INVITE-ONLY SCRIPT

업데이트됨 EL3V8FX KEY LEVEL SYSTEM

The EL3V8FX Key Level System is designed to provide you with the strongest key levels the market has to offer.

Once the conditions are met, the Key Levels will appear on your chart automatically. They will also extend along with the market. New levels will not print until conditions on the higher time frame are met.

KEY LEVELS ON GBPJPY

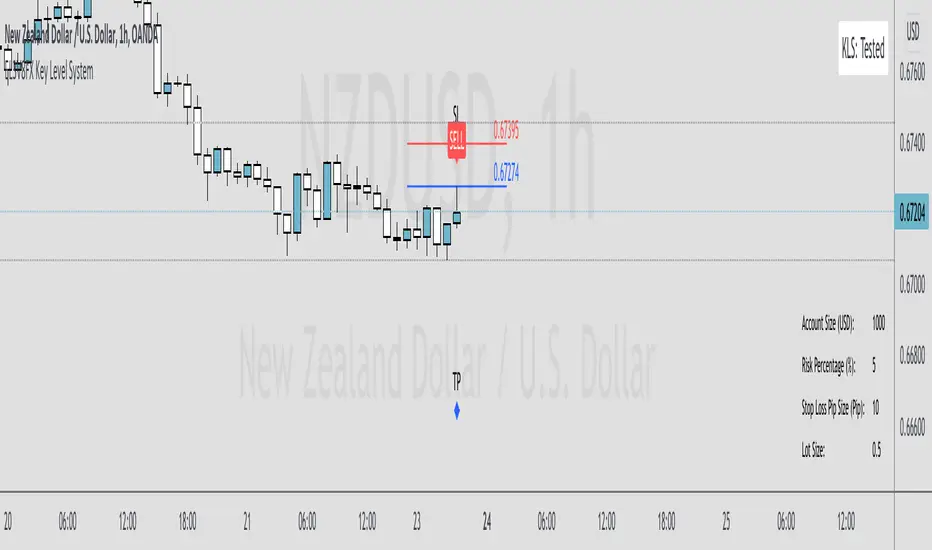

As you can see from the image above, you have a BLUE key level as well as a RED key level.

Blue Key Level = Is the FIRST key level to be tested. First Opportunity to trade should a trigger for a buy or sell is activated.

Red Key Level = is the LAST key level to be tested. This should be considered your Maximum Pull Back threshold where price can pull back and provide opportunity to trade.

Blue Key LVL above Red Key LVL = Bullish Sentiment. You are looking for a BUY to trigger at Blue Key LVL or RED KEY LEVEL.

Red Key LVL above Blue Key LVL = Bearish Sentiment. You are looking for a SELL to trigger at Blue Key LVL or RED KEY LVL.

For Example:

A buy was triggered on the 1HR timeframe using OANDAas the liquidity provider. You can see a loss of momentum where the candles wicked the key level. This is good signs for a buy. You can either execute with stops 20-30 pips below the key level or below the RED key level as you know that this is your maximum allowable pullback level ( Make sure your Take Profit and Stop Loss reflect a proper Risk to Reward.

Above is a PROPER 1:3 Risk to Reward trade set up. Below is how she played out at the first KEY LEVEL.

Now, levels will not repaint until we meet conditions on the HTF. Therefore, it is recommended that once you capture a trade and it has gone favorably, wait for the next key levels to print for you to take another set up. Of course, that is entirely up to you. Price did pull back down after TP was hit and tested our RT level (RED LEVEL)

Now because we see nice rejection, we can take this trade and entertain it; always with proper risk to reward.

FREQUENTLY ASKED QUESTIONS:

Q1- " What are the best time frames for the KLS?"

ANSWER: I personally enjoy setting my alerts on the 1HR time frame. You can use the lower time frame as well such as the 15m and 30m time frames but because we will need to see specific candlestick confirmation, You might not receive a trigger on the lower time frame but will receive the trigger on H1. You can place KLS indicator and scroll through the lower time frames for preference.

Q2- " Is there a specific session we need to trade?"

ANSWER- There is no specific session as we are waiting for a retest of key levels- this can happen at any given time depending on the pair we select to trade.

Q3- " What liquidity provider do i use for KLS?"

ANSWER- OANDA

Q4- " Do i need a paid version of Tradingview?"

ANSWER- No, you can use the indicator on a free account but you are limited as to the amount of ALERTS you are able to set with the free version.

Q5- " How can i avoid over leveraging ? "

ANSWER- The KLS indicator provides you a LOT SIZE CALCULATOR within the settings. Just place your account capital amount and how many pips you are going to need for your stop loss and it will calculate your lot size for you!

Once the conditions are met, the Key Levels will appear on your chart automatically. They will also extend along with the market. New levels will not print until conditions on the higher time frame are met.

KEY LEVELS ON GBPJPY

As you can see from the image above, you have a BLUE key level as well as a RED key level.

Blue Key Level = Is the FIRST key level to be tested. First Opportunity to trade should a trigger for a buy or sell is activated.

Red Key Level = is the LAST key level to be tested. This should be considered your Maximum Pull Back threshold where price can pull back and provide opportunity to trade.

Blue Key LVL above Red Key LVL = Bullish Sentiment. You are looking for a BUY to trigger at Blue Key LVL or RED KEY LEVEL.

Red Key LVL above Blue Key LVL = Bearish Sentiment. You are looking for a SELL to trigger at Blue Key LVL or RED KEY LVL.

