OPEN-SOURCE SCRIPT

Crypto Breakout Buy/Sell Sequence

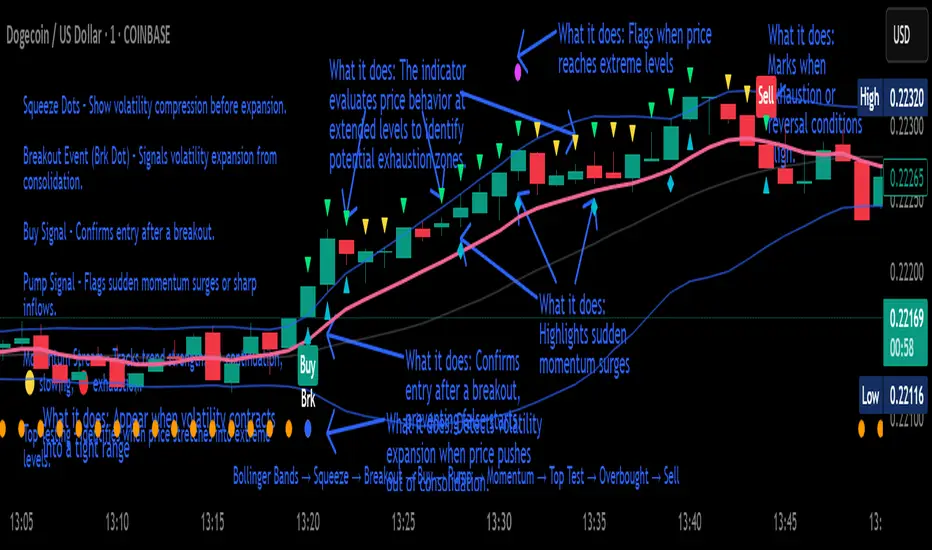

⚙️ Components & Sequence Multiple Timeframe (What It Does)

1. Bollinger Bands – Form the foundation by measuring volatility and creating the dynamic range where squeezes and breakouts occur.

2. Squeeze Dots – Show when price compresses inside the bands, signaling reduced volatility before expansion.

3. Breakout Event (Brk Dot) – Fires when price expands beyond the squeeze zone, confirming volatility expansion. (This paints Intra, before candle close)

4. Buy Signal – Confirms entry after a breakout is validated. (This paints at candle close)

5. Pump Signal – Flags sudden surges that extend sharply from the bands, often linked to strong inflows.

6. Momentum Stream – Tracks the strength of movement following the breakout, from continuation (🟢) to slowing (🟡) to exhaustion (🔴). (Resets at Pump Signal)

7. Overbought Indicator – Confirms when momentum has reached overheated conditions, often aligning with band extremes.

8. Sell Signal – Prints when exhaustion/reversal conditions are met, closing the trade cycle.

The Crypto Breakout Buy/Sell Sequence is a no-repaint event indicator that maps a full trade cycle using Bollinger-band-based volatility states: Bollinger Bands → Squeeze → Breakout → Buy → Pump → Momentum → Top Test → Overbought → Sell. Each stage is rule-based and designed to be read on standard candlesticks.

How It Works (System Logic)

Volatility framework: Bollinger Bands define dynamic range and compression/expansion.

Initiation: Squeeze → Breakout confirms expansion; Buy validates participation after expansion begins.

Management: Pump highlights unusual acceleration; Momentum stream tracks continuation → slowing → exhaustion.

Exhaustion/Exit: Top Testing + Overbought build the exhaustion case; Sell marks the sequence end.

How To Use (Quick Guide)

Wait for Squeeze → Breakout → Buy to establish a structured start.

Manage with Momentum:

🟢 continuation, 🟡 slowing, 🔴 exhaustion pressure.

Monitor extremes: Top Testing and/or Overbought = tighten risk.

Exit on Sell or on your risk rules when exhaustion builds.

Limitations & Good Practice

Signals reflect price/volatility behavior, not certainty.

Strong trends can remain extended; Overbought/Top Test ≠ instant reversal.

Always confirm with your own risk rules, position sizing, and market context.

Initial public release: integrated Squeeze/Breakout/Buy → Momentum → Exhaustion → Sell cycle; improved label clarity; cleaned defaults.

Disclaimer

For educational purposes only. Not financial advice. Past performance does not guarantee future results. Test before live use.

Thank You

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.