INVITE-ONLY SCRIPT

Deep in the Tape – VSA (Invite Only)

Deep in the Tape – VSA (Invite-Only)

Quick Start

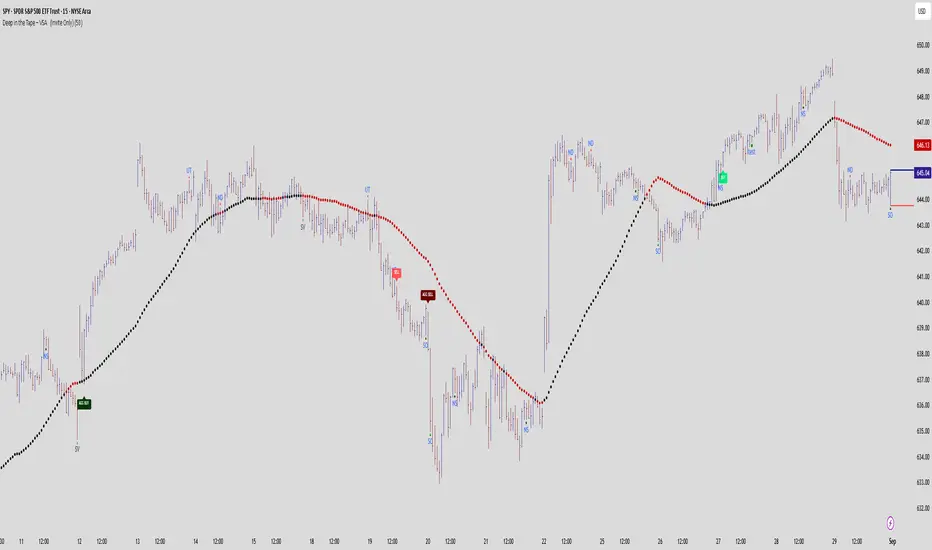

This invite-only indicator is built on Tom Williams’ Volume Spread Analysis (VSA). It highlights professional activity through classical VSA events and adds labels for confirmations, aggressive signals, and failures. The goal is to help traders study background strength/weakness, follow-through, and traps directly on the chart.

What It Shows

VSA Events: Stopping Volume, Selling Climax, Shakeout, Buying Climax, Upthrust, Supply Coming In, No Demand, No Supply, Confirmed Test Bars, End of Rising Market.

Labels:

BUY / SELL – show when classical confirmations appear (e.g., Test/NS after strength, ND after weakness).

AGG BUY / AGG SELL – highlight aggressive early entries when supply/demand is quickly absorbed or confirmed.

FAIL / TEST FAIL – show failed VSA setups where effort is not confirmed, helping traders recognize traps.

Context Tools:

High/low lines from ultra-high-volume trigger bars projected forward.

Optional high-volume cluster zones to mark potential accumulation/distribution.

Optional moving average for background context (not a signal generator).

How to Use It :

Read the Background

Look for ultra-high-volume events that mark professional activity: SC, SV, SO for strength; UT, BC, Supply Coming In for weakness.

Watch for the Response

After strength → look for Tests or No Supply to confirm demand, often labeled as BUY.

After weakness → watch for No Demand or UT follow-through, labeled as SELL.

Best Practice with Context

Bullish setups are best taken above the trigger levels and above the MA, showing demand in control.

Bearish setups are best taken below the trigger levels and below the MA, confirming supply pressure.

Study Failures and Aggressive Signals

Aggressive labels show when the market reacts quickly, confirming activity before a classical test.

Failure labels show when expected follow-through breaks down, revealing traps or absorption. These are highly educational in tape-reading.

Alerts: Ready-to-use alert conditions for all confirmations, aggressive signals, and failures, allowing real-time notifications.

Customization:

Users can toggle individual signals (e.g., Stopping Volume, No Demand, Tests, Aggressive Entries, Failure labels) on or off, tailoring the display to their preferred VSA study style.

Use Projected Levels & Clusters

Trigger levels and cluster zones provide natural S/R where professional money often reappears. Watching price response around these zones is key.

Why It’s Original

This script is not a mashup of indicators. Every condition is coded around VSA principles—spread, volume, wick proportions, close location, and context. Labels are mapped directly to Tom Williams’ methodology of background + test + confirmation. Clusters and projected levels extend the same VSA logic to make professional activity visible in real time.

Disclaimer

This script is for educational purposes only and does not constitute financial advice. Trading and investing involve risk. Always do your own analysis and risk management.

Quick Start

This invite-only indicator is built on Tom Williams’ Volume Spread Analysis (VSA). It highlights professional activity through classical VSA events and adds labels for confirmations, aggressive signals, and failures. The goal is to help traders study background strength/weakness, follow-through, and traps directly on the chart.

What It Shows

VSA Events: Stopping Volume, Selling Climax, Shakeout, Buying Climax, Upthrust, Supply Coming In, No Demand, No Supply, Confirmed Test Bars, End of Rising Market.

Labels:

BUY / SELL – show when classical confirmations appear (e.g., Test/NS after strength, ND after weakness).

AGG BUY / AGG SELL – highlight aggressive early entries when supply/demand is quickly absorbed or confirmed.

FAIL / TEST FAIL – show failed VSA setups where effort is not confirmed, helping traders recognize traps.

Context Tools:

High/low lines from ultra-high-volume trigger bars projected forward.

Optional high-volume cluster zones to mark potential accumulation/distribution.

Optional moving average for background context (not a signal generator).

How to Use It :

Read the Background

Look for ultra-high-volume events that mark professional activity: SC, SV, SO for strength; UT, BC, Supply Coming In for weakness.

Watch for the Response

After strength → look for Tests or No Supply to confirm demand, often labeled as BUY.

After weakness → watch for No Demand or UT follow-through, labeled as SELL.

Best Practice with Context

Bullish setups are best taken above the trigger levels and above the MA, showing demand in control.

Bearish setups are best taken below the trigger levels and below the MA, confirming supply pressure.

Study Failures and Aggressive Signals

Aggressive labels show when the market reacts quickly, confirming activity before a classical test.

Failure labels show when expected follow-through breaks down, revealing traps or absorption. These are highly educational in tape-reading.

Alerts: Ready-to-use alert conditions for all confirmations, aggressive signals, and failures, allowing real-time notifications.

Customization:

Users can toggle individual signals (e.g., Stopping Volume, No Demand, Tests, Aggressive Entries, Failure labels) on or off, tailoring the display to their preferred VSA study style.

Use Projected Levels & Clusters

Trigger levels and cluster zones provide natural S/R where professional money often reappears. Watching price response around these zones is key.

Why It’s Original

This script is not a mashup of indicators. Every condition is coded around VSA principles—spread, volume, wick proportions, close location, and context. Labels are mapped directly to Tom Williams’ methodology of background + test + confirmation. Clusters and projected levels extend the same VSA logic to make professional activity visible in real time.

Disclaimer

This script is for educational purposes only and does not constitute financial advice. Trading and investing involve risk. Always do your own analysis and risk management.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 deep_in_the_tape_1에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

This is an invite-only script. To request access, please visit https://deepinthetape.com or send me a private message on Trading View . Access is manually granted after request review. Please do not request access in the comments.

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 deep_in_the_tape_1에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

This is an invite-only script. To request access, please visit https://deepinthetape.com or send me a private message on Trading View . Access is manually granted after request review. Please do not request access in the comments.

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.