OPEN-SOURCE SCRIPT

업데이트됨 Breaker Blocks + Order Blocks confirm [TradingFinder] BBOB Alert

🔵Introduction

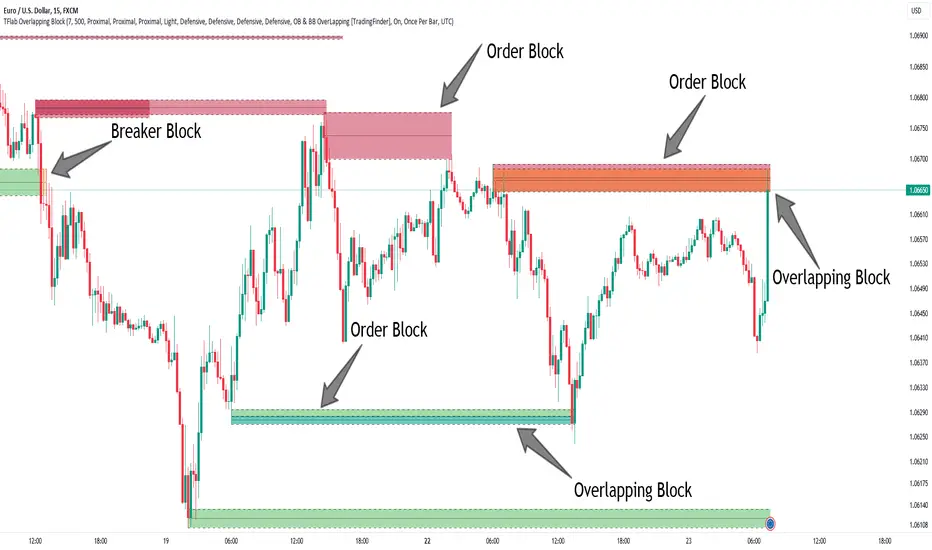

In the realm of technical analysis, various tools and concepts are employed to identify key levels on price charts. These tools assist traders in analyzing market trends with greater precision, enabling them to optimize their trading decisions. Among these tools, the Order Block and Breaker Block hold a significant place, serving as effective instruments for analyzing market structure.

🟣Order Block

An Order Block refers to zones on a chart where large financial institutions and high-volume traders place their orders. Due to the substantial volume of buy or sell orders in these areas, they are often regarded as pivotal points for potential price reversals or temporary pauses in a trend. Order Blocks are particularly crucial when prices react to these zones after a strong market move, acting as strong support or resistance levels.

🟣Breaker Block

On the other hand, a Breaker Block refers to areas on a chart that previously functioned as Order Blocks but where the price has managed to break through and continue in the opposite direction. These zones are typically recognized as key points where market trends might shift, helping traders identify potential reversal points in the market.

🟣Overlapping Block (BBOB)

Now, imagine a scenario where these two essential concepts in technical analysis—Order Blocks and Breaker Blocks—overlap on a chart. Although this overlap is not specifically discussed within the ICT (Inner Circle Trader) trading framework, exploring and utilizing this overlap can provide traders with powerful insights into strong support and resistance zones. The combination of these two robust concepts can highlight critical areas in trading, potentially offering significant advantages in making informed trading decisions.

In this article, we will delve into the concept of this overlap, explaining how to utilize it in trading strategies. Additionally, we will analyze the potential outcomes and benefits of incorporating this concept into your trading decisions.

Bullish Overlapping Block (BBOB):

Bearish Overlapping Block (BBOB):

🔵How to Use

The overlap between Order Blocks and Breaker Blocks is a compelling and powerful concept that can help traders identify key levels on the chart with a high probability of success. This overlap is particularly valuable because it combines two well-regarded concepts in technical analysis—zones of high order volume and critical market shifts.

🟣Here’s how to effectively use this overlap in your trading

1. Dentifying the Overlapping Block: To make the most of the overlap between Order Blocks and Breaker Blocks, begin by identifying these zones separately. Order Blocks are areas where price typically reacts and reverses after a strong market move.

