INVITE-ONLY SCRIPT

업데이트됨 Relative Strength Portfolio [AlphaAlgos]

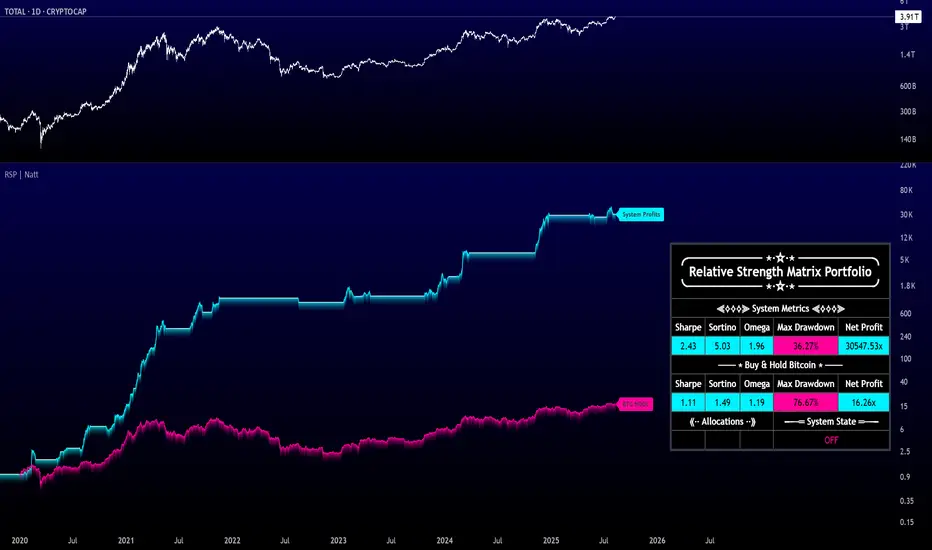

🚀 Relative Strength Matrix Portfolio - Advanced Multi-Asset Rotation Strategy

This institutional-grade portfolio rotation system represents a culmination of sophisticated quantitative research methodologies, delivering a comprehensive approach to systematic crypto-asset selection and portfolio management. Through advanced relative strength analysis and multi-factor filtering, the system identifies optimal trading opportunities while maintaining strict risk management protocols.

The Matrix Foundation

At its core, the system employs an intricate relative strength matrix that evaluates each asset against every other asset in the universe through RSI calculations. This creates a robust scoring framework where assets accumulate points based on their relative performance, generating a detailed picture of market leadership and strength. The matrix calculations account for the complex interrelationships between assets, ensuring a thorough understanding of relative performance.

Multi-Factor Filtering Framework

Beyond the foundational matrix, the system incorporates sophisticated filtering mechanisms that analyze multiple aspects of asset behavior:

Alpha and Beta Analysis examines each asset's performance characteristics relative to the broader market, identifying those that demonstrate superior risk-adjusted returns while maintaining favorable volatility profiles.

The GunzoTrendSniper algorithm provides specialized trend analysis, ensuring selected assets maintain positive directional bias. This combines with momentum calculations that evaluate price action characteristics across multiple timeframes.

Risk-adjusted performance metrics including Sharpe, Sortino, and Omega ratios undergo continuous calculation, offering deep insight into the quality of returns. These metrics ensure selected assets not only perform well but do so with favorable risk characteristics.

Market Regime Analysis

The system maintains constant awareness of broader market conditions through analysis of total cryptocurrency market capitalization (TOTAL). This crucial overlay determines whether market conditions warrant active positions or defensive positioning. When market trends or valuations deteriorate beyond critical thresholds, the system enters a protective cash state, preserving capital during adverse conditions.

Scoring Integration

The comprehensive scoring mechanism integrates all analyzed factors into a unified ranking system. Assets must demonstrate strength across multiple categories to qualify for selection, ensuring well-rounded technical characteristics rather than isolated metric strength.

Position Selection & Management

Final asset selection emerges from a rigorous evaluation process where candidates must:

- Rank highly in the relative strength matrix

- Display favorable alpha and beta metrics

- Maintain strong momentum characteristics

- Demonstrate superior risk-adjusted returns

- Pass the GunzoTrendSniper criteria

- Meet minimum threshold requirements across all metrics

Performance Analytics

The sophisticated dashboard provides real-time performance tracking, comparing strategy results against traditional buy-and-hold approaches. This includes:

- Risk-adjusted return metrics

- Maximum drawdown analysis

- Comparative performance ratios

- Real-time equity curves

- Current system state indication

- Active position monitoring

Timeframe Flexibility

While optimized for daily analysis, the system's mathematical framework adapts seamlessly across timeframes. The core logic maintains effectiveness whether deployed for intraday trading or longer-term position management.

