PINE LIBRARY

업데이트됨 VolumeIndicators

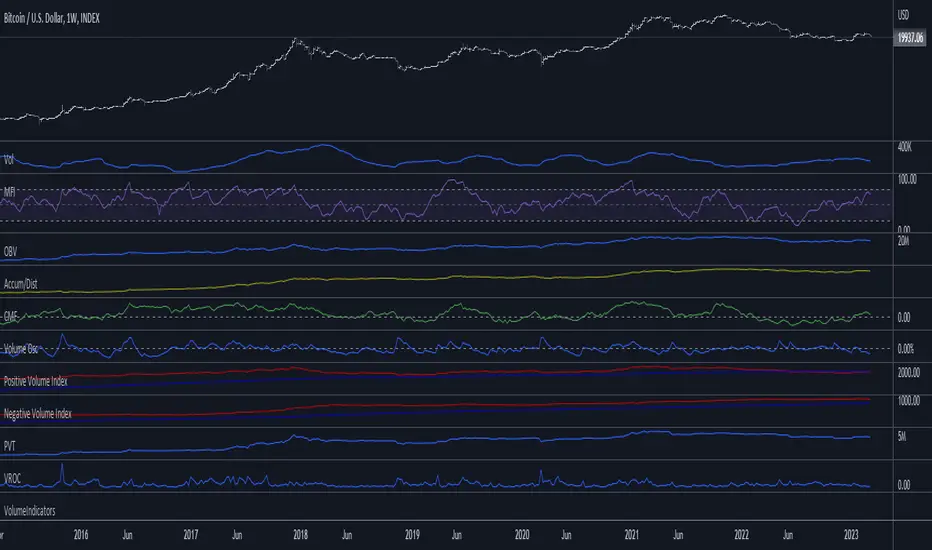

Library "VolumeIndicators"

This is a library of 'Volume Indicators'.

It aims to facilitate the grouping of this category of indicators, and also offer the customized supply of the source, not being restricted to just the closing price.

Indicators:

1. Volume Moving Average (VMA):

Moving average of volume. Identify trends in trading volume.

2. Money Flow Index (MFI): Measures volume pressure in a range of 0 to 100.

Calculates the ratio of volume when the price goes up and when the price goes down

3. On-Balance Volume (OBV):

Identify divergences between trading volume and an asset's price.

Sum of trading volume when the price rises and subtracts volume when the price falls.

4. Accumulation/Distribution (A/D):

Identifies buying and selling pressure by tracking the flow of money into and out of an asset based on volume patterns.

5. Chaikin Money Flow (CMF):

A variation of A/D that takes into account the daily price variation and weighs trading volume accordingly.

6. Volume Oscillator (VO):

Identify divergences between trading volume and an asset's price. Ratio of change of volume, from a fast period in relation to a long period.

7. Positive Volume Index (PVI):

Identify the upward strength of an asset. Volume when price rises divided by total volume.

8. Negative Volume Index (NVI):

Identify the downward strength of an asset. Volume when price falls divided by total volume.

9. Price-Volume Trend (PVT):

Identify the strength of an asset's price trend based on its trading volume. Cumulative change in price with volume factor

vma(length, maType, almaOffset, almaSigma, lsmaOffSet)

description Volume Moving Average (VMA)

Parameters:

length: (int) Length for moving average

maType: (int) Type of moving average for smoothing

almaOffset: (float) Offset for Arnauld Legoux Moving Average

almaSigma: (float) Sigma for Arnauld Legoux Moving Average

lsmaOffSet: (float) Offset for Least Squares Moving Average

Returns: (float) Moving average of Volume

mfi(source, length)

description MFI (Money Flow Index).

Uses both price and volume to measure buying and selling pressure in an asset.

Parameters:

source: (float) Source of series (close, high, low, etc.)

length

Returns: (float) Money Flow series

obv(source)

description On Balance Volume (OBV)

Same as ta.obv(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) OBV

ad()

description Accumulation/Distribution (A/D)

Returns: (float) Accumulation/Distribution (A/D) series

cmf(length)

description CMF (Chaikin Money Flow).

Measures the flow of money into or out of an asset over time, using a combination of price and volume, and is used to identify the strength and direction of a trend.

Parameters:

length

Returns: (float) Chaikin Money Flow series

vo(shortLen, longLen, maType, almaOffset, almaSigma, lsmaOffSet)

description Volume Oscillator (VO)

Parameters:

shortLen: (int) Fast period for volume

longLen: (int) Slow period for volume

maType: (int) Type of moving average for smoothing

almaOffset

almaSigma

lsmaOffSet

Returns: (float) Volume oscillator

pvi(source)

description Positive Volume Index (PVI)

Same as ta.pvi(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) PVI

nvi(source)

description Negative Volume Index (NVI)

Same as ta.nvi(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) PVI

pvt(source)

description Price-Volume Trend (PVT)

Same as ta.pvt(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) PVI

This is a library of 'Volume Indicators'.

