Hello!

This script presents volume delta data in various forms!

Features

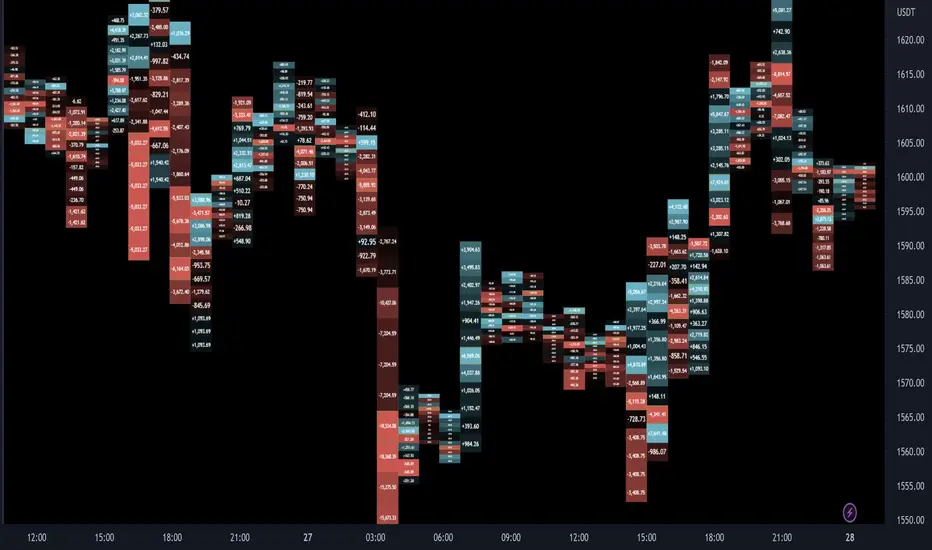

The image above shows Classic mode - delta blocks are oriented left/right contingent on positive/negative values!

The image above shows the same price sequence; however, delta blocks are superimposed on the price bar. Left-side blocks reflect negative delta while right-side blocks reflect positive delta! To apply this display method - select "On Bar" for the "Data Display Method" setting!

The image above shows "Pure Ladder" mode. Delta blocks remain color-coordinated; however, all delta blocks retain the same x-axis as the price bar they were calculated for!

Additionally, you can select to remove the delta values and merge the delta boxes to generate a color-based canvas indicative of volume delta at traded price levels!

The image above shows the same price sequence; however, the "Volume Assumption" setting is activated.

When active, the indicator assumes a 60/ 40 split when a level is traded at and only one metric - "buy volume" or "sell volume" is recorded. This means there shouldn't be any levels recorded where "buy volume" is greater than 0 and "sell volume" equals 0 and vice versa. While this assumption was performed arbitrarily, it may help better replicate volume delta and OI delta calculations seen on other charting platforms.

This option is configurable; you can select to have the script not assume a 60/ 40 split and instead record volume "as is" at the corresponding price level!

I plan to roll out additional features for the indicator - particularly tick-based price blocks! Stay tuned (:

Thank you!

This script presents volume delta data in various forms!

Features

- Classic mode: Volume delta boxes oriented to the right of the bar (sell closer / buy further)

- On Bar mode: Volume delta boxes oriented on the bar (sell left / buy right)

- Pure Ladder mode: Pure volume delta ladder

- PoC highlighting

- Color-coordinated delta boxes. Marginal volume differences are substantially shaded while large volume differences are lightly shaded.

- Volume delta boxes can be merged and delta values removed to generate a color-only canvas reflecting vol. delta differences in price blocks.

- Price bars can be split up to 497 times - allowing for greater precision.

- Total volume delta for the bar and timestamp included

The image above shows Classic mode - delta blocks are oriented left/right contingent on positive/negative values!

The image above shows the same price sequence; however, delta blocks are superimposed on the price bar. Left-side blocks reflect negative delta while right-side blocks reflect positive delta! To apply this display method - select "On Bar" for the "Data Display Method" setting!

The image above shows "Pure Ladder" mode. Delta blocks remain color-coordinated; however, all delta blocks retain the same x-axis as the price bar they were calculated for!

Additionally, you can select to remove the delta values and merge the delta boxes to generate a color-based canvas indicative of volume delta at traded price levels!

The image above shows the same price sequence; however, the "Volume Assumption" setting is activated.

When active, the indicator assumes a 60/ 40 split when a level is traded at and only one metric - "buy volume" or "sell volume" is recorded. This means there shouldn't be any levels recorded where "buy volume" is greater than 0 and "sell volume" equals 0 and vice versa. While this assumption was performed arbitrarily, it may help better replicate volume delta and OI delta calculations seen on other charting platforms.

This option is configurable; you can select to have the script not assume a 60/ 40 split and instead record volume "as is" at the corresponding price level!

I plan to roll out additional features for the indicator - particularly tick-based price blocks! Stay tuned (:

Thank you!

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

•Access to Next-Gen Optimization Tools: tradingiq.io

•Discord Server: discord.gg/aKWPuM4HPy

•Discord Server: discord.gg/aKWPuM4HPy

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

•Access to Next-Gen Optimization Tools: tradingiq.io

•Discord Server: discord.gg/aKWPuM4HPy

•Discord Server: discord.gg/aKWPuM4HPy

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.