OPEN-SOURCE SCRIPT

업데이트됨 [Pt] Periodic Volume Profile

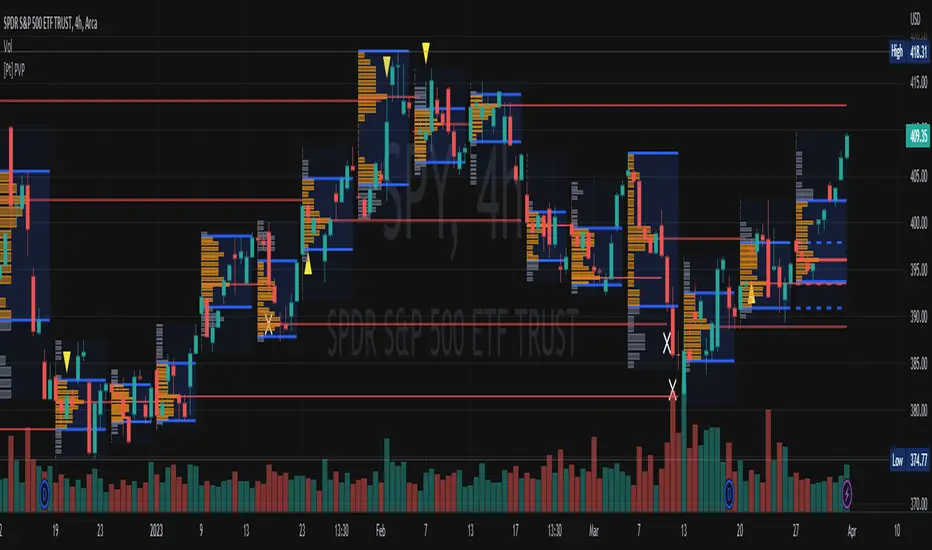

This script is an attempt to recreate the Periodic Volume Profile that is built-in by TradingView, with slightly different features. Related blog: https://www.tradingview.com/blog/en/volume-profiles-new-and-improved-31068/

This script is based on another script "Volume Profile, Pivot Anchored" by dgtrd

*Note that only limited number Volume Profile can be displayed on the chart due to limitations on displaying boxes and lines.

Description

This Periodic Volume Profile (PVP) indicator allows trades to view volume profiles for periods longer than the current timeframe. The indicator builds one general volume profile for each new period, set by the user through the “Periodic Timeframe” input parameter.

This script also has the option to extend Point of Control (POC) lines with optional end conditions: Until Bar Touch, Until Last Bar, Until Bar Cross, or None, which extends to the right.

Signals are generated for Naked POC touches and crosses by a triangle symbol and a cross symbol, by default.

Alerts are available for POC touches and crosses.

What is Volume Profile?

Volume profile is a technical analysis tool that shows the volume of trades at different prices for a given security or market over a specific period of time.

Volume profile can be used to identify key levels of support and resistance, as well as to assess the overall supply and demand for a security. For example, if there is a high volume of trades at a particular price level, this may indicate that there is a significant level of support or resistance at that price. On the other hand, if there is relatively low volume at a particular price, this may indicate that there is not much interest in trading at that level.

Traders can use volume profile to identify trends, make trading decisions, and set stop-loss and take-profit orders. It can also be useful for identifying patterns such as "pockets of liquidity," which are areas where there is a high volume of trades but relatively little price movement.

It is important to note that volume profile should be used in conjunction with other technical analysis tools and should not be relied upon in isolation. It is also important to consider the overall context and market conditions when interpreting volume profile data.

Key Difference with TradingView's PVP indicator - TradingView's PVP intraday period does not align with standard intraday timeframes as it is determined by # of bars. This script provides volume profiles that aligns with higher timeframe periods.

https://www.tradingview.com/x/w0wGmAFb/

Enjoy~!

This script is based on another script "Volume Profile, Pivot Anchored" by dgtrd

*Note that only limited number Volume Profile can be displayed on the chart due to limitations on displaying boxes and lines.

Description

This Periodic Volume Profile (PVP) indicator allows trades to view volume profiles for periods longer than the current timeframe. The indicator builds one general volume profile for each new period, set by the user through the “Periodic Timeframe” input parameter.