It aims to facilitate the grouping of this category of indicators, and also offer the customized supply of the source, not being restricted to just the closing price.

Indicators:

1. Volume Moving Average (VMA):

Moving average of volume. Identify trends in trading volume.

2. Money Flow Index (MFI): Measures volume pressure in a range of 0 to 100.

Calculates the ratio of volume when the price goes up and when the price goes down

3. On-Balance Volume (OBV):

Identify divergences between trading volume and an asset's price.

Sum of trading volume when the price rises and subtracts volume when the price falls.

4. Accumulation/Distribution (A/D):

Identifies buying and selling pressure by tracking the flow of money into and out of an asset based on volume patterns.

5. Chaikin Money Flow (CMF):

A variation of A/D that takes into account the daily price variation and weighs trading volume accordingly.

6. Volume Oscillator (VO):

Identify divergences between trading volume and an asset's price. Ratio of change of volume, from a fast period in relation to a long period.

7. Positive Volume Index (PVI):

Identify the upward strength of an asset. Volume when price rises divided by total volume.

8. Negative Volume Index (NVI):

Identify the downward strength of an asset. Volume when price falls divided by total volume.

9. Price-Volume Trend (PVT):

Identify the strength of an asset's price trend based on its trading volume. Cumulative change in price with volume factor

vma(length, maType, almaOffset, almaSigma, lsmaOffSet)

description Volume Moving Average (VMA)

Parameters:

length: (int) Length for moving average

maType: (int) Type of moving average for smoothing

almaOffset: (float) Offset for Arnauld Legoux Moving Average

almaSigma: (float) Sigma for Arnauld Legoux Moving Average

lsmaOffSet: (float) Offset for Least Squares Moving Average

Returns: (float) Moving average of Volume

mfi(source, length)

description MFI (Money Flow Index).

Uses both price and volume to measure buying and selling pressure in an asset.

Parameters:

source: (float) Source of series (close, high, low, etc.)

length

Returns: (float) Money Flow series

obv(source)

description On Balance Volume (OBV)

Same as ta.obv(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) OBV

ad()

description Accumulation/Distribution (A/D)

Returns: (float) Accumulation/Distribution (A/D) series

cmf(length)

description CMF (Chaikin Money Flow).

Measures the flow of money into or out of an asset over time, using a combination of price and volume, and is used to identify the strength and direction of a trend.

Parameters:

length

Returns: (float) Chaikin Money Flow series

vo(shortLen, longLen, maType, almaOffset, almaSigma, lsmaOffSet)

description Volume Oscillator (VO)

Parameters:

shortLen: (int) Fast period for volume

longLen: (int) Slow period for volume

maType: (int) Type of moving average for smoothing

almaOffset

almaSigma

lsmaOffSet

Returns: (float) Volume oscillator

pvi(source)

description Positive Volume Index (PVI)

Same as ta.pvi(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) PVI

nvi(source)

description Negative Volume Index (NVI)

Same as ta.nvi(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) PVI

pvt(source)

description Price-Volume Trend (PVT)

Same as ta.pvt(), but with customized type of source

Parameters:

source: (float) Series

Returns: (float) PVI

릴리즈 노트

v2Added:

vroc(length)

description Volume Rate of Change (VROC).

Uses ROC (Rate of Change) to measures the percentage change in volume of an asset over a specified time period.

Parameters:

length: [int] Period of loopback

Returns: (float) Series of VROC

릴리즈 노트

v3: Correction in the documentation파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

To contribute to my work:

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

파인 라이브러리

트레이딩뷰의 진정한 정신에 따라, 작성자는 이 파인 코드를 오픈소스 라이브러리로 게시하여 커뮤니티의 다른 파인 프로그래머들이 재사용할 수 있도록 했습니다. 작성자에게 경의를 표합니다! 이 라이브러리는 개인적으로 사용하거나 다른 오픈소스 게시물에서 사용할 수 있지만, 이 코드의 게시물 내 재사용은 하우스 룰에 따라 규제됩니다.

To contribute to my work:

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

⚡Bitcoin Lightning: forwardocean64@walletofsatoshi.com

🟠Bitcoin: bc1qv0j28wjsg6l8fdkphkmgfz4f55xpph893q0pdh

🔵PayPal: paypal.com/donate/?hosted_button_id=D9KRKY5HMSL9S

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.