OPEN-SOURCE SCRIPT

Yang & Zheng Extension of Garman & Klass

First off, a huge thank you to the following people:

theheirophant: tradingview.com/u/theheirophant/

alexgrover: tradingview.com/u/alexgrover/

NGBaltic: tradingview.com/u/NGBaltic/

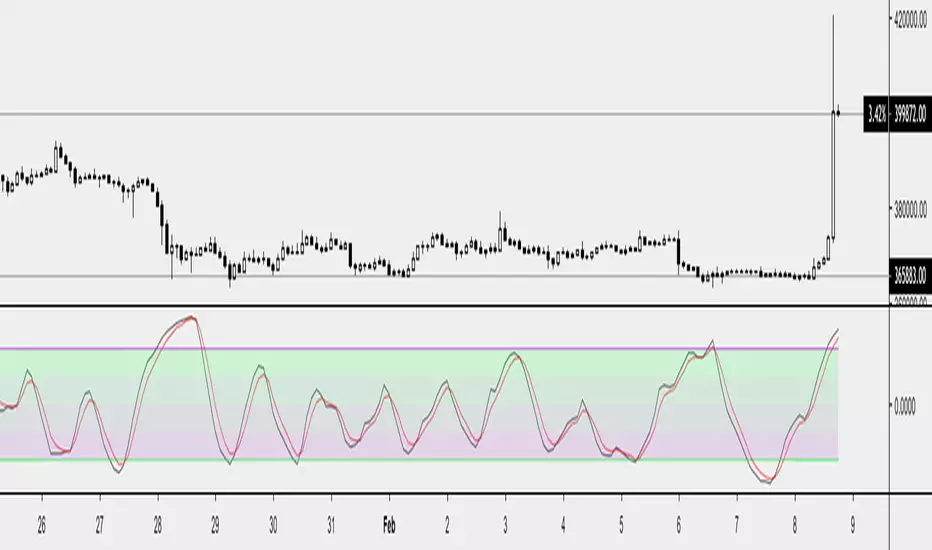

This is the Yang & Zhang extension of Garman & Klass. The equation was modified to include the logarithm of the open price divided by the preceding close price. As a result, this function uses the open, high, low and close prices to estimate volatility. This modification allows the volatility estimator to account for the opening jumps, but as the original function, it assumes that the underlying follows a Brownian motion with zero drift (the historical mean return should be equal to zero). This estimator tends to overestimate the volatility when the drift is different from zero, however, for a zero drift motion, this estimator has an efficiency of eight times the classic close-to-close estimator (standard deviation).

This script allows you to transform the volatility reading. The intention of this is to be able to compare volatility across different assets and timeframes. Having a relative reading of volatility also allows you to better gauge volatility within the context of current market conditions.

For the signal lie I chose a repulsion moving average to remove choppy crossovers of the estimator and the signal. This may have been a mistake, so in the near-future I might update so that the MA can be selected. Let me know if you have any opinions either way.

References

rdocumentation.org/packages/TTR/versions/0.23-4/topics/volatility

quantshare.com/item-197-yang-zhang-extension-of-the-garman-klass-volatility-estimator

Want to Learn?

If you'd like the opportunity to learn Pine but you have difficulty finding resources to guide you, take a look at this rudimentary list: docs.google.com/document/d/10t3Z...

The list will be updated in the future as more people share the resources that have helped, or continue to help, them. Follow me on Twitter to keep up-to-date with the growing list of resources.

Suggestions or Questions?

Don't even kinda hesitate to forward them to me. My (metaphorical) door is always open.

theheirophant: tradingview.com/u/theheirophant/

alexgrover: tradingview.com/u/alexgrover/

NGBaltic: tradingview.com/u/NGBaltic/

This is the Yang & Zhang extension of Garman & Klass. The equation was modified to include the logarithm of the open price divided by the preceding close price. As a result, this function uses the open, high, low and close prices to estimate volatility. This modification allows the volatility estimator to account for the opening jumps, but as the original function, it assumes that the underlying follows a Brownian motion with zero drift (the historical mean return should be equal to zero). This estimator tends to overestimate the volatility when the drift is different from zero, however, for a zero drift motion, this estimator has an efficiency of eight times the classic close-to-close estimator (standard deviation).

This script allows you to transform the volatility reading. The intention of this is to be able to compare volatility across different assets and timeframes. Having a relative reading of volatility also allows you to better gauge volatility within the context of current market conditions.

For the signal lie I chose a repulsion moving average to remove choppy crossovers of the estimator and the signal. This may have been a mistake, so in the near-future I might update so that the MA can be selected. Let me know if you have any opinions either way.

References

rdocumentation.org/packages/TTR/versions/0.23-4/topics/volatility

quantshare.com/item-197-yang-zhang-extension-of-the-garman-klass-volatility-estimator

Want to Learn?

If you'd like the opportunity to learn Pine but you have difficulty finding resources to guide you, take a look at this rudimentary list: docs.google.com/document/d/10t3Z...

The list will be updated in the future as more people share the resources that have helped, or continue to help, them. Follow me on Twitter to keep up-to-date with the growing list of resources.

Suggestions or Questions?

Don't even kinda hesitate to forward them to me. My (metaphorical) door is always open.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.