OPEN-SOURCE SCRIPT

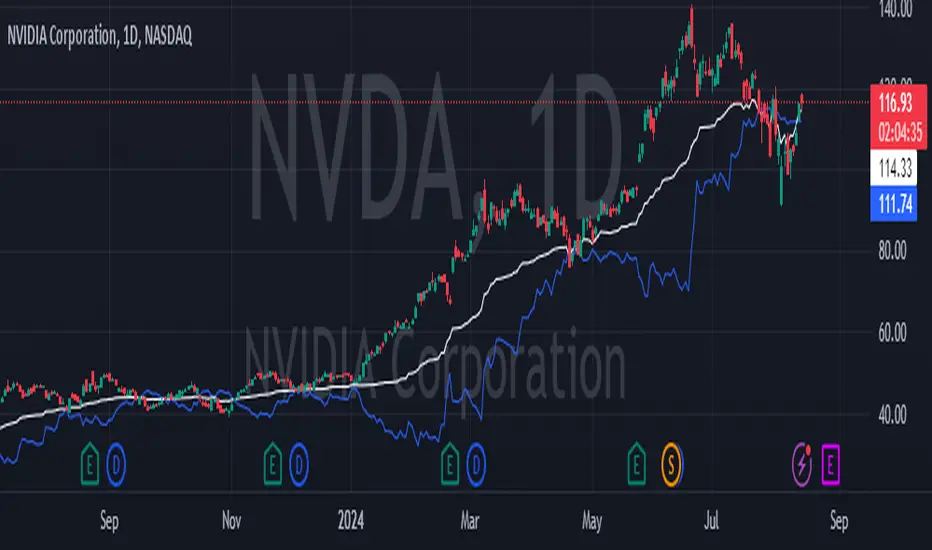

Support line based on RSI

This indicator builds a support line using the stock price and RSI.

Inputs:

1. Time window for the RSI:

the time window the RSI is calculated with, usually it's 14 but in here I recommend 30.

2. offset by percentage:

just adding or subtructing some percentage of the result, some stocks need a bit of offset to work

3. stability:

the higher it is the less the RSI effects the graph. for realy high stability the indicator the the stock price will be realy close.

formula: (close*(100-newRSI)/50)*(100+offset)/100

when:

newRSI = (RSI + (50 * stability1))/(stability+1)

recommended usage:

Usually, if the indicator becomes higher than the price, (the price lowers). the stock will go up again to around the last price where they met.

so, for example, if the stock price was 20 and going down. while the indicator was 18 and going up, then they met at 19 and later the indicator became 20 while the stock fell to 18. most chances are that the stock will come back to 19 where they met and at the same time the indicator will also get to 19.

In stocks that are unstable, like NVDA. this indicator can be used to see the trend and avoid the unstability of the stock.

Inputs:

1. Time window for the RSI:

the time window the RSI is calculated with, usually it's 14 but in here I recommend 30.

2. offset by percentage:

just adding or subtructing some percentage of the result, some stocks need a bit of offset to work

3. stability:

the higher it is the less the RSI effects the graph. for realy high stability the indicator the the stock price will be realy close.

formula: (close*(100-newRSI)/50)*(100+offset)/100

when:

newRSI = (RSI + (50 * stability1))/(stability+1)

recommended usage:

Usually, if the indicator becomes higher than the price, (the price lowers). the stock will go up again to around the last price where they met.

so, for example, if the stock price was 20 and going down. while the indicator was 18 and going up, then they met at 19 and later the indicator became 20 while the stock fell to 18. most chances are that the stock will come back to 19 where they met and at the same time the indicator will also get to 19.

In stocks that are unstable, like NVDA. this indicator can be used to see the trend and avoid the unstability of the stock.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.