INVITE-ONLY SCRIPT

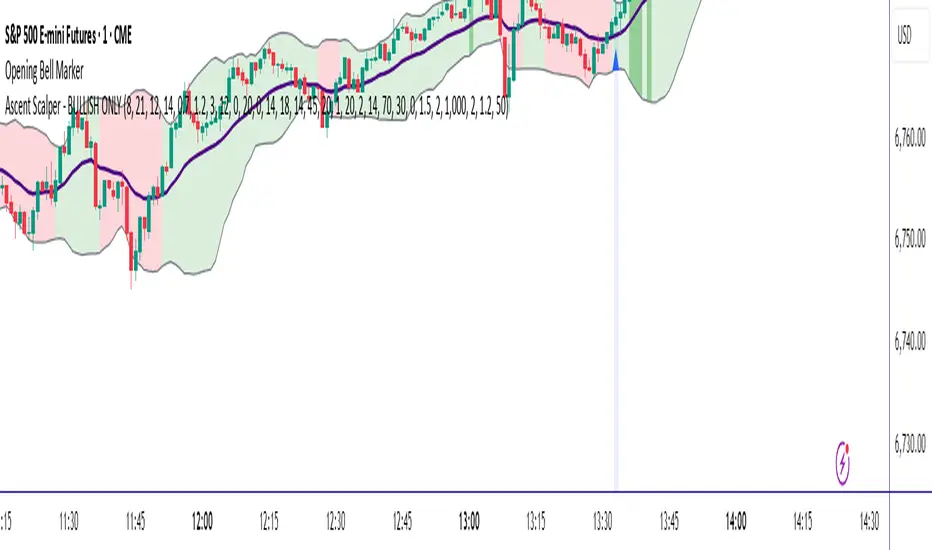

Ascent Scalper - BULLISH ONLY

Strategy Name: Ascent Scalper - BULLISH ONLY

This is a compliant description for a Closed-Source Subscription Strategy.

1. Overview and Core Logic

The Ascent Scalper is a sophisticated, trend-following strategy designed exclusively for long (bullish) scalping on low-timeframe charts. It uses a multi-indicator confluence model based on standard candlestick data to identify and capitalize on strong bullish momentum during active trading hours.

The long entry rule requires the simultaneous alignment of the following four conditions:

A. Trend Confirmation (Standard Close EMAs): The core trend is confirmed by the 8-period Fast EMA crossing and remaining above the 21-period Slow EMA, using the standard bar closing price.

B. Momentum Strength (ADX/RSI): Directional movement must be validated by the 14-period ADX exceeding a threshold (default 18), alongside the 14-period RSI being above a threshold (default 45), confirming strong momentum.

C. Volume Validation: A dynamic filter requires the current bar's volume to be greater than the 20-period Volume MA (default 1.0x) to ensure high market conviction at the time of entry.

D. Session Filter: Entries are restricted to a defined trading window (default UTC 12:00 to 20:00) to capture maximum market liquidity.

2. Trade Management and Realistic Risk

This strategy employs a dynamic, partial-exit risk management plan based on the Average True Range (ATR).

Initial Stop Loss (SL): The initial SL is tight and calculated based on the 14-period ATR multiplied by an adjustable factor (default 0.7).

Split Exits (P&L Management): The position is split into two halves upon entry:

A. $50\%$ Position (TP1): Exited at a 1R profit target, where 1R is equal to the initial ATR-based SL value.

B $50\%$ Position (Run): Managed by a Trailing Stop Loss (TSL), with trail points also calculated dynamically using the current ATR (default multiplier 1.2x).

Breakeven (BE) Lock: The optional Breakeven feature (default: ON) places a Breakeven stop (entry price plus 1 tick) once the position is 2 ticks in profit, locking in capital protection rapidly.

Daily Risk Controls: The strategy includes an optional (default: OFF) Max Daily Loss control (default $1,000), which stops trading for the day if the cumulative closed P&L exceeds the loss cap.