For Example:

A buy was triggered on the 1HR timeframe using OANDAas the liquidity provider. You can see a loss of momentum where the candles wicked the key level. This is good signs for a buy. You can either execute with stops 20-30 pips below the key level or below the RED key level as you know that this is your maximum allowable pullback level ( Make sure your Take Profit and Stop Loss reflect a proper Risk to Reward.

Above is a PROPER 1:3 Risk to Reward trade set up. Below is how she played out at the first KEY LEVEL.

Now, levels will not repaint until we meet conditions on the HTF. Therefore, it is recommended that once you capture a trade and it has gone favorably, wait for the next key levels to print for you to take another set up. Of course, that is entirely up to you. Price did pull back down after TP was hit and tested our RT level (RED LEVEL)

Now because we see nice rejection, we can take this trade and entertain it; always with proper risk to reward.

FREQUENTLY ASKED QUESTIONS:

Q1- " What are the best time frames for the KLS?"

ANSWER: I personally enjoy setting my alerts on the 1HR time frame. You can use the lower time frame as well such as the 15m and 30m time frames but because we will need to see specific candlestick confirmation, You might not receive a trigger on the lower time frame but will receive the trigger on H1. You can place KLS indicator and scroll through the lower time frames for preference.

Q2- " Is there a specific session we need to trade?"

ANSWER- There is no specific session as we are waiting for a retest of key levels- this can happen at any given time depending on the pair we select to trade.

Q3- " What liquidity provider do i use for KLS?"

ANSWER- OANDA

Q4- " Do i need a paid version of Tradingview?"

ANSWER- No, you can use the indicator on a free account but you are limited as to the amount of ALERTS you are able to set with the free version.

Q5- " How can i avoid over leveraging ? "

ANSWER- The KLS indicator provides you a LOT SIZE CALCULATOR within the settings. Just place your account capital amount and how many pips you are going to need for your stop loss and it will calculate your lot size for you!

릴리즈 노트

We have incorporated a separate KLS strategy for Swing Set ups now giving you the option to switch between Intraday KLS and Swing KLS. You will also notice a Take profit , Stop Loss displayed on your chart as two lines that appear above trigger candle.

Blue Line = Take Profit

Red Line = STOP LOSS

You can adjust the RR in the settings.

An input of "2" on your RR will display a Risk to Reward of 1:2. The Default is set to 1:1.

On the top right hand corner you will see a label that reads KLS: Tested or Untested. This provides you a quick insight as to which Key Levels are FRESH and which ones have already been tested.

Let's Eat

릴리즈 노트

QUICK UPDATE:The Following ADDITIONS have been made:

🔻 Label created for Stop Loss and Take Profit

🔻Alerts updated to include Pair, Price, Timeframe of alert

🔻Text color change option in settings.

Thank you

릴리즈 노트

Minor Update to TP and SL display릴리즈 노트

The update contains the Lot Size Calculator at the bottom right. Input settings allows you to fix the size of the calculator, adjust balance, risk percentage per trade and total amount of pips for your stop loss. 릴리즈 노트

Updating coding language. Next Update will contain a Trend Filtration system.

Have a good day.

릴리즈 노트

PanessoTECH fam! I am excited to provide you with these Key level System Upgrades that will allow for a easier understanding on how to capitalize the most profitable key levels these markets offer on a daily basis. 1. RISK TO REWARD ZONES-

I have made the script to include a visual for risk to reward zones which also provide the total pip count for each.

The SL PIPS input is a basically asking how many pips do you wish the stop to be above or below the SECOND opportunity KEY LEVEL ( THE RED KEY LEVEL)

The zones will adjust according to your input and the display will appear on each valid set up.

2. BUY SELL BASED ON Input-

This input is to determine if you wish to wait for candle closure below or above key level in order for the BUY/SELL to print OR if you wish to set this input to “TEST” where the buy and sell prints as SOON as key level is tested

3. UNTESTED KEY LEVELS alert !

This is going to make your life SO much easier! You now have the ability to set alerts on all your pairs- this alert will trigger whenever you have a valid new set of UNTESTED KEY LEVELS daily.

Enjoy!

릴리즈 노트

Guys, due to some bugs on the latest version - i will be reverting back to the original script until these bugs are handled. What bugs?

1. Untested Level alerts are not working according to its parameter.

2. Glitch seen on some of the key levels where it calls the reverse trade. This is a major issue.

I want to apologize for these bugs as the script should have had proper testing before being published. I was under the impression all issues were fixed. Apparently there are still some things that need to be done. I appreciate the patience and understanding. I will work on this immediately.

We will continue using the previous script as that script is FLAWLESS :)

Thank you.

릴리즈 노트

Bugs fixed. Please remove and replace your KLS from your chart to update to the latest script.

please note you must re-apply the indicator from the INVITE ONLY tab.

Thank you!

릴리즈 노트

Please remove existing KLS indicator and re-add the indicator from the INVITE ONLY TAB. Adjustments made to ALERTS.

Thank you.

릴리즈 노트

Small Lot size calculator update. Allowing you to use decimal point. 초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 Elev8FX에게 직접 문의하세요.

이 비공개 초대 전용 스크립트는 스크립트 모더레이터의 검토를 거치지 않았으며, 하우스 룰 준수 여부는 확인되지 않았습니다. 트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

You may request access via email at ADMIN@ELEV8FX.COM

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 Elev8FX에게 직접 문의하세요.

이 비공개 초대 전용 스크립트는 스크립트 모더레이터의 검토를 거치지 않았으며, 하우스 룰 준수 여부는 확인되지 않았습니다. 트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

You may request access via email at ADMIN@ELEV8FX.COM

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.