Breaker Blocks are areas where a previous Order Block has been breached, and the price continues in the opposite direction. When these two zones overlap on a chart, it’s crucial to pay close attention to this area, as it represents a high-probability reaction zone.

2. Analyzing the Overlapping Block: After identifying the overlap zone, carefully analyze price action within this region. Candlestick patterns and price behavior can provide essential clues.

If the price reaches this overlap zone and strong reversal patterns such as Pin Bars or Engulfing patterns are observed, it’s likely that this zone will act as a pivotal reversal point. In such cases, entering a trade with confidence becomes more feasible.

3. Entering the Trade: When sufficient signs of price reaction are present in the overlap zone, you can proceed to enter the trade. If the overlap zone is within an uptrend and bullish reversal signals are evident, a long position might be appropriate.

Conversely, if the overlap zone is in a downtrend and bearish reversal signals are observed, a short position would be more suitable.

4. Risk Management: One of the most critical aspects of trading in overlap zones is managing risk. To protect your capital, place your stop loss near the lowest point of the Order Block (for buy trades) or the highest point (for sell trades). This approach minimizes potential losses if the overlap zone fails to hold.

5. Price Targets: After entering the trade, set your price targets based on other key levels on the chart. These targets could include other support and resistance zones, Fibonacci levels, or pivot points.

Bullish Overlapping Block :

Bearish Overlapping Block:

🟣Benefits of the Overlapping Block Between Order Block and Breaker Block

1. Enhanced Precision in Identifying Key Levels: The overlap between these two zones usually acts as a highly reliable area for price reactions, increasing the accuracy of identifying entry and exit points.

2. Reduced Trading Risk: Given the high importance of the overlap zone, the likelihood of making incorrect decisions is reduced, contributing to overall lower trading risk.

3. Increased Probability of Success: The overlap between Order Blocks and Breaker Blocks combines two powerful concepts, enhancing the likelihood of success in trades, as multiple indicators confirm the importance of the area.

4. Creation of Better Trading Opportunities: Overlap zones often provide traders with more robust trading opportunities, as these areas typically represent strong reversal points in the market.

5. Compatibility with Other Technical Tools: This concept seamlessly integrates with other technical analysis tools such as Fibonacci retracements, trend lines, and chart patterns, offering a more comprehensive market analysis.

🔵Setting

🟣Global Setting

Pivot Period of Order Blocks Detector: Enter the desired pivot period to identify the Order Block.

Order Block Validity Period (Bar): You can specify the maximum time the Order Block remains valid based on the number of candles from the origin.

Mitigation Level Order Block: Determining the basic level of a Order Block. When the price hits the basic level, the Order Block due to mitigation.

Mitigation Level Breaker Block: Determining the basic level of a Breaker Block. When the price hits the basic level, the Breaker Block due to mitigation.

Mitigation Level Overlapping Block: Determining the basic level of a Overlapping Block. When the price hits the basic level, the Overlapping Block due to mitigation.

🟣Overlapping Block Display

Show All Overlapping Block: If it is turned off, only the last Order Block will be displayed.

Demand Overlapping Block: Show or not show and specify color.

Supply Overlapping Block: Show or not show and specify color.

🟣Order Block Display

Show All Order Block: If it is turned off, only the last Order Block will be displayed.

Demand Main Order Block: Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Order Block: Show or not show and specify color.

Supply Main Order Block: Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Order Block: Show or not show and specify color.

🟣Breaker Block Display

Show All Breaker Block: If it is turned off, only the last Breaker Block will be displayed.

Demand Main Breaker Block: Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

Supply Main Breaker Block: Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

🟣Order Block Refinement

Refine Order Blocks: Enable or disable the refinement feature. Mode selection.

🟣Alert

Alert Name: The name of the alert you receive.

Alert Overlapping Block Mitigation:

On / Off

Message Frequency:

This string parameter defines the announcement frequency. Choices include: "All" (activates the alert every time the function is called), "Once Per Bar" (activates the alert only on the first call within the bar), and "Once Per Bar Close" (the alert is activated only by a call at the last script execution of the real-time bar upon closing). The default setting is "Once per Bar".

