INVITE-ONLY SCRIPT

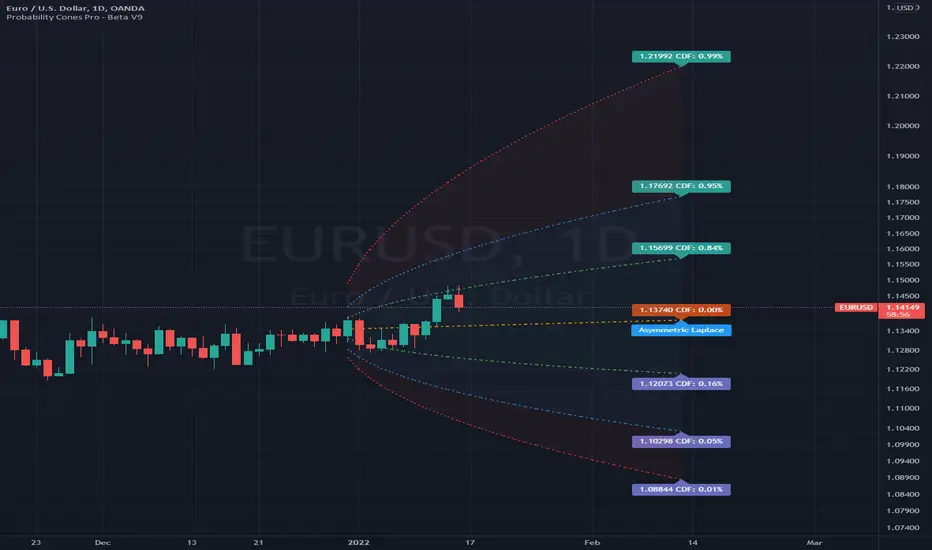

업데이트됨 Probability Cones Pro - Beta

An experimental probability cone indicator.

릴리즈 노트

Increased max_lines_count from 200 to 500.릴리즈 노트

Added a lot more stuff.- Add stationary cones. Lock the cones to the last bar location.

- Updated inputs menu with categories for clarity.

- Add options to position cone based on time instead of bars in the Date Settings.

릴리즈 노트

Add Asymmetric Laplace Distribution.Add Cauchy Distribution.

Add Logistic Distribution (currently broken)

Add Cumulative Distribution Function (CDF) Settings for Asymmetric Laplace and Cauchy Distributions.

Add input for mean selection. The "Auto" selection will use the recommended mean for your current selected distribution.

릴리즈 노트

Fixed 2 typos릴리즈 노트

- Add mean line and settings to adjust the calculations and style of it.

- Use a distribution's recommended mean calculation, or manually set it to use the average or median.

- If you don't want the cones to update their location, you can lock them in place with a setting.

- Two ways of anchoring the origin of the cones: 1. manually set it a specific number of bars back 2. start from the beginning of a selected higher time frame.

- If you need to offset the origin on the timeframe anchor, there's an offset input. It's 1 by default so that the cones are always considered "out of sample" from the trading period analyzed.

- Change any line's color, style, width.

- Change the highlight/fill colors between any two cones.

- Default colors are based on the Solarized color palette.

- Colors were selected to maximize contrast for color blind traders. If you are color blind let me know how well it works for you and your type of colorblindness.

릴리즈 노트

Update script's preview chart.릴리즈 노트

Remove minimized indicators from the indicator's chart preview.릴리즈 노트

- Started to add Expected Value CDF cones.

- Added Absolute Deviation CDF cones. This calculation takes all the data points past a set CDF probability, finds the average deviation from the mean, and then plots the line.

- Improved Cauchy distribution.

- Add Generalized Cauchy distribution.

- Add select date cone anchor.

So how do I use the AD CDF and E(X) CDF inputs?

First some definitions:

AD stands for Absolute Deviation. It takes the absolute deviation of the respective CDF input probability. E(X) is the symbol for Expected Value, however, right now it works more like a "True Value". Expected Value is probability weighted, and that has not been added yet. So I'm simply taking the respective value that corresponds to the set CDF probability and forecasting that.

So how to use it?

Either leave the settings alone if you want to stick with the defaults. Ideally distributions are more accurate with the Expected Value type over the Absolute Deviation type. However, the Absolute Deviation can behave more consistently; as in less bugs as it is a more well flushed out feature. This is especially true for the Cauchy distributions. They still need some more work, but the values displayed are proper forecasts from either forecast type. You just might get a current bug where a deviation doesn't show.

This is where you come in as a Beta participant!

Not all of the features are completely working. Not everything has appropriate tooltips or even works. The indicator is in a Beta phase and you're using it as I'm developing it. However, please send me your feedback and questions about the indicator so I can begin to create documentation for some of these more advanced statistical features! I always appreciate everything everybody does to contribute ideas, tooltips, or simple clarification on how things in the indicator are calculated.

For everyone who contributes to my Todo list essentially, I'll give credit for keeping me on track with features and polishing of the indicator. (and maybe a few extra things in the future 😉)

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 joebaus에게 직접 문의하세요.

이 프라이빗, 인바이트-온리 스크립트는 스크립트 관리자가 리뷰하지 않았으며 하우스 룰 준수 여부가 결정되지 않았습니다. 트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Ask me about access.

Joe Baus, bausbenchmarks.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 joebaus에게 직접 문의하세요.

이 프라이빗, 인바이트-온리 스크립트는 스크립트 관리자가 리뷰하지 않았으며 하우스 룰 준수 여부가 결정되지 않았습니다. 트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Ask me about access.

Joe Baus, bausbenchmarks.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.