OPEN-SOURCE SCRIPT

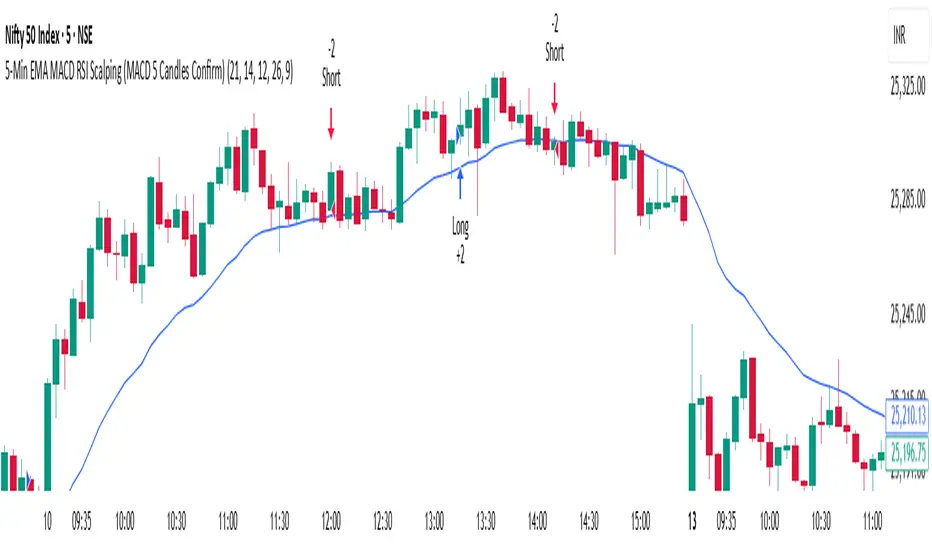

5-Min EMA MACD RSI Scalping (MACD 5 Candles Confirm) - BVK

🔹 5-Min EMA MACD RSI Scalping Strategy – Full Description

The 5-Min EMA MACD RSI Scalping Strategy is a powerful intraday trading technique designed for quick trades on lower timeframes, mainly the 5-minute chart. It combines trend confirmation (EMA), momentum analysis (MACD), and overbought/oversold signals (RSI) to capture short, high-probability price moves in both bullish and bearish markets.

⚙️ Indicators Used:

Exponential Moving Averages (EMA)

EMA 9 – Fast-moving average for entry trigger.

EMA 21 – Medium-term average for trend confirmation.

When EMA 9 crosses above EMA 21 → Bullish bias.

When EMA 9 crosses below EMA 21 → Bearish bias.

MACD (12, 26, 9)

Confirms momentum and possible entry zones.

Bullish confirmation: MACD line crosses above signal line.

Bearish confirmation: MACD line crosses below signal line.

RSI (14-period)

Filters out false signals.

Buy zone: RSI rising above 40–50.

Sell zone: RSI falling below 60–50.

Avoid trades when RSI is near 70 (overbought) or 30 (oversold).

💡 Entry Rules:

Buy Setup (Long Trade):

EMA 9 crosses above EMA 21.

MACD line crosses above signal line (positive momentum).

RSI is above 50 but below 70 (confirming strength).

Enter trade at candle close.

Sell Setup (Short Trade):

EMA 9 crosses below EMA 21.

MACD line crosses below signal line.

RSI is below 50 but above 30 (confirming weakness).

Enter trade at candle close.

🎯 Exit Rules:

Take Profit: 1.5x to 2x of risk or near the opposite EMA crossover.

Stop Loss: Below/above recent swing low/high or 0.3–0.5% away from entry.

Optional trailing stop using EMA 9 for dynamic exits.

📊 Best Timeframes & Assets:

Works best on 5-minute charts.

Suitable for Forex, Indices, Cryptocurrency, and Stocks with good liquidity.

Avoid major news events or low-volume sessions.

⚠️ Tips for Best Results:

Trade only during high-volume market sessions (e.g., London/New York overlap).

Always confirm trend direction on higher timeframes (15m or 1H).

Avoid overtrading—wait for clear signal confluence (EMA + MACD + RSI).

🧠 Strategy Summary:

“EMA gives you the trend, MACD gives you momentum, and RSI keeps you disciplined.”

This strategy is simple yet effective for traders who prefer quick in-and-out trades within minutes, offering a structured approach to scalping with reduced emotional bias.

The 5-Min EMA MACD RSI Scalping Strategy is a powerful intraday trading technique designed for quick trades on lower timeframes, mainly the 5-minute chart. It combines trend confirmation (EMA), momentum analysis (MACD), and overbought/oversold signals (RSI) to capture short, high-probability price moves in both bullish and bearish markets.

⚙️ Indicators Used:

Exponential Moving Averages (EMA)

EMA 9 – Fast-moving average for entry trigger.

EMA 21 – Medium-term average for trend confirmation.

When EMA 9 crosses above EMA 21 → Bullish bias.

When EMA 9 crosses below EMA 21 → Bearish bias.

MACD (12, 26, 9)

Confirms momentum and possible entry zones.

Bullish confirmation: MACD line crosses above signal line.

Bearish confirmation: MACD line crosses below signal line.

RSI (14-period)

Filters out false signals.

Buy zone: RSI rising above 40–50.

Sell zone: RSI falling below 60–50.

Avoid trades when RSI is near 70 (overbought) or 30 (oversold).

💡 Entry Rules:

Buy Setup (Long Trade):

EMA 9 crosses above EMA 21.

MACD line crosses above signal line (positive momentum).

RSI is above 50 but below 70 (confirming strength).

Enter trade at candle close.

Sell Setup (Short Trade):

EMA 9 crosses below EMA 21.

MACD line crosses below signal line.

RSI is below 50 but above 30 (confirming weakness).

Enter trade at candle close.

🎯 Exit Rules:

Take Profit: 1.5x to 2x of risk or near the opposite EMA crossover.

Stop Loss: Below/above recent swing low/high or 0.3–0.5% away from entry.

Optional trailing stop using EMA 9 for dynamic exits.

📊 Best Timeframes & Assets:

Works best on 5-minute charts.

Suitable for Forex, Indices, Cryptocurrency, and Stocks with good liquidity.

Avoid major news events or low-volume sessions.

⚠️ Tips for Best Results:

Trade only during high-volume market sessions (e.g., London/New York overlap).

Always confirm trend direction on higher timeframes (15m or 1H).

Avoid overtrading—wait for clear signal confluence (EMA + MACD + RSI).

🧠 Strategy Summary:

“EMA gives you the trend, MACD gives you momentum, and RSI keeps you disciplined.”

This strategy is simple yet effective for traders who prefer quick in-and-out trades within minutes, offering a structured approach to scalping with reduced emotional bias.

오픈 소스 스크립트

진정한 트레이딩뷰 정신에 따라 이 스크립트 작성자는 트레이더가 기능을 검토하고 검증할 수 있도록 오픈소스로 공개했습니다. 작성자에게 찬사를 보냅니다! 무료로 사용할 수 있지만 코드를 다시 게시할 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

오픈 소스 스크립트

진정한 트레이딩뷰 정신에 따라 이 스크립트 작성자는 트레이더가 기능을 검토하고 검증할 수 있도록 오픈소스로 공개했습니다. 작성자에게 찬사를 보냅니다! 무료로 사용할 수 있지만 코드를 다시 게시할 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.