INVITE-ONLY SCRIPT

업데이트됨 CryptoGraph Dynamic DCA

A system to backtest and automate comprehensive trading strategies

═════════════════════════════════════════════════════════════════════════

🟣 Supporting Your Trades

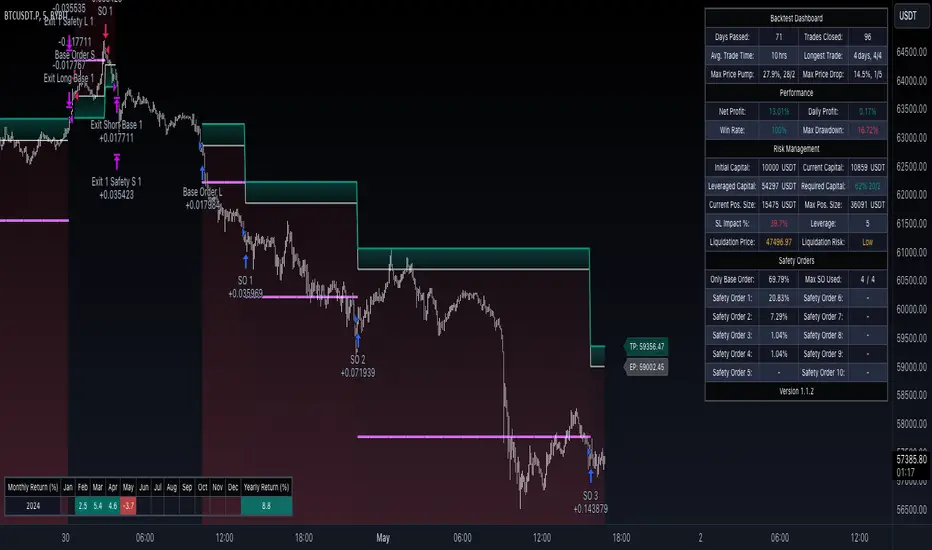

CryptoGraph Dynamic DCA serves as a comprehensive tool on TradingView, designed to refine your approach to cryptocurrency trading. It utilises dynamic dollar-cost averaging (DCA), based on external indicator sources, to provide structured market entry and exit strategies. Suitable for both short-term trading and long-term portfolio management, CryptoGraph Dynamic DCA can offer a methodical way to support your trading decisions.

The tool offers an intuitive interface with inputs for strategy customisation, visualised preferences, and bot alert configurations. It can assist traders seeking precision, adaptability, and control in their trading activities. In the example on the chart above, we use the CryptoGraph Entry Builder (part of CryptoGraph Dynamic DCA package) as an external source for our initial entry (base order) and our safety orders, as well as an external source for our second take profit, which can be configured to be signal based.

🟣 Features

🟣 Features Impression

🟣 Usage Guide

1. Strategy Configuration:

Select the appropriate cryptocurrency pair and exchange that corresponds to your trading preferences.

Choose your desired chart timeframe to align with your trading strategy’s temporal scope.

Ensure that you’re utilising the regular candle type for consistent and reliable data interpretation.

Pick an external entry source to trigger your trades based on predefined indicators or conditions.

Determine your take profit and stop loss levels to manage risks and secure earnings effectively.

Configure your DCA (Dollar-Cost Averaging) settings, including safety orders and the scaling method, to enhance entry points and manage investment distribution.

Always consult the tooltips next to each strategy input, to better understand their functions.

2. Backtest and Analysis:

Run backtests with your configured parameters to assess the strategy’s potential performance.

Review the backtest results and statistics tables to understand the strategy’s effectiveness, risk profile, and profitability.

3. Automated Trading Platform Integration:

Connect the strategy to a compatible automated trading platform to enable real-time execution of trades.

Within the trading platform, ensure the proper API setup of the bot’s configuration to align with the signals from the tool.

4. Alert Configuration in TradingView:

Set up the alert conditions in the TradingView tool to match your strategy triggers for entry, exit, take profit, and stop loss.

Configure the connection parameters within the tool to communicate effectively with your chosen automated trading platform

Activate the alerts, ensuring they are set to trigger actions such as order placement, adjustments, or closures as per your strategy’s logic.

5. Capital Management:

Confirm that your initial capital and order size are logically set, keeping in mind that the sum of all deals, especially when using pyramiding with safety orders, should not exceed your initial capital to avoid overexposure.

🟣 Trade Example

A clear example of a trade. Base order entry, safety order 1 fills, take profit 1 hits at 1%, the remainder of the position runs until the exit signal fires.

🟣 Warning

This tool has been developed to support your trading analysis, yet it’s important to acknowledge the inherent risks associated with trading. It is advisable to perform thorough research, assess your risk tolerance, and utilise this tool as one element of an overall trading strategy. Ensure that you only trade with capital that you are prepared to risk. In addition, due to the complexity of the tool, bugs may be found. Please alert us whenever you think you have found a bug in the system.

═════════════════════════════════════════════════════════════════════════

🟣 Supporting Your Trades

CryptoGraph Dynamic DCA serves as a comprehensive tool on TradingView, designed to refine your approach to cryptocurrency trading. It utilises dynamic dollar-cost averaging (DCA), based on external indicator sources, to provide structured market entry and exit strategies. Suitable for both short-term trading and long-term portfolio management, CryptoGraph Dynamic DCA can offer a methodical way to support your trading decisions.

