OPEN-SOURCE SCRIPT

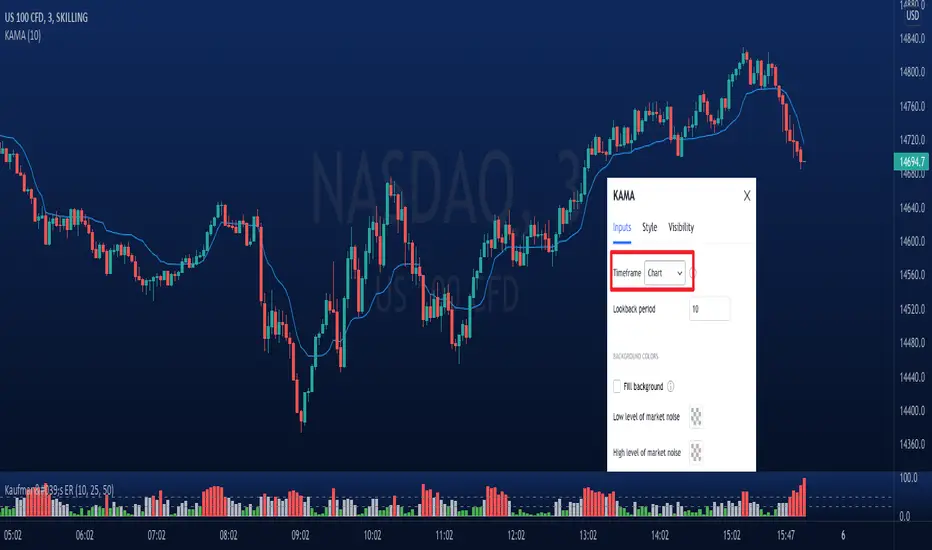

업데이트됨 Kaufman's Adaptive Moving Average (KAMA) - Multi timeframe

Kaufman's Adaptive Moving Average (KAMA)

KAMA was developed by Perry Kaufman to give better directions of short term market trends.

Idea is similar to an EMA, but it makes adjustments to the smoothing factor by taking Market Noise into consideration. Levels of noise in KAMA is modelled using Kaufman's Efficiency Ratio.

The problem with traditional of moving averages (ie. SMA/EMA) is that they are very sensitive to sudden price movements.

Applications:

- Less prone to false signals compared to other types of moving averages. When price suddenly surges or tanks, KAMA will lag behind telling us that the move is rather abnormal.

- On the other hand, when volatility of price movements is low, KAMA will be close to the ranging candles with a slope approximate to zero. KAMA can be used for filtering out choppy markets.

Other features:

- Multi-timeframe.

- Can visualize levels of market noise with background color mode turned on.

KAMA was developed by Perry Kaufman to give better directions of short term market trends.

Idea is similar to an EMA, but it makes adjustments to the smoothing factor by taking Market Noise into consideration. Levels of noise in KAMA is modelled using Kaufman's Efficiency Ratio.

The problem with traditional of moving averages (ie. SMA/EMA) is that they are very sensitive to sudden price movements.

Applications:

- Less prone to false signals compared to other types of moving averages. When price suddenly surges or tanks, KAMA will lag behind telling us that the move is rather abnormal.

- On the other hand, when volatility of price movements is low, KAMA will be close to the ranging candles with a slope approximate to zero. KAMA can be used for filtering out choppy markets.

Other features:

- Multi-timeframe.

- Can visualize levels of market noise with background color mode turned on.

릴리즈 노트

New feature: Coded candles to identify price crossing with MA.릴리즈 노트

Amended line 43, calling of nz(src=kama, replacement=close). Previously, param. replacement==0릴리즈 노트

Features:- Added: Option to show smooth KAMA (least of squares over same KAMA period).

- Added: Low/high thresholds for background colors linked to noise (if turned on)

- Removed: bar colors during crosses

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.