OPEN-SOURCE SCRIPT

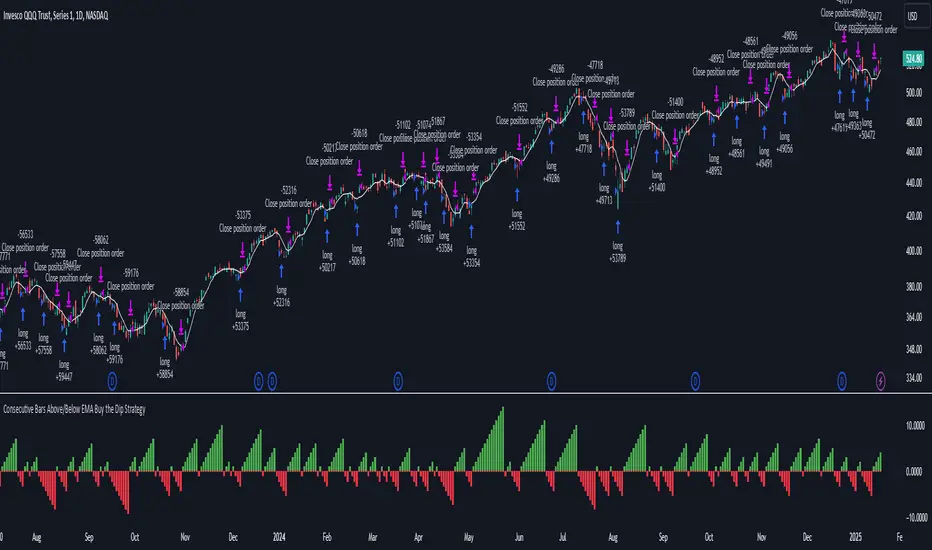

Consecutive Bars Above/Below EMA Buy the Dip Strategy

█ STRATEGY DESCRIPTION

The "Consecutive Bars Above/Below EMA Buy the Dip Strategy" is a mean-reversion strategy designed to identify potential buying opportunities when the price dips below a moving average for a specified number of consecutive bars. It enters a long position when the dip condition is met and exits when the price shows strength by exceeding the previous bar's high. This strategy is suitable for use on various timeframes.

█ WHAT IS THE MOVING AVERAGE?

The strategy uses either a Simple Moving Average (SMA) or an Exponential Moving Average (EMA) as a reference for identifying dips. The type and length of the moving average can be customized in the settings.

█ SIGNAL GENERATION

1. LONG ENTRY

A Buy Signal is triggered when:

2. EXIT CONDITION

█ ADDITIONAL SETTINGS

█ PERFORMANCE OVERVIEW

The "Consecutive Bars Above/Below EMA Buy the Dip Strategy" is a mean-reversion strategy designed to identify potential buying opportunities when the price dips below a moving average for a specified number of consecutive bars. It enters a long position when the dip condition is met and exits when the price shows strength by exceeding the previous bar's high. This strategy is suitable for use on various timeframes.

█ WHAT IS THE MOVING AVERAGE?

The strategy uses either a Simple Moving Average (SMA) or an Exponential Moving Average (EMA) as a reference for identifying dips. The type and length of the moving average can be customized in the settings.

█ SIGNAL GENERATION

1. LONG ENTRY

A Buy Signal is triggered when:

- The close price is below the selected moving average for a specified number of consecutive bars (`consecutiveBarsTreshold`).

- The signal occurs within the specified time window (between `Start Time` and `End Time`).

2. EXIT CONDITION

- A Sell Signal is generated when the current closing price exceeds the high of the previous bar (`close > high[1]`). This indicates that the price has shown strength, potentially confirming the reversal and prompting the strategy to exit the position.

█ ADDITIONAL SETTINGS

- Consecutive Bars Threshold: The number of consecutive bars the price must remain below the moving average to trigger a Buy Signal. Default is 3.

- MA Type: The type of moving average used (SMA or EMA). Default is SMA.

- MA Length: The length of the moving average. Default is 5.

- Start Time and End Time: The time window during which the strategy is allowed to execute trades.

█ PERFORMANCE OVERVIEW

- This strategy is designed for mean-reverting markets and performs best when the price frequently oscillates around the moving average.

- It is sensitive to the number of consecutive bars below the moving average, which helps to identify potential dips.

- Backtesting results should be analysed to optimize the Consecutive Bars Threshold, MA Type, and MA Length for specific instruments.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.