PINE LIBRARY

pseudorenko

█ CALCULATE PSEUDO-RENKO VALUE

Calculates and returns the Pseudo-Renko Stabilized value (or close price) based on a given input value, along with the direction of the current Renko brick. This function adapts the traditional Renko brick size dynamically based on the volatility of the input value using a combination of SMA and EMA calculations. The calculated price represents the closing price of the most recent Pseudo-Renko brick, while the direction indicates the trend (1 for uptrend, -1 for downtrend).

Parameters:

* `val`:

* Type: `float`

* Description: The input value upon which the Pseudo-Renko calculations are performed. You can use any price series or custom value as input.

* `sensitivity`:

* Type: `float`

* Default Value: `1.0`

* Description: Controls the sensitivity of the brick size to the volatility of the `val`. Higher values lead to larger bricks, resulting in a smoother Renko chart. Lower values produce smaller bricks, leading to a more reactive chart.

* Possible Values: Any positive float.

* `length`:

* Type: `int`

* Default Value: `7`

* Description: The length used for calculating the EMA and SMA in the dynamic brick size calculation. It influences how quickly the brick size adapts to changing volatility of the `val`.

* Possible Values: Any positive integer.

Return Values:

* `lastRenkoClose`:

* Type: `float`

* Description: The closing price of the last completed Pseudo-Renko brick based on the `val`.

* `renkoDirection`:

* Type: `int`

* Description: The direction of the current Pseudo-Renko brick based on the `val`:

* `1`: Uptrend

* `-1`: Downtrend

* `0`: No change (initially, or no brick change since the previous bar)

Example Usage:

Pine Script®

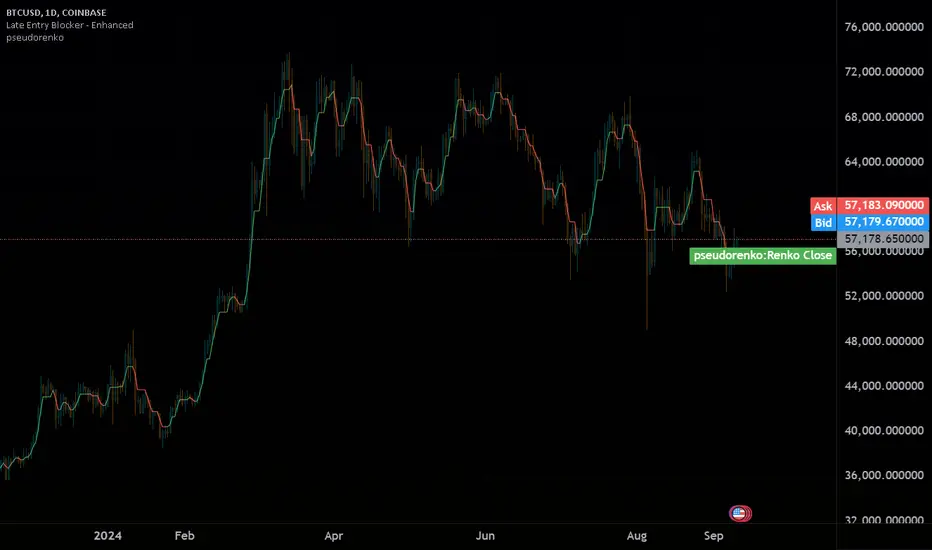

This example demonstrates how to use the `pseudo_renko` function within an indicator. It takes user inputs for `sensitivity` and `length`, then calculates the Pseudo-Renko values using the average of the `close` and `open` prices as the `val`. The resulting `renkoClose` price is plotted on the chart, with a color change based on the `renkoDirection`. It also illustrates how you can use other values, like `high` and `low`, as input to the function.

Note: The Pseudo-Renko algorithm is based on adapting the Renko brick size dynamically based on the input `val`. This provides more flexibility compared to the normal, but is experimental. The `sensitivity` and `length` parameters, along with the choice of the `val`, offer further customization to tune the algorithm's behavior to your preference and trading style.

Calculates and returns the Pseudo-Renko Stabilized value (or close price) based on a given input value, along with the direction of the current Renko brick. This function adapts the traditional Renko brick size dynamically based on the volatility of the input value using a combination of SMA and EMA calculations. The calculated price represents the closing price of the most recent Pseudo-Renko brick, while the direction indicates the trend (1 for uptrend, -1 for downtrend).

Parameters:

* `val`:

* Type: `float`

* Description: The input value upon which the Pseudo-Renko calculations are performed. You can use any price series or custom value as input.

* `sensitivity`:

* Type: `float`

* Default Value: `1.0`

* Description: Controls the sensitivity of the brick size to the volatility of the `val`. Higher values lead to larger bricks, resulting in a smoother Renko chart. Lower values produce smaller bricks, leading to a more reactive chart.

* Possible Values: Any positive float.

* `length`:

* Type: `int`

* Default Value: `7`

* Description: The length used for calculating the EMA and SMA in the dynamic brick size calculation. It influences how quickly the brick size adapts to changing volatility of the `val`.

* Possible Values: Any positive integer.

Return Values:

* `lastRenkoClose`:

* Type: `float`

* Description: The closing price of the last completed Pseudo-Renko brick based on the `val`.

* `renkoDirection`:

* Type: `int`

* Description: The direction of the current Pseudo-Renko brick based on the `val`:

* `1`: Uptrend

* `-1`: Downtrend

* `0`: No change (initially, or no brick change since the previous bar)

Example Usage:

//@version=5

indicator("Pseudo-Renko Stabilized (Val)", overlay=true)

// Get user inputs

sensitivityInput = input.float(0.1, "Sensitivity",0.01,step=0.01)

lengthInput = input.int(5, "Length",2)

// Example usage with the 'close' price as the input value

[renkoClose, renkoDirection] = pseudo_renko(math.avg(close,open), sensitivityInput, lengthInput)

// Plot the Renko close price

plot(renkoClose, "Renko Close", renkoDirection>0?color.aqua:color.orange,2)

// You can also use other values as input, such as:

// [renkoCloseHigh, renkoDirectionHigh] = pseudo_renko(high, sensitivityInput, lengthInput)

// [renkoCloseLow, renkoDirectionLow] = pseudo_renko(low, sensitivityInput, lengthInput)

This example demonstrates how to use the `pseudo_renko` function within an indicator. It takes user inputs for `sensitivity` and `length`, then calculates the Pseudo-Renko values using the average of the `close` and `open` prices as the `val`. The resulting `renkoClose` price is plotted on the chart, with a color change based on the `renkoDirection`. It also illustrates how you can use other values, like `high` and `low`, as input to the function.

Note: The Pseudo-Renko algorithm is based on adapting the Renko brick size dynamically based on the input `val`. This provides more flexibility compared to the normal, but is experimental. The `sensitivity` and `length` parameters, along with the choice of the `val`, offer further customization to tune the algorithm's behavior to your preference and trading style.

파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.