PROTECTED SOURCE SCRIPT

3 Day Trailing Stop Rule

Peter L. Brandt's 3 Day Trailing Stop Rule

This indicator implements Peter's 3DTSR on daily price movements.

A long exit signal following 3DTSR works as follows:

1. Identify the Highest High Day since the last 3DTSR Long Signal was triggered.

2. A close below the low of that High Hay triggers a Setup Day.

3. Any penetration of the low of the Setup Day triggers the rule - sell to close.

A short exit signal following 3DTSR works as follows:

1. Identify the Lowest Low Day since the 3DTSR was last triggered.

2. A close above the high of that Lowest Low Day triggers a Setup Day.

3. Any penetration of the high of the Setup Day triggers the rule - buy to close.

The signals can be used in reverse to enter positions.

Intraday

This indicator sources data from daily price bars so the integrity of the signals is maintained even when looking at intraday charts.

Settings

The long and short signals can be enabled or disabled in the settings.

The 3DTSR can look very busy on a daily chart so price cutoff point settings are available to hide any instances above or below a price.

Example

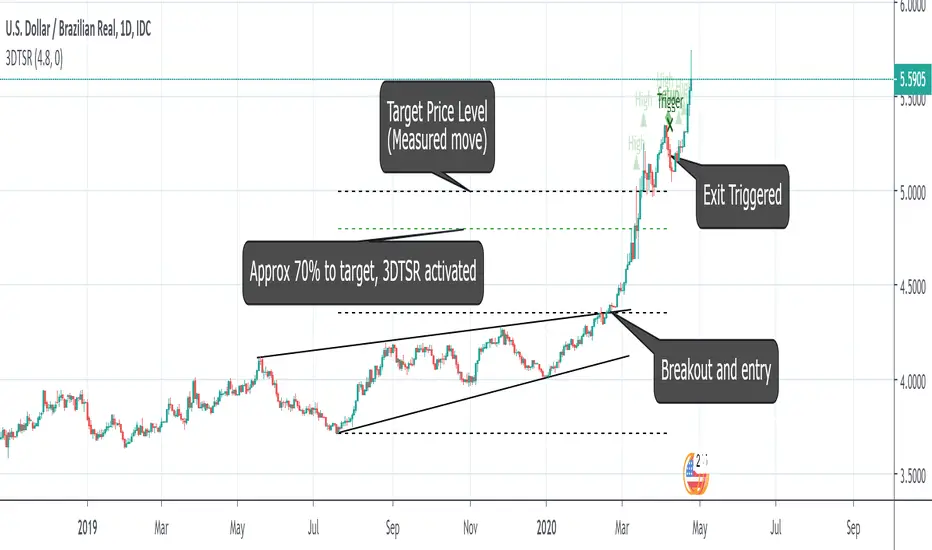

In the example above, a long position is entered in USDBRL after a breakout.

The 3-Day Trailing Stop Rule becomes active when 70% to the price target. The cutoff setting is useful here to make the chart look less busy.

The Setup Day and subsequent Trigger day occur a few days later signaling an exit from the trade.

This indicator implements Peter's 3DTSR on daily price movements.

A long exit signal following 3DTSR works as follows:

1. Identify the Highest High Day since the last 3DTSR Long Signal was triggered.

2. A close below the low of that High Hay triggers a Setup Day.

3. Any penetration of the low of the Setup Day triggers the rule - sell to close.

A short exit signal following 3DTSR works as follows:

1. Identify the Lowest Low Day since the 3DTSR was last triggered.

2. A close above the high of that Lowest Low Day triggers a Setup Day.

3. Any penetration of the high of the Setup Day triggers the rule - buy to close.

The signals can be used in reverse to enter positions.

Intraday

This indicator sources data from daily price bars so the integrity of the signals is maintained even when looking at intraday charts.

Settings

The long and short signals can be enabled or disabled in the settings.

The 3DTSR can look very busy on a daily chart so price cutoff point settings are available to hide any instances above or below a price.

Example

In the example above, a long position is entered in USDBRL after a breakout.

The 3-Day Trailing Stop Rule becomes active when 70% to the price target. The cutoff setting is useful here to make the chart look less busy.

The Setup Day and subsequent Trigger day occur a few days later signaling an exit from the trade.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.