This script also has the option to extend Point of Control (POC) lines with optional end conditions: Until Bar Touch, Until Last Bar, Until Bar Cross, or None, which extends to the right.

Signals are generated for Naked POC touches and crosses by a triangle symbol and a cross symbol, by default.

Alerts are available for POC touches and crosses.

What is Volume Profile?

Volume profile is a technical analysis tool that shows the volume of trades at different prices for a given security or market over a specific period of time.

Volume profile can be used to identify key levels of support and resistance, as well as to assess the overall supply and demand for a security. For example, if there is a high volume of trades at a particular price level, this may indicate that there is a significant level of support or resistance at that price. On the other hand, if there is relatively low volume at a particular price, this may indicate that there is not much interest in trading at that level.

Traders can use volume profile to identify trends, make trading decisions, and set stop-loss and take-profit orders. It can also be useful for identifying patterns such as "pockets of liquidity," which are areas where there is a high volume of trades but relatively little price movement.

It is important to note that volume profile should be used in conjunction with other technical analysis tools and should not be relied upon in isolation. It is also important to consider the overall context and market conditions when interpreting volume profile data.

Key Difference with TradingView's PVP indicator - TradingView's PVP intraday period does not align with standard intraday timeframes as it is determined by # of bars. This script provides volume profiles that aligns with higher timeframe periods.

https://www.tradingview.com/x/w0wGmAFb/

Enjoy~!

릴리즈 노트

Fixed bug for daily, weekly, monthly periodic timeframe not displaying.Fixed bug for weird line and background fills on developing profile.

릴리즈 노트

Updated to add display toggle for developing profile릴리즈 노트

Added option to show extension of previous period VAH, VAL, and POChttps://www.tradingview.com/x/FycxiSSb/

릴리즈 노트

Resolved bug - error on -1 historical reference릴리즈 노트

Fixed bug: For some combination of chart and periodic timeframe, volume profile was showing up between specified period. 릴리즈 노트

Updated volume calculation to give more accurate volume estimation. Keep in mind that this indicator does not pull lower timeframe volume, hence volume bars on the profile is only an approximation.릴리즈 노트

Made same update to developing profile.릴리즈 노트

Fixed bug where each profile included 1 extra bar at the end of the period.릴리즈 노트

Fixed bug: zero line plot is shown if 'Show Developing Profile' or 'Show Previous POC, VAH, VAL' is disabled, when 'Scale Price Chart Only' option is disabled.릴리즈 노트

Updated Profile reset option to enable reset at the start of regular sessions.By default, the Reset option is turned off. Volume Profile will carry forward from last session into the next session:

https://www.tradingview.com/x/mWcPb8P1/

With reset option turned on, profile will reset at the start of the new regular session:

https://www.tradingview.com/x/2DjYlgcy/

릴리즈 노트

Per requests, adding POC, VAH , VAL paths. These settings can be found under "Show Developing Profile". Turning these ON will toggle POC, VAH, VAL levels off on the developing profile. This is to prevent overcrowding of lines.https://www.tradingview.com/x/aswJp9Q0/

릴리즈 노트

Fixed bug - in some cases, while loop won't break causing runtime error.Updated developing POC, VAH, VAL paths to break between periods.

릴리즈 노트

Correcting minor bug from recent updates.릴리즈 노트

Added new profile placement option "Next period" that will place the volume profile after the end of the period. Example below:https://www.tradingview.com/x/v46icACt/

릴리즈 노트

Fixed bug on monthly profile.릴리즈 노트

Added option for POC line width 오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Purchases / Subscriptions / Support - buymeacoffee.com/ptgambler

PayPal - paypal.me/PtGambler

You can reach me privately through my Discord Channel: discord.gg/WMQfaVGyQC

PayPal - paypal.me/PtGambler

You can reach me privately through my Discord Channel: discord.gg/WMQfaVGyQC

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Purchases / Subscriptions / Support - buymeacoffee.com/ptgambler

PayPal - paypal.me/PtGambler

You can reach me privately through my Discord Channel: discord.gg/WMQfaVGyQC

PayPal - paypal.me/PtGambler

You can reach me privately through my Discord Channel: discord.gg/WMQfaVGyQC

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.