OPEN-SOURCE SCRIPT

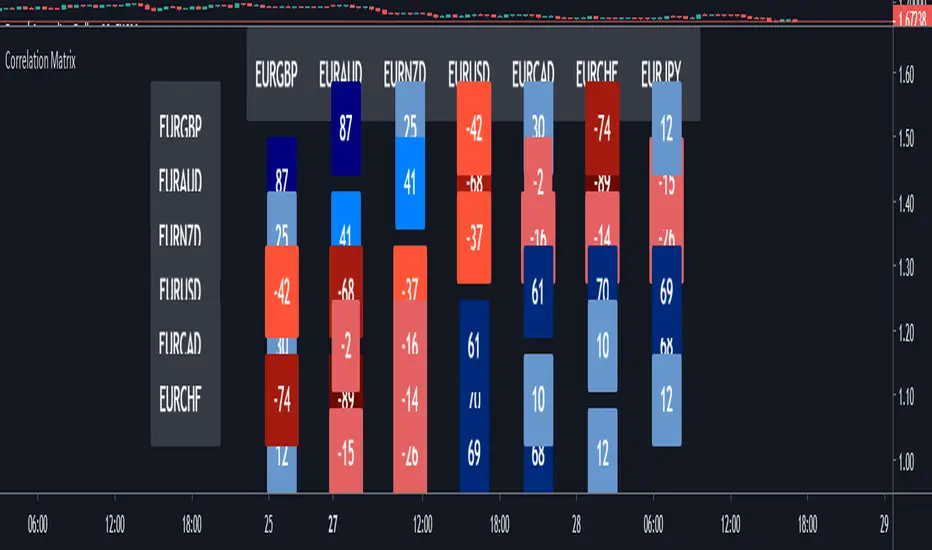

Correlation Matrix

In financial terms, 'correlation' is the numerical measure of the relationship between two variables (in this case, the variables are Forex pairs).

The range of the correlation coefficient is between -1 and +1. A correlation of +1 indicates that two currency pairs will flow in the same direction.

A correlation of -1 indicates that two currency pairs will move in the opposite direction.

Here, I multiplied correlation coefficient by 100 so that it is easier to read. Range between 100 and -100.

Color Coding:-

The darker the color, the higher the correlation positively or negatively.

Extra Light Blue (up to +29) : Weak correlation. Positions on these symbols will tend to move independently.

Light Blue (up to +49) : There may be similarity between positions on these symbols.

Medium Blue (up to +75) : Medium positive correlation.

Navy Blue (up to +100) : Strong positive correlation.

Extra Light Red (up to -30) : Weak correlation. Positions on these symbols will tend to move independently

Light Red (up to -49) : There may be similarity between positions on these symbols.

Dark Red: (up to -75) : Medium negative correlation.

Maroon: (up to -100) : Strong negative correlation.

The range of the correlation coefficient is between -1 and +1. A correlation of +1 indicates that two currency pairs will flow in the same direction.

A correlation of -1 indicates that two currency pairs will move in the opposite direction.

Here, I multiplied correlation coefficient by 100 so that it is easier to read. Range between 100 and -100.

Color Coding:-

The darker the color, the higher the correlation positively or negatively.

Extra Light Blue (up to +29) : Weak correlation. Positions on these symbols will tend to move independently.

Light Blue (up to +49) : There may be similarity between positions on these symbols.

Medium Blue (up to +75) : Medium positive correlation.

Navy Blue (up to +100) : Strong positive correlation.

Extra Light Red (up to -30) : Weak correlation. Positions on these symbols will tend to move independently

Light Red (up to -49) : There may be similarity between positions on these symbols.

Dark Red: (up to -75) : Medium negative correlation.

Maroon: (up to -100) : Strong negative correlation.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.