OPEN-SOURCE SCRIPT

업데이트됨 Universal Valuation[public code]

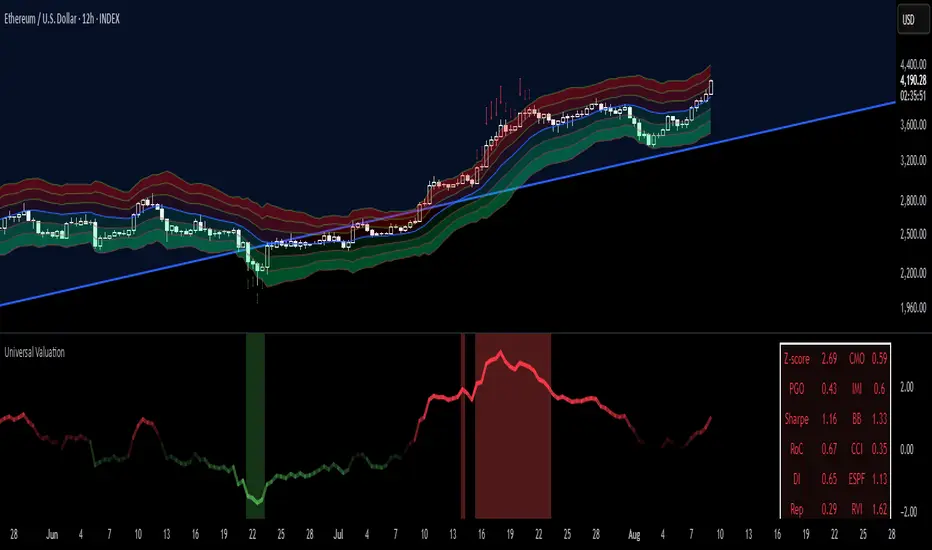

Universal valuation indicator for all assets. Consists of 12 different indicators which are z-scored and averaged out.

> Volatility bands via Keltner Channels with a NWMA

> Confluence when price > vol.bands and valuation is high/low. The confluence is marked with red arrows when above the upper third band(green when below the lower on the downside), and 50% transparency when between 2/3 band(green when below the lower 2/3 bands on the downside.)

> Can be used separately of course.

> Can be used as valuation of indicators, when possible. (eg. Global Liquidity index valuation)

Code is a mess a bit, but parts can be extracted and a new strategy/indicator can be made.

*Big probs to the creator of this indicator [tradingview.com/script/8ylRJMKr-Universal-Valuation-GTies/]. Inspired by him. I want to make it possible for people to extrapolate and create their own indicators/strategies. And of course, so I can do the same.

> Volatility bands via Keltner Channels with a NWMA

> Confluence when price > vol.bands and valuation is high/low. The confluence is marked with red arrows when above the upper third band(green when below the lower on the downside), and 50% transparency when between 2/3 band(green when below the lower 2/3 bands on the downside.)

> Can be used separately of course.

> Can be used as valuation of indicators, when possible. (eg. Global Liquidity index valuation)

Code is a mess a bit, but parts can be extracted and a new strategy/indicator can be made.

*Big probs to the creator of this indicator [tradingview.com/script/8ylRJMKr-Universal-Valuation-GTies/]. Inspired by him. I want to make it possible for people to extrapolate and create their own indicators/strategies. And of course, so I can do the same.

릴리즈 노트

Polished some code. *Disclaimer: ⚠️ This is not financial advice. It’s for educational purposes only. Use at your own risk.

릴리즈 노트

> Found out that with some tickers(eg. WRBWFRBL or the Fed Net Balance Sheet) IMI produces a NaN thus the whole valuation becomes a NaN. IMI now defaults to the CMO value when this happens, otherwise works as intended. 오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.