PROTECTED SOURCE SCRIPT

SpringBoard Delta (Bonds vs. Stocks Performance Oscillator)

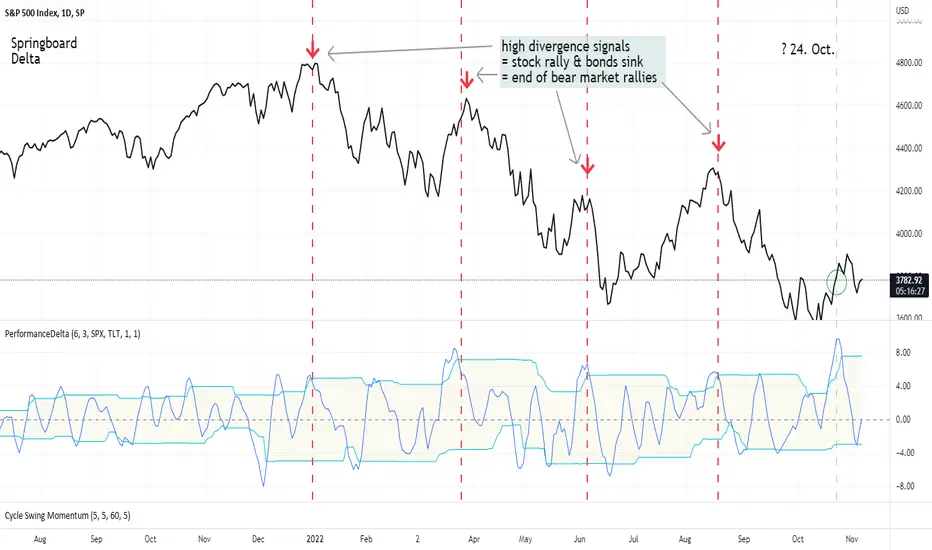

Bonds and stocks move "in tandem" over the current market context. Higher yields cause bonds and stocks to decline. What's interesting is the timing of when the equity markets try to decouple from the bond market. That is, stocks begin to rise, but bonds do not.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

Let's apply the above observation to a cyclical oscillator. We calculate the difference between the change in the price of stocks and the change in the price of bonds. If stocks and bonds move "in sync", that difference will be zero. If stocks move up and bonds move down, we' ll see high values of this indicator.

I like to call the cyclical difference indicator between stock and bond changes "The Springboard." The following chart tells why.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Lars von Thienen

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

Join my blog and never miss an update:

stockmarketcycles.substack.com/subscribe

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.