Professional Applications

This system serves multiple roles in professional trading environments:

- Portfolio managers seeking systematic rotation strategies

- Risk managers requiring market state evaluation

- Quantitative analysts conducting relative strength assessment

- Long-term investors pursuing systematic exposure

- Active traders requiring comprehensive market analysis

Financial Advisor Disclaimer

This indicator is for informational and educational purposes only and should not be considered financial advice or a recommendation to buy, sell, or hold any investment or security. The creator is not a registered investment advisor. Trading and investing in financial markets carries significant risk, including the potential loss of principal. Past performance does not indicate future results. Users must conduct their own due diligence and consult with licensed financial advisors, accountants, or attorneys for professional advice regarding their specific situation before making any investment decisions. The user assumes all responsibility and liability for their trading and investment decisions.

This institutional-grade portfolio rotation system represents a culmination of sophisticated quantitative research methodologies, delivering a comprehensive approach to systematic crypto-asset selection and portfolio management. Through advanced relative strength analysis and multi-factor filtering, the system identifies optimal trading opportunities while maintaining strict risk management protocols.

The Matrix Foundation

At its core, the system employs an intricate relative strength matrix that evaluates each asset against every other asset in the universe through RSI calculations. This creates a robust scoring framework where assets accumulate points based on their relative performance, generating a detailed picture of market leadership and strength. The matrix calculations account for the complex interrelationships between assets, ensuring a thorough understanding of relative performance.

Multi-Factor Filtering Framework

Beyond the foundational matrix, the system incorporates sophisticated filtering mechanisms that analyze multiple aspects of asset behavior:

Alpha and Beta Analysis examines each asset's performance characteristics relative to the broader market, identifying those that demonstrate superior risk-adjusted returns while maintaining favorable volatility profiles.

The GunzoTrendSniper algorithm provides specialized trend analysis, ensuring selected assets maintain positive directional bias. This combines with momentum calculations that evaluate price action characteristics across multiple timeframes.

Risk-adjusted performance metrics including Sharpe, Sortino, and Omega ratios undergo continuous calculation, offering deep insight into the quality of returns. These metrics ensure selected assets not only perform well but do so with favorable risk characteristics.

Market Regime Analysis

The system maintains constant awareness of broader market conditions through analysis of total cryptocurrency market capitalization (TOTAL). This crucial overlay determines whether market conditions warrant active positions or defensive positioning. When market trends or valuations deteriorate beyond critical thresholds, the system enters a protective cash state, preserving capital during adverse conditions.

Scoring Integration

The comprehensive scoring mechanism integrates all analyzed factors into a unified ranking system. Assets must demonstrate strength across multiple categories to qualify for selection, ensuring well-rounded technical characteristics rather than isolated metric strength.

Position Selection & Management

Final asset selection emerges from a rigorous evaluation process where candidates must:

- Rank highly in the relative strength matrix

- Display favorable alpha and beta metrics

- Maintain strong momentum characteristics

- Demonstrate superior risk-adjusted returns

- Pass the GunzoTrendSniper criteria

- Meet minimum threshold requirements across all metrics

Performance Analytics

The sophisticated dashboard provides real-time performance tracking, comparing strategy results against traditional buy-and-hold approaches. This includes:

- Risk-adjusted return metrics

- Maximum drawdown analysis

- Comparative performance ratios

- Real-time equity curves

- Current system state indication

- Active position monitoring

Timeframe Flexibility

While optimized for daily analysis, the system's mathematical framework adapts seamlessly across timeframes. The core logic maintains effectiveness whether deployed for intraday trading or longer-term position management.

Professional Applications

This system serves multiple roles in professional trading environments:

- Portfolio managers seeking systematic rotation strategies

- Risk managers requiring market state evaluation

- Quantitative analysts conducting relative strength assessment

- Long-term investors pursuing systematic exposure

- Active traders requiring comprehensive market analysis

Financial Advisor Disclaimer

This indicator is for informational and educational purposes only and should not be considered financial advice or a recommendation to buy, sell, or hold any investment or security. The creator is not a registered investment advisor. Trading and investing in financial markets carries significant risk, including the potential loss of principal. Past performance does not indicate future results. Users must conduct their own due diligence and consult with licensed financial advisors, accountants, or attorneys for professional advice regarding their specific situation before making any investment decisions. The user assumes all responsibility and liability for their trading and investment decisions.

릴리즈 노트

V1.1Improved strategy logic, implemented a market regime filter to identify whether the market is trending or mean reverting. The strategy now utilizes different entry and exit criteria depending on the market regime:

Mean reversion:

The strategy will enter positions when we are in a period of high value.

Trending:

The strategy will enter positions when the trend probability indicators (medium and long term) are both bullish.

릴리즈 노트

V1.2Patch release

릴리즈 노트

V1.3Small update to script parameters

릴리즈 노트

V2릴리즈 노트

V2.1릴리즈 노트

V2.2릴리즈 노트

V3릴리즈 노트

V3.1릴리즈 노트

Token Update릴리즈 노트

Updated token list릴리즈 노트

V5릴리즈 노트

V5.1릴리즈 노트

Added alert functionality초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 AlphaNatt에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

DM me for access to private scripts

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 AlphaNatt에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

DM me for access to private scripts

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.