OPEN-SOURCE SCRIPT

MA RSI @KING

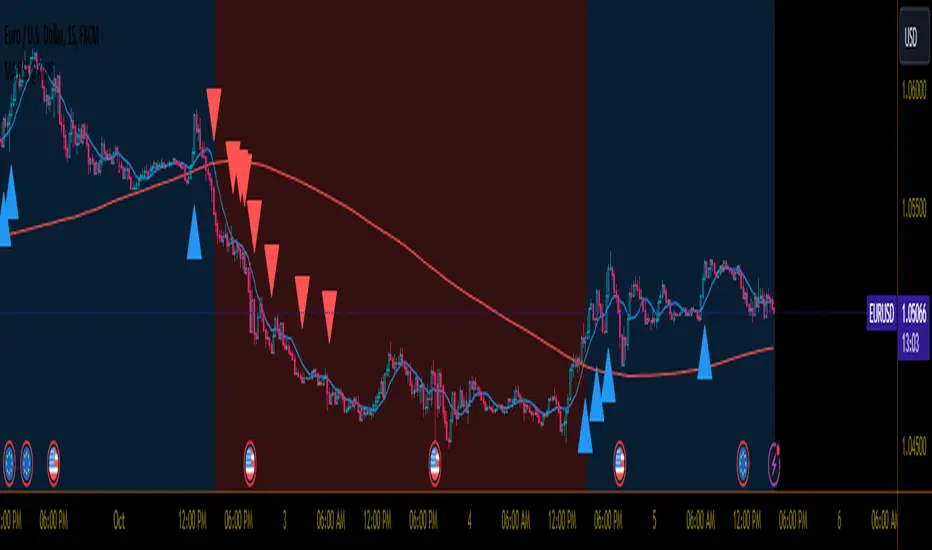

This Pine Script is designed to create a trading indicator with moving averages (MA) and relative strength index (RSI), along with arrow signals and background color changes based on those signals. Here's a description of its functions:

1. Moving Averages and RSI Calculation:

- Two moving averages (`fastMA` and `slowMA`) are calculated based on user-input lengths.

- The Relative Strength Index (`rsi`) is calculated based on a user-defined length.

2. Crossover Conditions:

- `crossoverUp` is true when the fastMA crosses above the slowMA and RSI is above an overbought level.

- `crossoverDown` is true when the fastMA crosses below the slowMA and RSI is below an oversold level.

3. Arrow Signals:

- Triangle-shaped arrows (`arrowUp` and `arrowDown`) are plotted below and above bars, indicating buy (green) and sell (red) signals, respectively.

4. Background Color Changes:

- The background color (`bgColor`) changes based on buy and sell signals.

- If there's a buy signal (`crossoverUp`), the background color is set to a light blue with 40% transparency.

- If there's a sell signal (`crossoverDown`), the background color is set to a light red with 40% transparency.

- On the next opposite signal, the background color is scaled up (transparency set to 80%) to indicate a stronger signal.

In summary, this script provides visual cues through arrows and background color changes to assist traders in identifying potential buy and sell signals based on moving average crossovers and RSI conditions. The background color variations aim to highlight the strength of the signal, with scaling based on consecutive signals in the same direction.

********************************************************************************

1. Buy Signal:

- Condition: The arrow points up (green) with a background color indicating a buy signal.

- Confirmation: Ensure that there is a strong upward crossover (fastMA above slowMA) and RSI is above the overbought level.

2. Sell Signal:

- Condition: The arrow points down (red) with a background color indicating a sell signal.

- Confirmation: Ensure that there is a strong downward crossover (fastMA below slowMA) and RSI is below the oversold level.

3. Exit Signal:

- Condition: No arrow is present, and the background color is reset.

- Confirmation: Confirm that there is no active buy or sell signal.

Example Trading Rules:

Risk Management:

Notes:

Remember that trading involves risk, and past performance is not indicative of future results. It's recommended to paper trade or use a demo account to test the strategy before risking real capital.

Best wishes on your trading journey! May your strategies be profitable, your risks well-managed, and your decisions guided by wisdom and success. Happy trading!

1. Moving Averages and RSI Calculation:

- Two moving averages (`fastMA` and `slowMA`) are calculated based on user-input lengths.

- The Relative Strength Index (`rsi`) is calculated based on a user-defined length.

2. Crossover Conditions:

- `crossoverUp` is true when the fastMA crosses above the slowMA and RSI is above an overbought level.

- `crossoverDown` is true when the fastMA crosses below the slowMA and RSI is below an oversold level.

3. Arrow Signals:

- Triangle-shaped arrows (`arrowUp` and `arrowDown`) are plotted below and above bars, indicating buy (green) and sell (red) signals, respectively.

4. Background Color Changes:

- The background color (`bgColor`) changes based on buy and sell signals.

- If there's a buy signal (`crossoverUp`), the background color is set to a light blue with 40% transparency.

- If there's a sell signal (`crossoverDown`), the background color is set to a light red with 40% transparency.

- On the next opposite signal, the background color is scaled up (transparency set to 80%) to indicate a stronger signal.

In summary, this script provides visual cues through arrows and background color changes to assist traders in identifying potential buy and sell signals based on moving average crossovers and RSI conditions. The background color variations aim to highlight the strength of the signal, with scaling based on consecutive signals in the same direction.

********************************************************************************

1. Buy Signal:

- Condition: The arrow points up (green) with a background color indicating a buy signal.

- Confirmation: Ensure that there is a strong upward crossover (fastMA above slowMA) and RSI is above the overbought level.

2. Sell Signal:

- Condition: The arrow points down (red) with a background color indicating a sell signal.

- Confirmation: Ensure that there is a strong downward crossover (fastMA below slowMA) and RSI is below the oversold level.

3. Exit Signal:

- Condition: No arrow is present, and the background color is reset.

- Confirmation: Confirm that there is no active buy or sell signal.

Example Trading Rules:

- Opening a Long Position (Buy):

- Enter a long (buy) position when:

- The green arrow appears with a light blue background.

- Confirm that the fastMA is above the slowMA.

- Confirm that RSI is above the overbought level. - Opening a Short Position (Sell):

- Enter a short (sell) position when:

- The red arrow appears with a light red background.

- Confirm that the fastMA is below the slowMA.

- Confirm that RSI is below the oversold level. - Exiting a Position:

- Close the position when:

- There is no arrow present (neither green nor red).

- The background color is reset, indicating no active signal.

Risk Management:

- Position Sizing: Determine the size of your positions based on your risk tolerance and the size of your trading account.

- Stop-Loss and Take-Profit: Set stop-loss orders to limit potential losses and take-profit orders to secure profits.

- Risk-Reward Ratio: Consider maintaining a favorable risk-reward ratio in your trades.

Notes:

- Backtesting: Before applying this strategy in a live market, it's crucial to backtest it using historical data to assess its performance.

- Market Conditions: Adapt the strategy to different market conditions, and be aware that no strategy is guaranteed to be profitable.

- Continuous Monitoring: Regularly monitor the performance of the strategy and make adjustments as needed.

- Educational Purpose: This strategy is for educational purposes only. Always consult with financial professionals and use your judgment when making trading decisions.

Remember that trading involves risk, and past performance is not indicative of future results. It's recommended to paper trade or use a demo account to test the strategy before risking real capital.

Best wishes on your trading journey! May your strategies be profitable, your risks well-managed, and your decisions guided by wisdom and success. Happy trading!

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.