OPEN-SOURCE SCRIPT

업데이트됨 Uptrick: Bullish/Bearish Highlight -DEMO

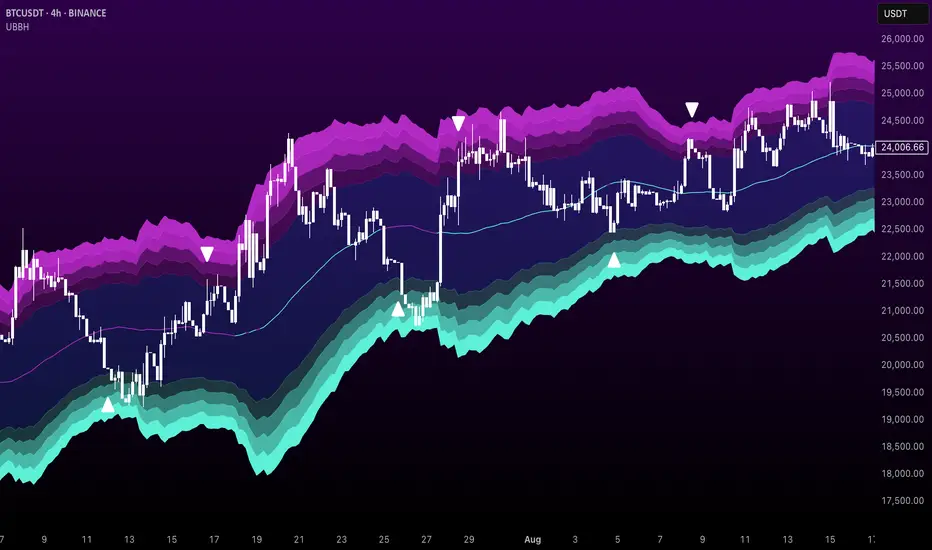

1 Indicator Purpose:

• The indicator serves as a technical analysis tool for traders to identify potential bullish

and bearish trends in the market.

• It highlights periods where the closing price is above or below a 50-period simple

moving average (SMA), indicating potential bullish or bearish sentiment, respectively.

2 Moving Averages:

• The indicator calculates a 50-period SMA (sma50) to smooth out price fluctuations

and identify the overall trend direction.

• It also computes an 8-period exponential moving average (EMA), which responds

more quickly to recent price changes compared to the SMA.

3 Bollinger Bands:

• Bollinger Bands are plotted around the SMA, indicating volatility in the price

movement.

• The bands are typically set at two standard deviations above and below the SMA,

representing approximately 95% of the price data within that range.

4 Bullish and Bearish Conditions:

• The indicator defines conditions for identifying bullish and bearish market sentiments.

• When the closing price is above the SMA50, it indicates a bullish condition, and when

it's below, it suggests a bearish condition.

5 Plotting:

• The indicator visualizes the bullish and bearish conditions by changing the

background color accordingly.

• It also plots the SMA50, EMA, and Bollinger Bands to provide a graphical

representation of the market dynamics.

6 User Interface:

• The indicator is designed to be used as an overlay on price charts, allowing traders to

easily incorporate it into their analysis.

Overall, the "Uptrick: Bullish/Bearish Highlight" indicator offers traders a comprehensive view of market trends and potential reversal points, helping them make informed trading decisions.

TIP: When the white line, which is the EMA , crosses above the SMA (the orange line), it is usually a good idea to buy, but when the EMA crosses below the SMA it is a good idea to sell.

• The indicator serves as a technical analysis tool for traders to identify potential bullish

and bearish trends in the market.

• It highlights periods where the closing price is above or below a 50-period simple

moving average (SMA), indicating potential bullish or bearish sentiment, respectively.

2 Moving Averages:

• The indicator calculates a 50-period SMA (sma50) to smooth out price fluctuations

and identify the overall trend direction.

• It also computes an 8-period exponential moving average (EMA), which responds

more quickly to recent price changes compared to the SMA.

3 Bollinger Bands:

• Bollinger Bands are plotted around the SMA, indicating volatility in the price

movement.

• The bands are typically set at two standard deviations above and below the SMA,

representing approximately 95% of the price data within that range.

4 Bullish and Bearish Conditions:

• The indicator defines conditions for identifying bullish and bearish market sentiments.

