OPEN-SOURCE SCRIPT

Golden Launch Pad

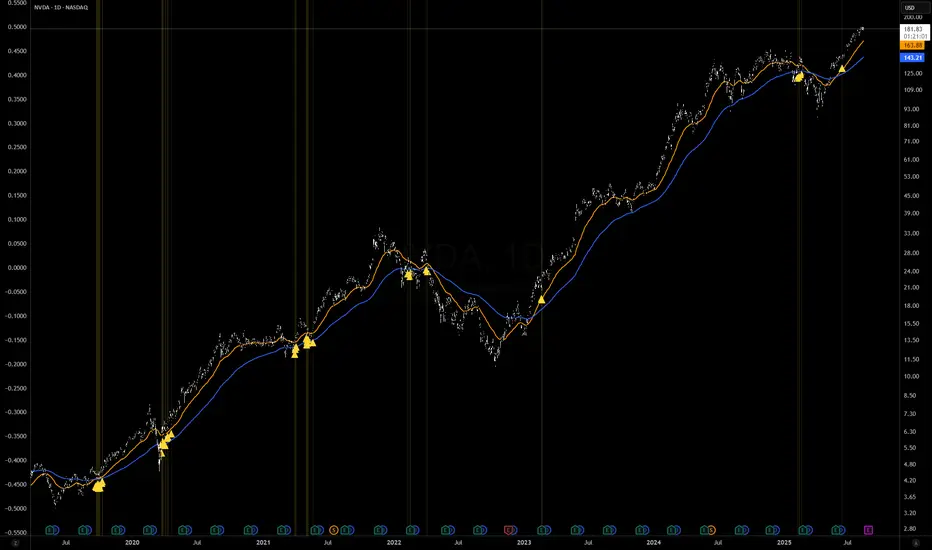

🔰 Golden Launch Pad

This indicator identifies high-probability bullish setups by analyzing the relationship between multiple moving averages (MAs). A “Golden Launch Pad” is formed when the following five conditions are met simultaneously:

📌 Launch Pad Criteria (all must be true):

MAs Are Tightly Grouped

The selected MAs must be close together, measured using the Z-score spread — the difference between the highest and lowest Z-scores of the MAs.

Z-scores are calculated relative to the average and standard deviation of price over a user-defined window.

This normalizes MA distance based on volatility, making the signal adaptive across different assets.

MAs Are Bullishly Stacked

The MAs must be in strict ascending order: MA1 > MA2 > MA3 > ... > MA(n).

This ensures the short-term trend leads the longer-term trend — a classic sign of bullish structure.

All MAs Have Positive Slope

Each MA must be rising, based on a lookback period that is a percentage of its length (e.g. 30% of the MA’s bars).

This confirms momentum and avoids signals during sideways or weakening trends.

Price Is Above the Fastest MA

The current close must be higher than the first (fastest) moving average.

This adds a momentum filter and reduces false positives.

Price Is Near the MA Cluster

The current price must be close to the average of all selected MAs.

Proximity is measured in standard deviations (e.g. within 1.0), ensuring the price hasn't already made a large move away from the setup zone.

⚙️ Customization Options:

Use 2 to 6 MAs for the stack

Choose from SMA, EMA, WMA, VWMA for each MA

Adjustable Z-score window and spread threshold

Dynamic slope lookback based on MA length

Volatility-adjusted price proximity filter

🧠 Use Case:

This indicator helps traders visually and systematically detect strong continuation setups — often appearing before breakouts or sustained uptrends. It works well on intraday, swing, and positional timeframes across all asset classes.

For best results, combine with volume, breakout structure, or multi-timeframe confirmation.

This indicator identifies high-probability bullish setups by analyzing the relationship between multiple moving averages (MAs). A “Golden Launch Pad” is formed when the following five conditions are met simultaneously:

📌 Launch Pad Criteria (all must be true):

MAs Are Tightly Grouped

The selected MAs must be close together, measured using the Z-score spread — the difference between the highest and lowest Z-scores of the MAs.

Z-scores are calculated relative to the average and standard deviation of price over a user-defined window.

This normalizes MA distance based on volatility, making the signal adaptive across different assets.

MAs Are Bullishly Stacked

The MAs must be in strict ascending order: MA1 > MA2 > MA3 > ... > MA(n).

This ensures the short-term trend leads the longer-term trend — a classic sign of bullish structure.

All MAs Have Positive Slope

Each MA must be rising, based on a lookback period that is a percentage of its length (e.g. 30% of the MA’s bars).

This confirms momentum and avoids signals during sideways or weakening trends.

Price Is Above the Fastest MA

The current close must be higher than the first (fastest) moving average.

This adds a momentum filter and reduces false positives.

Price Is Near the MA Cluster

The current price must be close to the average of all selected MAs.

Proximity is measured in standard deviations (e.g. within 1.0), ensuring the price hasn't already made a large move away from the setup zone.

⚙️ Customization Options:

Use 2 to 6 MAs for the stack

Choose from SMA, EMA, WMA, VWMA for each MA

Adjustable Z-score window and spread threshold

Dynamic slope lookback based on MA length

Volatility-adjusted price proximity filter

🧠 Use Case:

This indicator helps traders visually and systematically detect strong continuation setups — often appearing before breakouts or sustained uptrends. It works well on intraday, swing, and positional timeframes across all asset classes.

For best results, combine with volume, breakout structure, or multi-timeframe confirmation.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.