Show Alert Time by Time Zone:

The date, hour, and minute you receive in alert messages can be based on any time zone you choose. For example, if you want New York time, you should enter "UTC-4". This input is set to the time zone "UTC" by default.

🔵Conclusion

The overlap between Order Blocks and Breaker Blocks represents a critical and powerful area in technical analysis that can serve as an effective tool for determining entry and exit points in trading.

These zones, due to the combination of two key concepts in technical analysis, hold significant importance and can help traders make more confident trading decisions.

Although this concept is not specifically discussed in the ICT framework and is introduced as a new idea, traders can achieve better results in their trades through practice and testing.

Utilizing the overlap between Order Blocks and Breaker Blocks, in conjunction with other technical analysis tools, can significantly improve the chances of success in trading.

In the realm of technical analysis, various tools and concepts are employed to identify key levels on price charts. These tools assist traders in analyzing market trends with greater precision, enabling them to optimize their trading decisions. Among these tools, the Order Block and Breaker Block hold a significant place, serving as effective instruments for analyzing market structure.

🟣Order Block

An Order Block refers to zones on a chart where large financial institutions and high-volume traders place their orders. Due to the substantial volume of buy or sell orders in these areas, they are often regarded as pivotal points for potential price reversals or temporary pauses in a trend. Order Blocks are particularly crucial when prices react to these zones after a strong market move, acting as strong support or resistance levels.

🟣Breaker Block

On the other hand, a Breaker Block refers to areas on a chart that previously functioned as Order Blocks but where the price has managed to break through and continue in the opposite direction. These zones are typically recognized as key points where market trends might shift, helping traders identify potential reversal points in the market.

🟣Overlapping Block (BBOB)

Now, imagine a scenario where these two essential concepts in technical analysis—Order Blocks and Breaker Blocks—overlap on a chart. Although this overlap is not specifically discussed within the ICT (Inner Circle Trader) trading framework, exploring and utilizing this overlap can provide traders with powerful insights into strong support and resistance zones. The combination of these two robust concepts can highlight critical areas in trading, potentially offering significant advantages in making informed trading decisions.

In this article, we will delve into the concept of this overlap, explaining how to utilize it in trading strategies. Additionally, we will analyze the potential outcomes and benefits of incorporating this concept into your trading decisions.

Bullish Overlapping Block (BBOB):

Bearish Overlapping Block (BBOB):

🔵How to Use

The overlap between Order Blocks and Breaker Blocks is a compelling and powerful concept that can help traders identify key levels on the chart with a high probability of success. This overlap is particularly valuable because it combines two well-regarded concepts in technical analysis—zones of high order volume and critical market shifts.

🟣Here’s how to effectively use this overlap in your trading

1. Dentifying the Overlapping Block: To make the most of the overlap between Order Blocks and Breaker Blocks, begin by identifying these zones separately. Order Blocks are areas where price typically reacts and reverses after a strong market move.

Breaker Blocks are areas where a previous Order Block has been breached, and the price continues in the opposite direction. When these two zones overlap on a chart, it’s crucial to pay close attention to this area, as it represents a high-probability reaction zone.

2. Analyzing the Overlapping Block: After identifying the overlap zone, carefully analyze price action within this region. Candlestick patterns and price behavior can provide essential clues.

If the price reaches this overlap zone and strong reversal patterns such as Pin Bars or Engulfing patterns are observed, it’s likely that this zone will act as a pivotal reversal point. In such cases, entering a trade with confidence becomes more feasible.

3. Entering the Trade: When sufficient signs of price reaction are present in the overlap zone, you can proceed to enter the trade. If the overlap zone is within an uptrend and bullish reversal signals are evident, a long position might be appropriate.

Conversely, if the overlap zone is in a downtrend and bearish reversal signals are observed, a short position would be more suitable.