The tool offers an intuitive interface with inputs for strategy customisation, visualised preferences, and bot alert configurations. It can assist traders seeking precision, adaptability, and control in their trading activities. In the example on the chart above, we use the CryptoGraph Entry Builder (part of CryptoGraph Dynamic DCA package) as an external source for our initial entry (base order) and our safety orders, as well as an external source for our second take profit, which can be configured to be signal based.

🟣 Features

- External Entry/Exit sources: The strategy is designed to assist with accurate market entries and exits by utilising signals from external indicators. It offers the flexibility to tailor your trading approach, providing an opportunity to leverage the analytical capabilities of various indicators available on TradingView.

- Strategic Direction Control: Configure your strategy to go long, short, or both, adapting to market trends and your trading style.

- Leverage Customisation: Tailor your leverage settings for isolated or cross margin to align with your risk tolerance, a liquidation estimation level is plotted on the chart, based on your input settings.

- Diverse Entry Points: Utilise base orders and safety orders to diversify your entry points, reducing risk and enhancing potential returns.

- Tailored Order Size: Fine-tune your order sizes using margin percentages or fixed contract sizes to fit your strategy’s requirements.

- Profit Taking & Loss Prevention: Set take profit levels and stop losses with percentage or ATR-based parameters to secure profits and minimise losses. Options for moving the stop loss to entry after Take Profit 1, with an adjustable buffer, give you control over your risk management.

- Max Safety Orders Count: Determine the maximum number of safety orders to manage risk effectively.

- Price Deviation for DCA Orders: Specify the minimum price deviation percentage to trigger DCA orders, ensuring strategic order placement.

- DCA Size Method: Choose from scaling or fixed-size DCA orders to align with your capital allocation strategy.

- Visualisation & Alerts: Analyse your strategy’s performance with a backtest results table and configure bot alerts for automated trading. Auto configuration methods are integrated for multiple automated trading platforms.

🟣 Features Impression

🟣 Usage Guide

1. Strategy Configuration:

Select the appropriate cryptocurrency pair and exchange that corresponds to your trading preferences.

Choose your desired chart timeframe to align with your trading strategy’s temporal scope.

Ensure that you’re utilising the regular candle type for consistent and reliable data interpretation.

Pick an external entry source to trigger your trades based on predefined indicators or conditions.

Determine your take profit and stop loss levels to manage risks and secure earnings effectively.

Configure your DCA (Dollar-Cost Averaging) settings, including safety orders and the scaling method, to enhance entry points and manage investment distribution.

Always consult the tooltips next to each strategy input, to better understand their functions.

2. Backtest and Analysis:

Run backtests with your configured parameters to assess the strategy’s potential performance.

Review the backtest results and statistics tables to understand the strategy’s effectiveness, risk profile, and profitability.

3. Automated Trading Platform Integration:

Connect the strategy to a compatible automated trading platform to enable real-time execution of trades.

Within the trading platform, ensure the proper API setup of the bot’s configuration to align with the signals from the tool.

4. Alert Configuration in TradingView:

Set up the alert conditions in the TradingView tool to match your strategy triggers for entry, exit, take profit, and stop loss.

Configure the connection parameters within the tool to communicate effectively with your chosen automated trading platform

Activate the alerts, ensuring they are set to trigger actions such as order placement, adjustments, or closures as per your strategy’s logic.

5. Capital Management:

Confirm that your initial capital and order size are logically set, keeping in mind that the sum of all deals, especially when using pyramiding with safety orders, should not exceed your initial capital to avoid overexposure.

🟣 Trade Example

A clear example of a trade. Base order entry, safety order 1 fills, take profit 1 hits at 1%, the remainder of the position runs until the exit signal fires.

🟣 Warning

This tool has been developed to support your trading analysis, yet it’s important to acknowledge the inherent risks associated with trading. It is advisable to perform thorough research, assess your risk tolerance, and utilise this tool as one element of an overall trading strategy. Ensure that you only trade with capital that you are prepared to risk. In addition, due to the complexity of the tool, bugs may be found. Please alert us whenever you think you have found a bug in the system.

릴리즈 노트

🟣 Version 1.0.1- Scaling DCA distance threshold added

- Issue with external sources for DCA solved

- Tooltips improved

- Dashboard tables improved

릴리즈 노트

🟣 Version 1.0.1- Improved backtest dashboard. Information has been added like maximum price pump/dump without user defined retrace percentage, leveraged capital, required capital to fill all orders, stop loss impact % on your account balance, liquidation risk, and more. All table cells include tooltips when hovered over with your mouse explaining the data in more detail.

- An option has been added to only fire the take profit 2 signal exit, above user defined input percentage (for example above take profit 1).

- An option has been added to set a minimum take profit or maximum stop loss when using ATR based take profit/stop loss.

- A time based exit option has been added.

- A more standard color theme has been added for trade visualizations.

- Risk % order sizing has been improved.

- Bot setup auto configuration has been improved.

릴리즈 노트

🟣 Version 1.1.2- Fixed manual order sizing

- Fixed stop loss impact %

릴리즈 노트

🟣 Version 1.1.3- Test plot removed

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 ScryptoMB에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

For access visit our website at: http://www.cryptographtrading.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 ScryptoMB에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

For access visit our website at: http://www.cryptographtrading.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.