OPEN-SOURCE SCRIPT

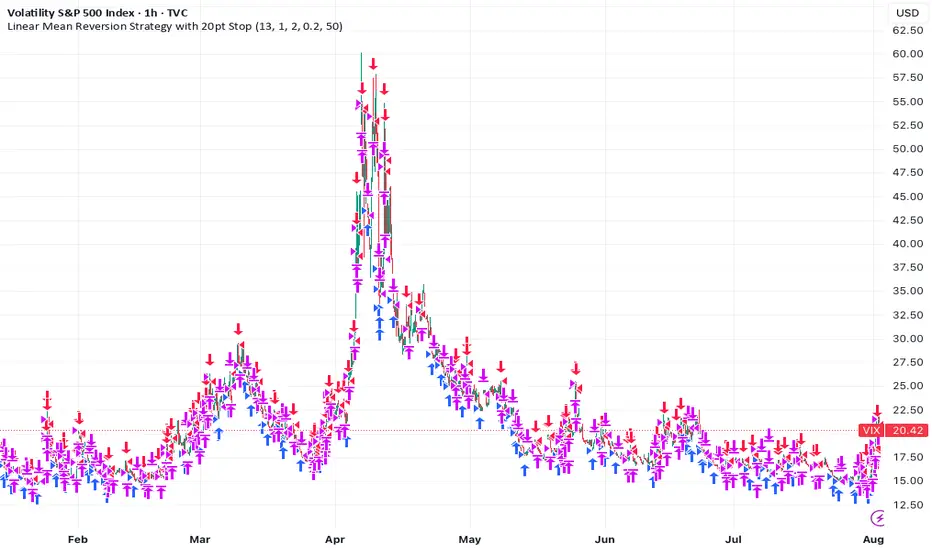

업데이트됨 Linear Mean Reversion Strategy

📘 Strategy Introduction: Linear Mean Reversion with Fixed Stop

This strategy implements a simple yet powerful mean reversion model that assumes price tends to oscillate around a dynamic average over time. It identifies statistically significant deviations from the moving average using a z-score, and enters trades expecting a return to the mean.

🧠 Core Logic:

A z-score is calculated by comparing the current price to its moving average, normalized by standard deviation, over a user-defined half-life window.

Trades are entered when the z-score crosses a threshold (e.g., ±1), signaling overbought or oversold conditions.

The strategy exits positions either when price reverts back near the mean (z-score close to 0), or if a fixed stop loss of 100 points is hit, whichever comes first.

⚙️ Key Features:

Dynamic mean and volatility estimation using moving average and standard deviation

Configurable z-score thresholds for entry and exit

Position size scaling based on z-score magnitude

Fixed stop loss to control risk and avoid prolonged drawdowns

🧪 Use Case:

Ideal for range-bound markets or assets that exhibit stationary behavior around a mean, this strategy is especially useful on assets with mean-reverting characteristics like currency pairs, ETFs, or large-cap stocks. It is best suited for traders looking for short-term reversions rather than long-term trends.

This strategy implements a simple yet powerful mean reversion model that assumes price tends to oscillate around a dynamic average over time. It identifies statistically significant deviations from the moving average using a z-score, and enters trades expecting a return to the mean.

🧠 Core Logic:

A z-score is calculated by comparing the current price to its moving average, normalized by standard deviation, over a user-defined half-life window.

Trades are entered when the z-score crosses a threshold (e.g., ±1), signaling overbought or oversold conditions.

The strategy exits positions either when price reverts back near the mean (z-score close to 0), or if a fixed stop loss of 100 points is hit, whichever comes first.

⚙️ Key Features:

Dynamic mean and volatility estimation using moving average and standard deviation

Configurable z-score thresholds for entry and exit

Position size scaling based on z-score magnitude

Fixed stop loss to control risk and avoid prolonged drawdowns

🧪 Use Case:

Ideal for range-bound markets or assets that exhibit stationary behavior around a mean, this strategy is especially useful on assets with mean-reverting characteristics like currency pairs, ETFs, or large-cap stocks. It is best suited for traders looking for short-term reversions rather than long-term trends.

릴리즈 노트

The idea is simple: if an instrument’s price is truly mean-reverting, we can expect it to return to its long-term average. Most assets, however, behave more like random walks and show little tendency to revert. The VIX—an index of S&P 500 volatility—is a notable exception, exhibiting clear mean-reversion.

For this strategy, I’ve assumed a trading cost of 0.1%, which seems reasonable given the typical bid-ask spread on the VIX is about 0.18 points.

A z-score is calculated by comparing the current price to its moving average, normalized by standard deviation, over a user-defined half-life window.

Trades are entered when the z-score crosses a threshold (e.g., ±1), signaling overbought or oversold conditions.

The strategy exits positions either when price reverts back near the mean (z-score close to 0), or if a fixed stop loss is hit, whichever comes first.

Designed for a 1 H window, where the VIX’s mean reversion and assumed costs tend to align well.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.