OPEN-SOURCE SCRIPT

업데이트됨 Divergence Cheat Sheet

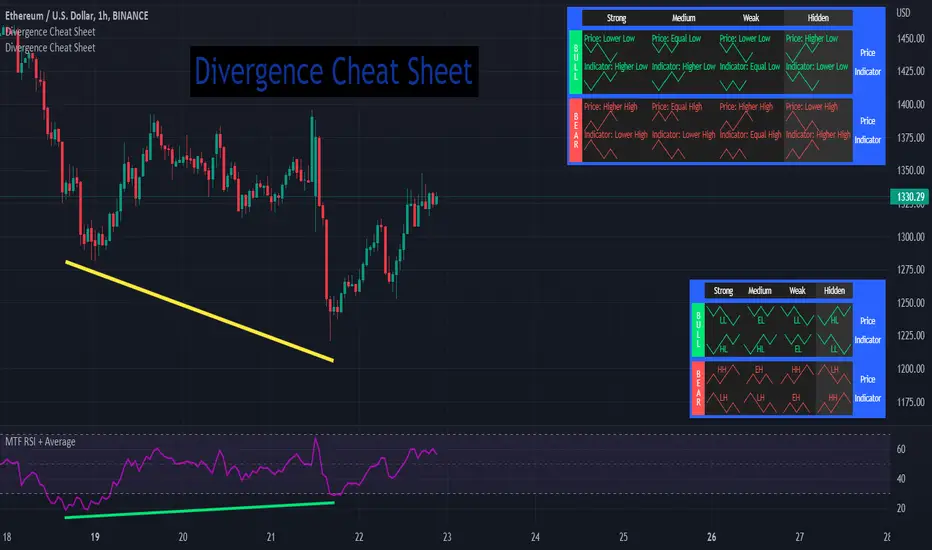

'Divergence Cheat Sheet' helps in understanding what to look for when identifying divergences between price and an indicator. The strength of a divergence can be strong, medium, or weak. Divergences are always most effective when references prior peaks and on higher time frames. The most common indicators to identify divergences with are the Relative Strength Index (RSI) and the Moving average convergence divergence (MACD).

Regular Bull Divergence: Indicates underlying strength. Bears are exhausted. Warning of a possible trend direction change from a downtrend to an uptrend.

Hidden Bull Divergence: Indicates underlying strength. Good entry or re-entry. This occurs during retracements in an uptrend. Nice to see during the price retest of previous lows. “Buy the dips."

Regular Bear Divergence: Indicates underlying weakness. The bulls are exhausted. Warning of a possible trend direction change from an uptrend to a downtrend.

Hidden Bear Divergence: Indicates underlying weakness. Found during retracements in a downtrend. Nice to see during price retests of previous highs. “Sell the rallies.”

Divergences can have different strengths.

Strong Bull Divergence

Medium Bull Divergence

Weak Bull Divergence

Hidden Bull Divergence

Strong Bear Divergence

Medium Bear Divergence

Weak Bear Divergence

Hidden Bull Divergence

Regular Bull Divergence: Indicates underlying strength. Bears are exhausted. Warning of a possible trend direction change from a downtrend to an uptrend.

Hidden Bull Divergence: Indicates underlying strength. Good entry or re-entry. This occurs during retracements in an uptrend. Nice to see during the price retest of previous lows. “Buy the dips."

Regular Bear Divergence: Indicates underlying weakness. The bulls are exhausted. Warning of a possible trend direction change from an uptrend to a downtrend.

Hidden Bear Divergence: Indicates underlying weakness. Found during retracements in a downtrend. Nice to see during price retests of previous highs. “Sell the rallies.”

Divergences can have different strengths.

Strong Bull Divergence

- Price: Lower Low

- Indicator: Higher Low

Medium Bull Divergence

- Price: Equal Low

- Indicator: Higher Low

Weak Bull Divergence

- Price: Lower Low

- Indicator: Equal Low

Hidden Bull Divergence

- Price: Higher Low

- Indicator: Higher Low

Strong Bear Divergence

- Price: Higher High

- Indicator: Lower High

Medium Bear Divergence

- Price: Equal High

- Indicator: Lower High

Weak Bear Divergence

- Price: Higher High

- Indicator: Equal High

Hidden Bull Divergence

- Price: Lower High

- Indicator: Higher High

릴리즈 노트

Tooltips added.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

tanhef.com/

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

tanhef.com/

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.