PROTECTED SOURCE SCRIPT

FX Rotation Dashboard – FX vs DXY

FX Rotation Dashboard

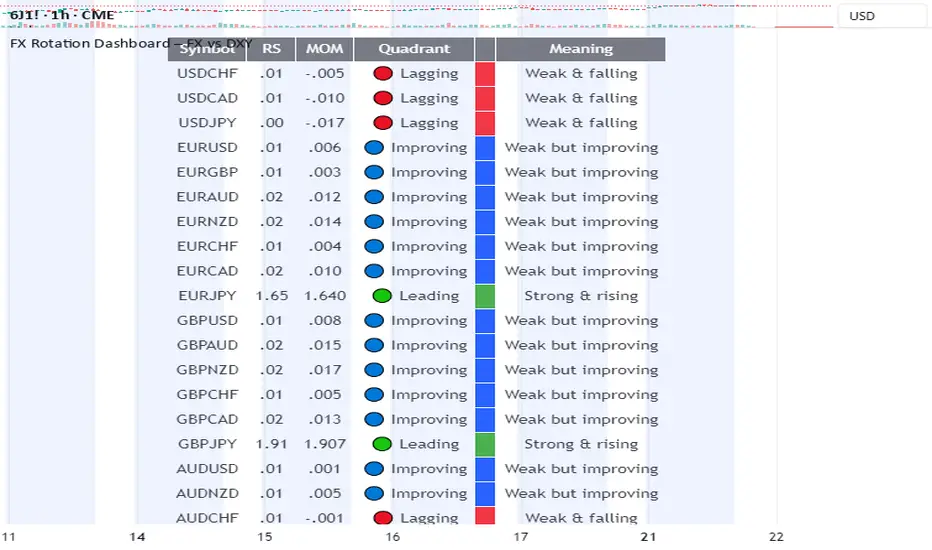

This FX Rotation Dashboard indicator offers a clear, at-a-glance overview of the relative strength and momentum of major FX pairs when measured against the US Dollar Index (DXY). It helps identify which currency pairs are leading or lagging in performance and how their relative positioning is evolving over time.

🔎 Structure

Each row in the table represents a currency pair and provides the following data:

Symbol: The FX pair (e.g., EURJPY, GBPUSD, AUDNZD)

RS: The current relative strength ratio vs. DXY

MOM: The momentum of the RS – showing whether strength is accelerating or decelerating

Quadrant:

🔴 Lagging: Underperforming and losing momentum

🔵 Improving: Underperforming but gaining momentum

🟢 Leading: Outperforming with rising momentum

🟡 Weakening (not visible in current table): Outperforming but slowing down

Meaning: A descriptive label summarizing the quadrant status

🧭 Interpretation

Currency pairs in the Leading quadrant (e.g., EURJPY, GBPJPY, CHFJPY, CADJPY) are currently outperforming the USD with rising momentum – often indicating strength across both RS and MOM dimensions.

Pairs in the Improving quadrant (e.g., GBPUSD, EURUSD, AUDUSD) are showing positive momentum but still lagging in relative strength – potential early signs of rotation into leadership.

Pairs in the Lagging quadrant (e.g., USDCHF, USDJPY, AUDCHF) are underperforming and continue to weaken – often considered the least attractive at the current stage of the cycle.

🧠 Purpose

This FX Rotation visualization is particularly useful for:

Macro-level FX rotation analysis

Spotting emerging trends before they are fully priced in

Tracking performance of G10 and cross pairs against USD

It provides context for currency strength beyond individual price movements by placing them in a relative performance framework.

⚠️ Disclaimer: This indicator is for informational and analytical purposes only. It does not constitute investment advice or a recommendation to buy or sell any financial instrument. Always conduct your own research before making trading decisions.

This FX Rotation Dashboard indicator offers a clear, at-a-glance overview of the relative strength and momentum of major FX pairs when measured against the US Dollar Index (DXY). It helps identify which currency pairs are leading or lagging in performance and how their relative positioning is evolving over time.

🔎 Structure

Each row in the table represents a currency pair and provides the following data:

Symbol: The FX pair (e.g., EURJPY, GBPUSD, AUDNZD)

RS: The current relative strength ratio vs. DXY

MOM: The momentum of the RS – showing whether strength is accelerating or decelerating

Quadrant:

🔴 Lagging: Underperforming and losing momentum

🔵 Improving: Underperforming but gaining momentum

🟢 Leading: Outperforming with rising momentum

🟡 Weakening (not visible in current table): Outperforming but slowing down

Meaning: A descriptive label summarizing the quadrant status

🧭 Interpretation

Currency pairs in the Leading quadrant (e.g., EURJPY, GBPJPY, CHFJPY, CADJPY) are currently outperforming the USD with rising momentum – often indicating strength across both RS and MOM dimensions.

Pairs in the Improving quadrant (e.g., GBPUSD, EURUSD, AUDUSD) are showing positive momentum but still lagging in relative strength – potential early signs of rotation into leadership.

Pairs in the Lagging quadrant (e.g., USDCHF, USDJPY, AUDCHF) are underperforming and continue to weaken – often considered the least attractive at the current stage of the cycle.

🧠 Purpose

This FX Rotation visualization is particularly useful for:

Macro-level FX rotation analysis

Spotting emerging trends before they are fully priced in

Tracking performance of G10 and cross pairs against USD

It provides context for currency strength beyond individual price movements by placing them in a relative performance framework.

⚠️ Disclaimer: This indicator is for informational and analytical purposes only. It does not constitute investment advice or a recommendation to buy or sell any financial instrument. Always conduct your own research before making trading decisions.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.