PINE LIBRARY

업데이트됨 lib_divergence

Library "lib_divergence"

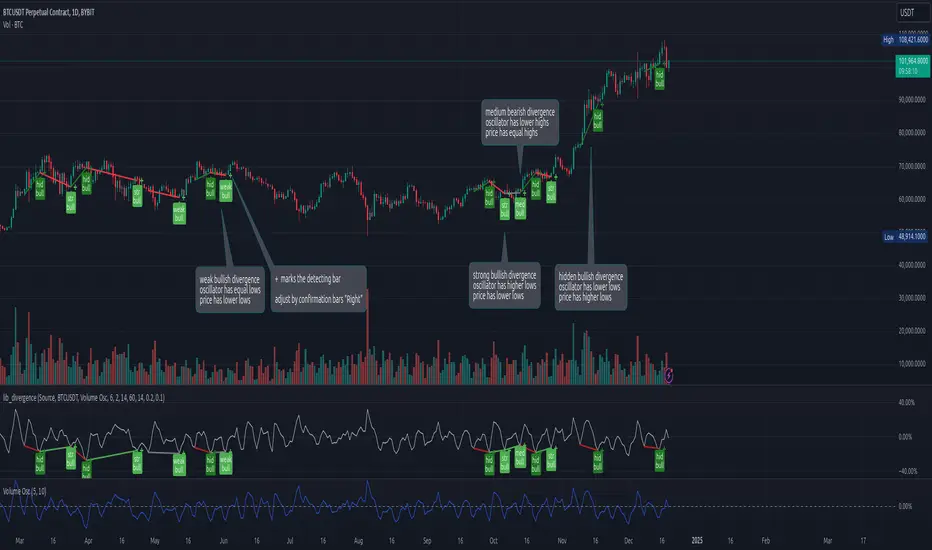

offers a commonly usable function to detect divergences. This will take the default RSI or other symbols / indicators / oscillators as source data.

divergence(osc, pivot_left_bars, pivot_right_bars, div_min_range, div_max_range, ref_low, ref_high, min_divergence_offset_fraction, min_divergence_offset_dev_len, min_divergence_offset_atr_mul)

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_left_bars (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_right_bars (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 5)

div_min_range (simple int): (simple int) optional minimum distance to the pivot point creating a divergence (default: 5)

div_max_range (simple int): (simple int) optional maximum amount of bars in a divergence (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

min_divergence_offset_fraction (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L detecting following equal H/Ls (default: 0.01)

min_divergence_offset_dev_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

min_divergence_offset_atr_mul (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L detecting following equal H/Ls (default: 1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, pivot_h, pivot_l]

offers a commonly usable function to detect divergences. This will take the default RSI or other symbols / indicators / oscillators as source data.

divergence(osc, pivot_left_bars, pivot_right_bars, div_min_range, div_max_range, ref_low, ref_high, min_divergence_offset_fraction, min_divergence_offset_dev_len, min_divergence_offset_atr_mul)

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_left_bars (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_right_bars (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 5)

div_min_range (simple int): (simple int) optional minimum distance to the pivot point creating a divergence (default: 5)

div_max_range (simple int): (simple int) optional maximum amount of bars in a divergence (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

min_divergence_offset_fraction (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L detecting following equal H/Ls (default: 0.01)

min_divergence_offset_dev_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

min_divergence_offset_atr_mul (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L detecting following equal H/Ls (default: 1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, pivot_h, pivot_l]

릴리즈 노트

v2 improved performance, fixed bug in 'weak bear' detection, improved naming and comments for function parametersUpdated:

divergence(osc, pivot_confirmation_bars_left, pivot_confirmation_bars_right, pivot_min_x_distance, pivot_max_x_distance, ref_low, ref_high, pivot_min_y_distance_len, pivot_min_y_distance_dev_mult, pivot_min_y_distance_atr_mult)

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_confirmation_bars_left (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_confirmation_bars_right (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 3)

pivot_min_x_distance (simple int): (simple int) optional minimum distance between pivot points considered for a divergence (should not be bigger than pivot_leftbars) (default: 5)

pivot_max_x_distance (simple int): (simple int) optional maximum distance between pivot points considered for a divergence (should not be bigger than pivot_leftbars) (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

pivot_min_y_distance_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L when detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

pivot_min_y_distance_dev_mult (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L when detecting following equal H/Ls (default: 0.1)

pivot_min_y_distance_atr_mult (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L when detecting following equal H/Ls (default: 0.1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, osc_pivot_h, osc_pivot_l]

파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.