OPEN-SOURCE SCRIPT

Volume Flares

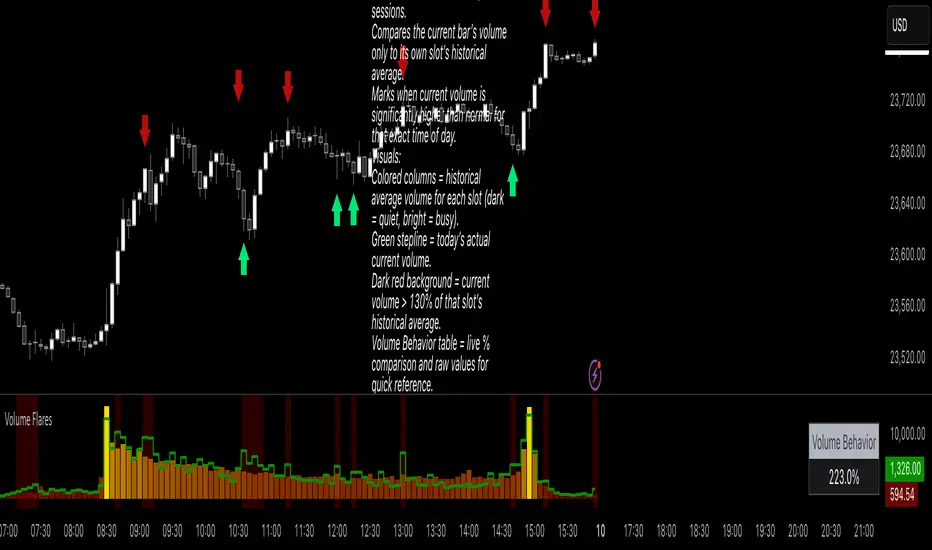

Volume Flares – Spotting Abnormal Volume by Time of Day

Most volume tools compare current volume to a moving average of the last X bars. That’s fine for seeing short-term changes, but it ignores how volume naturally ebbs and flows throughout the day.

Volume at 9:35 is not the same as volume at 1:15.

A standard MA will treat them the same.

What Volume Flares does differently:

Breaks the day into exact time slots (based on your chosen timeframe).

Calculates the historical average volume for each slot across past sessions.

Compares the current bar’s volume only to its own slot’s historical average.

Marks when current volume is significantly higher than normal for that exact time of day.

Visuals:

Colored columns = historical average volume for each slot (dark = quiet, bright = busy).

Green stepline = today’s actual current volume.

Dark red background = current volume > 130% of that slot’s historical average.

Volume Behavior table = live % comparison and raw values for quick reference.

How I use it:

Red and green arrows on the price chart are manually drawn where the background turns red in the volume panel.

These often align with liquidity grabs, institutional entries, or areas where the market is “louder” than it should be for that moment in the day.

Helps filter out false urgency — high volume at the open isn’t the same as high volume in the lunch lull.

Key takeaway:

This is not a buy/sell signal.

It’s context.

It’s about spotting when the market is behaving out of character for that specific moment, and using that to read intent behind the move.

Most volume tools compare current volume to a moving average of the last X bars. That’s fine for seeing short-term changes, but it ignores how volume naturally ebbs and flows throughout the day.

Volume at 9:35 is not the same as volume at 1:15.

A standard MA will treat them the same.

What Volume Flares does differently:

Breaks the day into exact time slots (based on your chosen timeframe).

Calculates the historical average volume for each slot across past sessions.

Compares the current bar’s volume only to its own slot’s historical average.

Marks when current volume is significantly higher than normal for that exact time of day.

Visuals:

Colored columns = historical average volume for each slot (dark = quiet, bright = busy).

Green stepline = today’s actual current volume.

Dark red background = current volume > 130% of that slot’s historical average.

Volume Behavior table = live % comparison and raw values for quick reference.

How I use it:

Red and green arrows on the price chart are manually drawn where the background turns red in the volume panel.

These often align with liquidity grabs, institutional entries, or areas where the market is “louder” than it should be for that moment in the day.

Helps filter out false urgency — high volume at the open isn’t the same as high volume in the lunch lull.

Key takeaway:

This is not a buy/sell signal.

It’s context.

It’s about spotting when the market is behaving out of character for that specific moment, and using that to read intent behind the move.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.