• When the closing price is above the SMA50, it indicates a bullish condition, and when

it's below, it suggests a bearish condition.

5 Plotting:

• The indicator visualizes the bullish and bearish conditions by changing the

background color accordingly.

• It also plots the SMA50, EMA, and Bollinger Bands to provide a graphical

representation of the market dynamics.

6 User Interface:

• The indicator is designed to be used as an overlay on price charts, allowing traders to

easily incorporate it into their analysis.

Overall, the "Uptrick: Bullish/Bearish Highlight" indicator offers traders a comprehensive view of market trends and potential reversal points, helping them make informed trading decisions.

TIP: When the white line, which is the EMA , crosses above the SMA (the orange line), it is usually a good idea to buy, but when the EMA crosses below the SMA it is a good idea to sell.

릴리즈 노트

In this update, I just added histogram bars into the background.릴리즈 노트

This is not really a update because here I just changed the cover image.릴리즈 노트

This script, titled "Uptrick: Bullish/Bearish Highlight," is a TradingView Pine Script indicator that helps identify bullish and bearish conditions by using a combination of technical analysis tools. It overlays on the chart and generates signals based on moving averages, volatility bands, multi-timeframe analysis, and asset correlation.The script uses *smaLength*, *emaLength*, and *atrLength* to calculate the Simple Moving Average (SMA), Exponential Moving Average (EMA), and Average True Range (ATR), respectively. The ATR is adjusted by *atrMultiplier* to create dynamic bands that act as support and resistance levels. The *higherTimeframe* parameter confirms the trend on a larger timeframe, while *correlationAsset* and *correlationPeriod* check if the asset is moving in correlation with another asset. The script also includes a pyramiding option for allowing multiple positions in the same direction.

### Validation:

The script ensures valid input values for *smaLength*, *emaLength*, and *atrLength*, raising an error if any of them are set incorrectly.

### Calculations:

- The script calculates SMA, EMA, and ATR, adjusting the ATR bands for market volatility.

- It uses multi-timeframe analysis to confirm trends and measures the correlation between the asset and another asset (e.g., BTCUSDT).

- Signal strength is determined based on the price difference from the SMA compared to market noise.

### Signal Conditions:

- A bullish signal occurs when the price is above both the SMA and the higher timeframe SMA.

- A bearish signal is generated when the price is below both the SMA and the higher timeframe SMA.

### Visualization:

ATR bands are plotted, and the area between them is filled with a blue cloud. The SMA’s color changes based on the trend of the asset and the correlated asset.

### Pyramiding Logic:

If pyramiding is enabled, new positions are allowed in the same direction; otherwise, positions are restricted until the market changes direction.

### Entry and Exit Levels:

The script defines buy and sell signals based on price touching the defined ATR levels.

### Alerts:

Custom alerts can be set based on price touching key levels or when buy/sell signals are generated.

### Uniqueness:

This script combines multiple features like dynamic ATR bands, multi-timeframe analysis, and multi-asset correlation. The ATR bands adjust with volatility, and the higher timeframe SMA adds confirmation. Smart signal filtering and pyramiding options give flexibility and precision, while the SMA color change enhances trend visibility.

---

### How to Use:

1. Using it as support and resistance:

The ATR bands act as dynamic support and resistance levels. Watch for price to interact with these levels to identify potential reversals or breakouts.

2. Buying if the price gets below all layers and selling if the price gets above all layers:

Enter buy trades when the price touches and moves above all lower ATR levels, and enter sell trades when the price moves above all upper ATR levels.

3. Tight cloud indicates breakout, wide cloud indicates consolidation:

When the ATR cloud is tight, it suggests low volatility and a potential breakout. A wide cloud signals high volatility, indicating a cooling-off period or consolidation.

릴리즈 노트

Updated color scheme.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

💎 Free Discord: discord.gg/Def47ueyuD

💎 Website: uptrick.io

Nothing is financial advice. Always do your own research.

💎 Website: uptrick.io

Nothing is financial advice. Always do your own research.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

💎 Free Discord: discord.gg/Def47ueyuD

💎 Website: uptrick.io

Nothing is financial advice. Always do your own research.

💎 Website: uptrick.io

Nothing is financial advice. Always do your own research.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.