4. Risk Management: One of the most critical aspects of trading in overlap zones is managing risk. To protect your capital, place your stop loss near the lowest point of the Order Block (for buy trades) or the highest point (for sell trades). This approach minimizes potential losses if the overlap zone fails to hold.

5. Price Targets: After entering the trade, set your price targets based on other key levels on the chart. These targets could include other support and resistance zones, Fibonacci levels, or pivot points.

Bullish Overlapping Block :

Bearish Overlapping Block:

🟣Benefits of the Overlapping Block Between Order Block and Breaker Block

1. Enhanced Precision in Identifying Key Levels: The overlap between these two zones usually acts as a highly reliable area for price reactions, increasing the accuracy of identifying entry and exit points.

2. Reduced Trading Risk: Given the high importance of the overlap zone, the likelihood of making incorrect decisions is reduced, contributing to overall lower trading risk.

3. Increased Probability of Success: The overlap between Order Blocks and Breaker Blocks combines two powerful concepts, enhancing the likelihood of success in trades, as multiple indicators confirm the importance of the area.

4. Creation of Better Trading Opportunities: Overlap zones often provide traders with more robust trading opportunities, as these areas typically represent strong reversal points in the market.

5. Compatibility with Other Technical Tools: This concept seamlessly integrates with other technical analysis tools such as Fibonacci retracements, trend lines, and chart patterns, offering a more comprehensive market analysis.

🔵Setting

🟣Global Setting

Pivot Period of Order Blocks Detector: Enter the desired pivot period to identify the Order Block.

Order Block Validity Period (Bar): You can specify the maximum time the Order Block remains valid based on the number of candles from the origin.

Mitigation Level Order Block: Determining the basic level of a Order Block. When the price hits the basic level, the Order Block due to mitigation.

Mitigation Level Breaker Block: Determining the basic level of a Breaker Block. When the price hits the basic level, the Breaker Block due to mitigation.

Mitigation Level Overlapping Block: Determining the basic level of a Overlapping Block. When the price hits the basic level, the Overlapping Block due to mitigation.

🟣Overlapping Block Display

Show All Overlapping Block: If it is turned off, only the last Order Block will be displayed.

Demand Overlapping Block: Show or not show and specify color.

Supply Overlapping Block: Show or not show and specify color.

🟣Order Block Display

Show All Order Block: If it is turned off, only the last Order Block will be displayed.

Demand Main Order Block: Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Order Block: Show or not show and specify color.

Supply Main Order Block: Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Order Block: Show or not show and specify color.

🟣Breaker Block Display

Show All Breaker Block: If it is turned off, only the last Breaker Block will be displayed.

Demand Main Breaker Block: Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

Supply Main Breaker Block: Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

🟣Order Block Refinement

Refine Order Blocks: Enable or disable the refinement feature. Mode selection.

🟣Alert

Alert Name: The name of the alert you receive.

Alert Overlapping Block Mitigation:

On / Off

Message Frequency:

This string parameter defines the announcement frequency. Choices include: "All" (activates the alert every time the function is called), "Once Per Bar" (activates the alert only on the first call within the bar), and "Once Per Bar Close" (the alert is activated only by a call at the last script execution of the real-time bar upon closing). The default setting is "Once per Bar".

Show Alert Time by Time Zone:

The date, hour, and minute you receive in alert messages can be based on any time zone you choose. For example, if you want New York time, you should enter "UTC-4". This input is set to the time zone "UTC" by default.

🔵Conclusion

The overlap between Order Blocks and Breaker Blocks represents a critical and powerful area in technical analysis that can serve as an effective tool for determining entry and exit points in trading.

These zones, due to the combination of two key concepts in technical analysis, hold significant importance and can help traders make more confident trading decisions.

Although this concept is not specifically discussed in the ICT framework and is introduced as a new idea, traders can achieve better results in their trades through practice and testing.

Utilizing the overlap between Order Blocks and Breaker Blocks, in conjunction with other technical analysis tools, can significantly improve the chances of success in trading.

릴리즈 노트

🔵Fixed ErrorBug fix in "Switching Colors Theme Mode" Overlapping Block.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.