OPEN-SOURCE SCRIPT

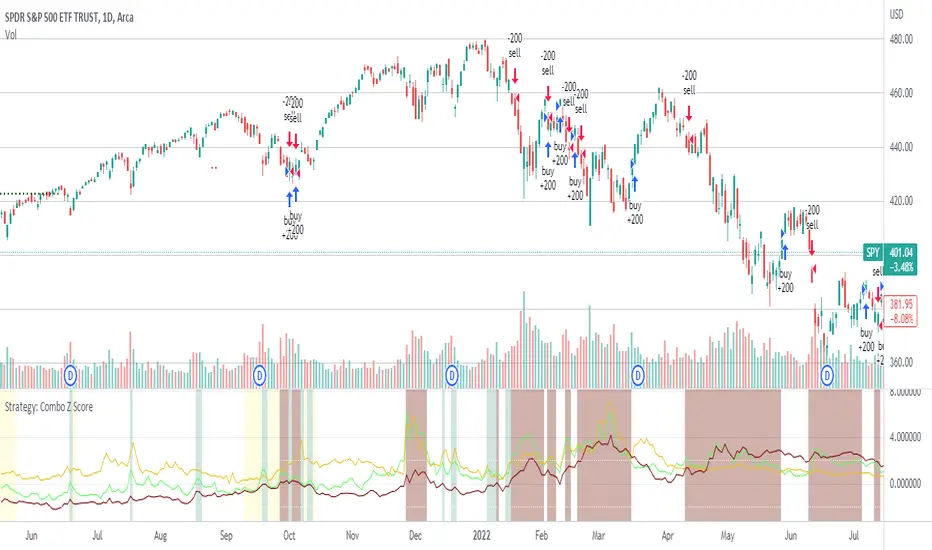

업데이트됨 Strategy: Combo Z Score

Strategy version of Combo Z Score

Objective:

Can we use both VIX and MOVE relationships to indicate movement in the SPY? VIX (forward contract on SPY options) correlations are quite common as forward indicators however MOVE (forward contract on bonds) also provides a slightly different level of insight

Using the Z-Score of VIX vs VVIX and MOVE vs inverted VIX (there is no M of Move so we use inverted Vix as a proxy) we get some helpful indications of potential future moves. Added %B to give us some exposure to momentum. Toggle VIX or MOVE.

If anyone has a better idea of inverted Vix to proxy forward interest in MOVE let me know.

Noticeable delta is that Vix only approach over the back test period is slightly better. Questions would be, what is the structure and nature of the market over the test period and in a bear market would MOVE or combined perform better.

Objective:

Can we use both VIX and MOVE relationships to indicate movement in the SPY? VIX (forward contract on SPY options) correlations are quite common as forward indicators however MOVE (forward contract on bonds) also provides a slightly different level of insight

Using the Z-Score of VIX vs VVIX and MOVE vs inverted VIX (there is no M of Move so we use inverted Vix as a proxy) we get some helpful indications of potential future moves. Added %B to give us some exposure to momentum. Toggle VIX or MOVE.

If anyone has a better idea of inverted Vix to proxy forward interest in MOVE let me know.

Noticeable delta is that Vix only approach over the back test period is slightly better. Questions would be, what is the structure and nature of the market over the test period and in a bear market would MOVE or combined perform better.

릴리즈 노트

Added closing of trades ie when selling (shorting) close all long positions and vice versa릴리즈 노트

Add capability to set your own start period. This will help if you want to test say a bullish market (2010 -> now) or expand to longer timeframes. Would it help to add an end date for those that want to choose specific date range?릴리즈 노트

Added option to apply an EMA on shorts ie only short if close is below ema. Ran this through Python with some different EMA values and 100 appears most reliable. CAUTION: Use normal candles not hiken ashi as you will get different results. Also, I ran this through a Python Backtester (Backtesting.py) and got woeful results so be cautious. Having said that I also ran it in 'dumb' mode essentially mimicing buy sell on long and short which was profitable with 100 lots (allowing for time to see event trigger and placing position the following day). Slippage and broker fees need to be considered as well. I also ran a model with OBV + OBV MA in Python and it under performed simple EMA릴리즈 노트

Added Oil over Oil Volatility as a selectable option. Oil by itself out performs as an indicator over long timeframes. I also ran this in a Python script I built to validate the return profile using CL=F (due to yfinance not having USOIL as a ticker). Excluding the EMA (which matters for this script) you get a return of 72.8 however note the volatility on the combined scenario. Essentially it validates the script will be profitable. Better than buy and hold? Not sure.Long Results for SPY going back to 0, Sample size: 24 trades

Batting Avg: 0.625

Gain/loss ratio: 2.8692089166896686

Average Gain: 4.184139196337219

Average Loss: -1.4582901830531891

Max Return: 11.456469648562306

Max Loss: -6.071636796151914

Total return over 24 trades: 60.26%

Short Results for SPY going back to 0, Sample size: 24 trades

Batting Avg: 0.75

Gain/loss ratio: 0.5881085471783537

Average Gain: 1.7299946052241066

Average Loss: -2.9416246601487614

Max Return: 6.139772751730832

Max Loss: -14.700454102882887

Total return over 24 trades: 12.54%

Combined L + S Results for SPY going back to 0, Sample size: 48 trades

Batting Avg: 1.375

Gain/loss ratio: 2.86920891668966860.5881085471783537

Average Gain: 5.914133801561326

Average Loss: -4.399914843201951

Max Return: 17.59624240029314

Max Loss: -20.7720908990348

Total return over 48 trades: 72.8%

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.