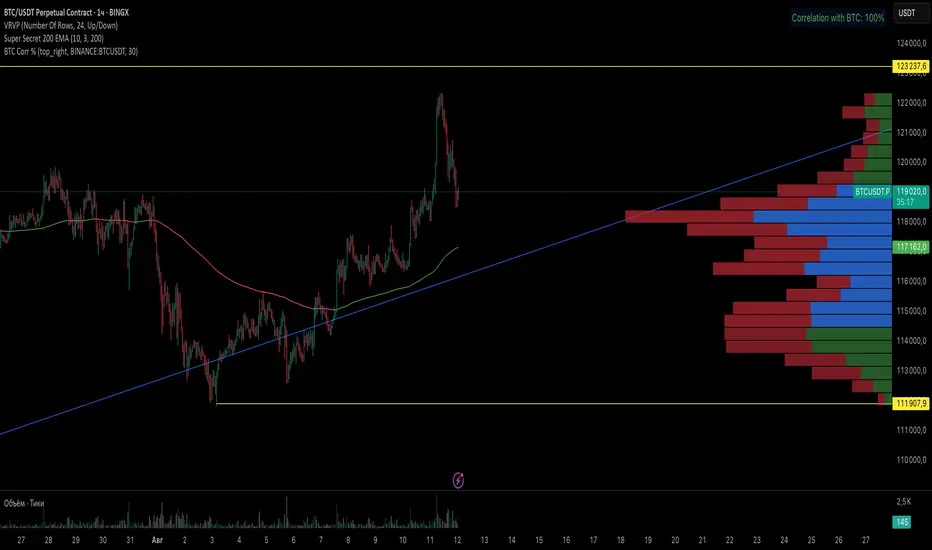

This indicator displays the correlation percentage between the current trading instrument and Bitcoin (BTC/USDT) as a text label on the chart. It helps traders quickly assess how closely an asset's price movements align with Bitcoin's fluctuations.

Key Features

Precise Calculation: Shows correlation as a percentage with one decimal place (e.g., 25.6%).

Customizable Appearance: Allows adjustment of colors, position, and calculation period.

Clean & Simple: Displays only essential information without cluttering the chart.

Universal Compatibility: Works on any timeframe and with any trading pair.

Input Settings

Core Parameters:

BTC Symbol – Ticker for Bitcoin (default: BINANCE:BTCUSDT).

Correlation Period – Number of bars used for calculation (default: 50 candles).

Show Correlation Label – Toggle visibility of the correlation label.

Visual Customization:

Text Color – Label text color (default: white).

Background Color – Label background color (default: semi-transparent blue).

Border Color – Border color around the label (default: gray).

Label Position – Where the label appears on the chart (default: top-right).

Interpreting Correlation Values

70% to 100% → Strong positive correlation (asset moves in sync with BTC).

30% to 70% → Moderate positive correlation.

-30% to 30% → Weak or no correlation.

-70% to -30% → Moderate negative correlation (asset moves opposite to BTC).

-100% to -70% → Strong negative correlation.

Practical Use Cases

For Altcoins: A correlation above 50% suggests high dependence on Bitcoin’s price action.

For Futures Trading: Helps assess systemic risks tied to BTC movements.

During High Volatility: Determines whether an asset’s price change is driven by its own factors or broader market trends.

How It Works

The indicator recalculates automatically with each new candle. For the most reliable results, it is recommended for use on daily or higher timeframes.

This tool provides traders with a quick, visual way to gauge Bitcoin’s influence on other assets, improving decision-making in crypto markets. 🚀

This response is AI-generated, for reference only.

New chat

This indicator displays the correlation percentage between the current trading instrument and Bitcoin (BTC/USDT) as a text label on the chart. It helps traders quickly assess how closely an asset's price movements align with Bitcoin's fluctuations.

Key Features

Precise Calculation: Shows correlation as a percentage with one decimal place (e.g., 25.6%).

Customizable Appearance: Allows adjustment of colors, position, and calculation period.

Clean & Simple: Displays only essential information without cluttering the chart.

Universal Compatibility: Works on any timeframe and with any trading pair.

Input Settings

Core Parameters:

BTC Symbol – Ticker for Bitcoin (default: BINANCE:BTCUSDT).

Correlation Period – Number of bars used for calculation (default: 50 candles).

Show Correlation Label – Toggle visibility of the correlation label.

Visual Customization:

Text Color – Label text color (default: white).

Background Color – Label background color (default: semi-transparent blue).

Border Color – Border color around the label (default: gray).

Label Position – Where the label appears on the chart (default: top-right).

Interpreting Correlation Values

70% to 100% → Strong positive correlation (asset moves in sync with BTC).

30% to 70% → Moderate positive correlation.

-30% to 30% → Weak or no correlation.

-70% to -30% → Moderate negative correlation (asset moves opposite to BTC).

-100% to -70% → Strong negative correlation.

Practical Use Cases

For Altcoins: A correlation above 50% suggests high dependence on Bitcoin’s price action.

For Futures Trading: Helps assess systemic risks tied to BTC movements.

During High Volatility: Determines whether an asset’s price change is driven by its own factors or broader market trends.

How It Works

The indicator recalculates automatically with each new candle. For the most reliable results, it is recommended for use on daily or higher timeframes.

This tool provides traders with a quick, visual way to gauge Bitcoin’s influence on other assets, improving decision-making in crypto markets. 🚀

This response is AI-generated, for reference only.

New chat

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.