3. Backtesting Results & Mandatory Disclosures

The default settings are configured for high-liquidity markets. Users must comply with the following:

A. Risk Per Trade: The ATR-based SL system ensures the risk per trade is highly variable but generally kept below $5\%$ of a reasonable account size.

B. Commissions/Slippage: Commissions and slippage MUST be configured by the user in the Strategy Properties window to ensure backtest results accurately reflect real-world execution costs.

C. Trade Sample Size: The strategy must be run on a dataset that generates over 100 trades for statistically valid results.

MANDATORY DISCLAIMER: Past performance is not necessarily indicative of future results. Trading involves substantial risk of loss. All claims of historical performance are substantiated by the backtesting results on the chart, but these results do not guarantee actual trading outcomes.

This is a compliant description for a Closed-Source Subscription Strategy.

1. Overview and Core Logic

The Ascent Scalper is a sophisticated, trend-following strategy designed exclusively for long (bullish) scalping on low-timeframe charts. It uses a multi-indicator confluence model based on standard candlestick data to identify and capitalize on strong bullish momentum during active trading hours.

The long entry rule requires the simultaneous alignment of the following four conditions:

A. Trend Confirmation (Standard Close EMAs): The core trend is confirmed by the 8-period Fast EMA crossing and remaining above the 21-period Slow EMA, using the standard bar closing price.

B. Momentum Strength (ADX/RSI): Directional movement must be validated by the 14-period ADX exceeding a threshold (default 18), alongside the 14-period RSI being above a threshold (default 45), confirming strong momentum.

C. Volume Validation: A dynamic filter requires the current bar's volume to be greater than the 20-period Volume MA (default 1.0x) to ensure high market conviction at the time of entry.

D. Session Filter: Entries are restricted to a defined trading window (default UTC 12:00 to 20:00) to capture maximum market liquidity.

2. Trade Management and Realistic Risk

This strategy employs a dynamic, partial-exit risk management plan based on the Average True Range (ATR).

Initial Stop Loss (SL): The initial SL is tight and calculated based on the 14-period ATR multiplied by an adjustable factor (default 0.7).

Split Exits (P&L Management): The position is split into two halves upon entry:

A. $50\%$ Position (TP1): Exited at a 1R profit target, where 1R is equal to the initial ATR-based SL value.

B $50\%$ Position (Run): Managed by a Trailing Stop Loss (TSL), with trail points also calculated dynamically using the current ATR (default multiplier 1.2x).

Breakeven (BE) Lock: The optional Breakeven feature (default: ON) places a Breakeven stop (entry price plus 1 tick) once the position is 2 ticks in profit, locking in capital protection rapidly.

Daily Risk Controls: The strategy includes an optional (default: OFF) Max Daily Loss control (default $1,000), which stops trading for the day if the cumulative closed P&L exceeds the loss cap.

3. Backtesting Results & Mandatory Disclosures

The default settings are configured for high-liquidity markets. Users must comply with the following:

A. Risk Per Trade: The ATR-based SL system ensures the risk per trade is highly variable but generally kept below $5\%$ of a reasonable account size.

B. Commissions/Slippage: Commissions and slippage MUST be configured by the user in the Strategy Properties window to ensure backtest results accurately reflect real-world execution costs.

C. Trade Sample Size: The strategy must be run on a dataset that generates over 100 trades for statistically valid results.

MANDATORY DISCLAIMER: Past performance is not necessarily indicative of future results. Trading involves substantial risk of loss. All claims of historical performance are substantiated by the backtesting results on the chart, but these results do not guarantee actual trading outcomes.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 ngukevin90에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

ACCESS: Contact us via Private Message (PM) or use the link in our profile signature. DO NOT use public comments for commercial inquiries.

Pine Script Strategist | Uses Heikin-Ashi in some strategies for Signal Smoothing | *WARNING: Backtest Results are Theoretical* 📊

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 ngukevin90에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

ACCESS: Contact us via Private Message (PM) or use the link in our profile signature. DO NOT use public comments for commercial inquiries.

Pine Script Strategist | Uses Heikin-Ashi in some strategies for Signal Smoothing | *WARNING: Backtest Results are Theoretical* 📊

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.